Coal would be phased out of power generation, and nuclear sharply cut, under 2050 carbon neutrality scenarios submitted this month, writes Evelyn Lee

South Korea is answering the international call to step up emissions cuts to meet its 2050 net zero target, but an ambitious plan to expand renewables capacity and end coal use, while heavily reducing the share of nuclear in the power mix over the same period, raises questions about its feasibility.

Seoul this month proposed a 40pc cut to its greenhouse gas emissions by 2030 compared with 2018 levels, up from a previous target of 26pc, and from a goal of "at least 35pc" promised in late August, when the national assembly enacted the country's 2050 carbon neutrality framework. The 2030 proposal is part of South Korea's updated nationally determined contribution (NDC), the ministry of trade, industry and energy says. The Moon Jae-In government is due on 27 October to approve one of two scenarios to achieve 2050 net zero emissions, both entailing a complete coal phase-out by 2050. And it expects to officially declare its 2030 NDC target at the UN Cop 26 climate summit next month.

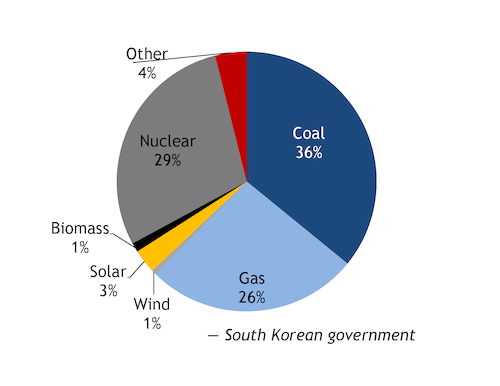

Under both scenarios, overall power demand is expected to more than double by 2050 from 552TWh in 2020. And the share of nuclear in the mix is expected to fall sharply from 160TWh in 2020, with the country planning to phase out nuclear power over the coming decades. Seoul plans to reduce power-sector emissions to 20.7mn t of CO2 equivalent (CO2e) by 2050 under the second scenario, which would be down by 92.3pc from 269.6mn t of CO2e in 2018.

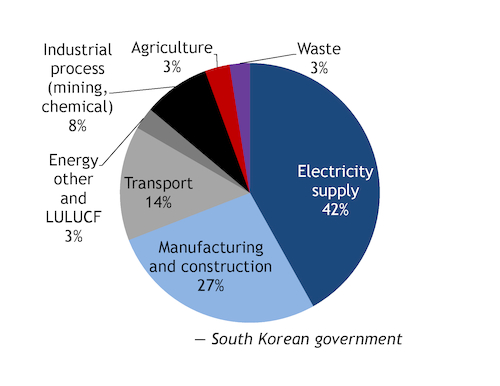

South Korea achieved rapid industrialisation through carbon-intensive industries such as manufacturing, electronics and cars, shipbuilding, and steelmaking. It was the world's eighth-largest exporter of goods and services in 2019 and had the tenth-highest GDP in the world in 2020, World Bank data show. But with these energy-intensive industries fuelled largely by coal, South Korea's emissions in 2018 were around 12.2 t/capita, the World Bank says, compared with EU and OECD averages of 6.4 t/capita and 8.8 t/capita, respectively.

The gap between South Korea and the rest of the world prompted the government to introduce the Korea Emissions Trading Scheme in January 2015, although this did little to change market dynamics, largely because of the 97-100pc free allowances handed out during the first two phases. Given its failure to induce lower coal burn, Seoul asked state-owned utility Kepco to voluntarily reduce its coal-fired power output in April-November to meet overall emissions targets, while Kepco units have been obliged since 2019 to cut their coal use in December-March to tackle air pollution.

Cap in hand

The government is now considering an annual cap on coal-fired generation from 2022 that aligns with the country's NDC targets leading up to 2050, and a new power auction system to enable utilities to bid for generation allowances to make carbon costs more meaningful. The new cap-and-trade system would support South Korea to adopt more-stringent NDC targets.

But Moon's commitment to the nuclear phase-out risks making it challenging to achieve fossil fuel reduction targets. The latest electricity plan shows Seoul's intention to reduce nuclear capacity to 20.4GW in 2030 and then 19.4GW in 2034, from 23.3GW in 2021.

The government has also taken steps to encourage the adoption of electric vehicles (EVs), offering incentives for consumers, and is supporting industrial-level schemes to encourage battery manufacturing. Domestic car manufacturers Kia and Hyundai have invested heavily in EVs and have co-operated to develop a shared electric platform for their vehicles to help scale production. EVs now account for around 16pc of car exports from South Korea, up by around 30pc on the year.