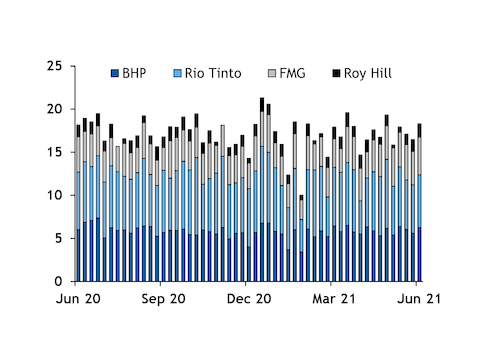

Australian iron ore producer Rio Tinto is approaching its fifth week with no shipments from its 45mn t/yr East Intercourse Island (EII) berths, weighing against stronger shipments from the three other largest producers in the Pilbara region of Western Australia (WA) in the week to 12 June.

The four largest WA producers — Rio Tinto, BHP, Fortescue Metals and Roy Hill — loaded vessels with a combined 18.31mn deadweight tonnes (dwt) of capacity in the latest week, up from 16.57mn dwt in the week ending 5 June. Loadings were 7pc above the average of 17.17mn dwt/week over the past year, despite Rio Tinto not shipping anything from its EII berths at Dampier since 20 May.

The deadweight tonnage is the maximum capacity of the vessel and overestimates actual shipments by around 5pc.

Rio Tinto loaded vessels with 6.17mn dwt capacity in the week to 12 June, up from 5.6mn dwt the previous week, as it used the latent capacity in its rail and port systems to push up exports out of its other berths at Dampier and through Cape Lambert. Its shipments were still 8pc below its annual rolling average of 6.65mn dwt/week, as maintenance work continues at the EII site.

BHP shipped 7pc above average in the most recent week at 6.22mn dwt, up from 5.61mn dwt the previous week, as it restarted the Finucane Island A berth on 11 June for the first time since 31 May. This followed a pause in shipping from the Nelson Point A berth during 23 May to 1 June. The firm has been upgrading port facilities to increase its operational flexibility, which has delayed its usual ramp-up ahead of the end of its financial year on 30 June.

Fortescue continued its eight-week run of above-average exports at 3.88mn dwt, up from 4.36mn dwt the previous week and 22pc above its weekly average of 3.56mn dwt. Fortescue had a very strong May and is on track to come in near the top of its guidance of 178mn-182mn t for the year to 30 June.

Roy Hill shipped 1.58mn dwt, up from 1.38mn dwt in the week to 5 June and 38pc above its rolling average of 1.15mn dwt.

China was listed as the destination for 79pc of shipments in the latest week, up from 73pc a week earlier. After including shipments with unconfirmed destinations — most of which are probably headed to China — the percentage was 84pc, up from 81pc a week earlier and above the average of around 82pc.

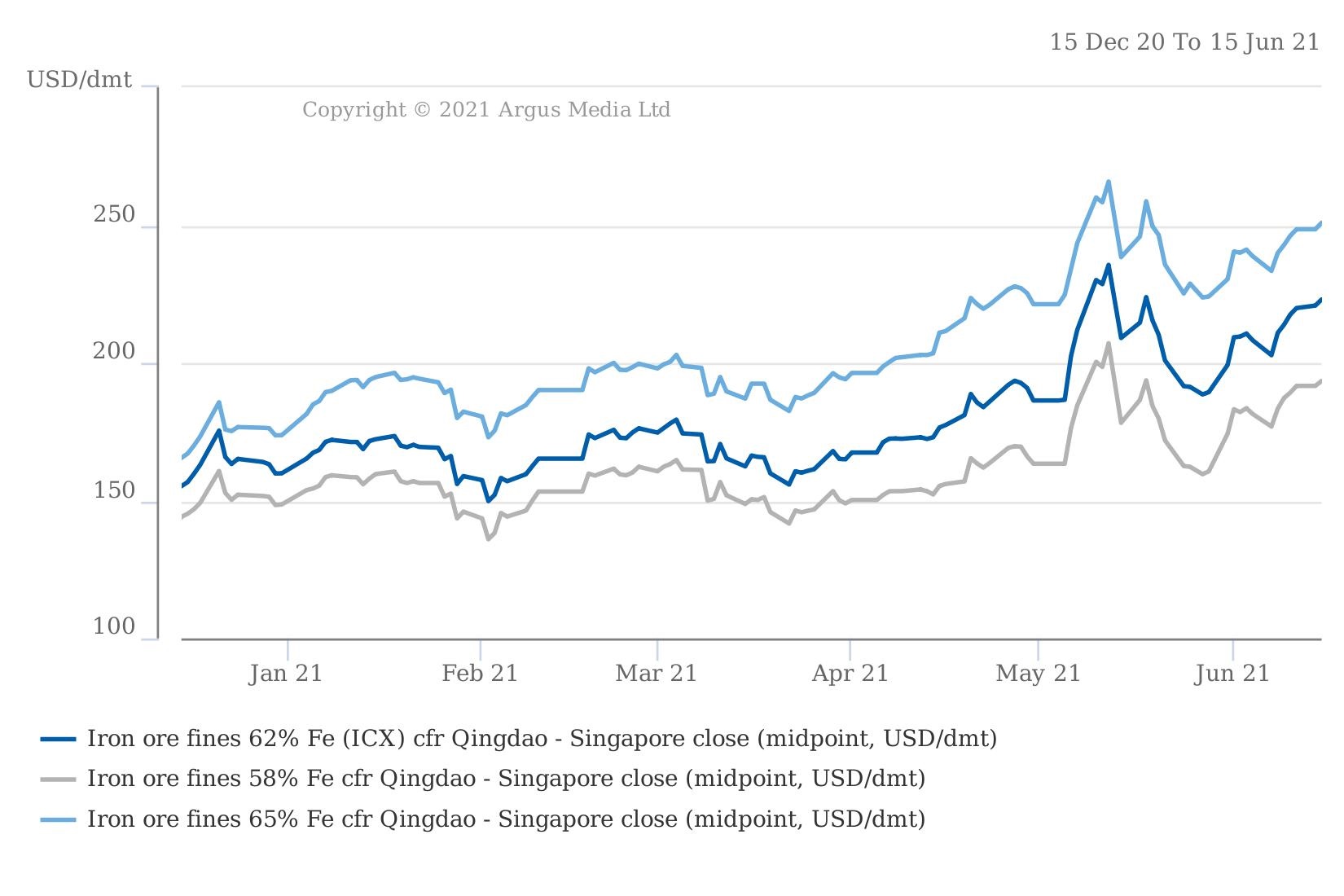

Argus assessed the ICX iron ore price at $223/dmt cfr Qingdao on a 62pc Fe basis yesterday, up from $209.30/dmt on 1 June but down from a high of $235.55/dmt on 12 May. Yesterday's assessment increased from $167.45/t on 1 April and $159.90/t on 31 December.