Russian ferrous scrap collection in August–September fell to the lowest level for the corresponding period in the past five years, as it came under pressure from the export restrictions on ferrous scrap and steel products, particularly for billet.

The country collected 2.33mn t of scrap in August, down by 24.7pc on the month and 3.6pc on the year, data from Russian scrap trade association Ruslom show. In September, collection edged up by 3.3pc from August, but was 3.3pc below September 2020.

The drop was underpinned primarily by a drastic fall in exports. Moscow in June introduced a higher export duty for ferrous scrap, effective from 1 August to 31 December. And it has significantly dented Russian exporters' appetite to collect and purchase scrap.

The country has also placed export duties on steel products for the same period, which, combined with a fall in global ferrous prices, has led to a drop in steelmakers' demand for scrap (see table), and consequently put further pressure on scrap prices in Russia.

An export duty of 15pc, but no less than $115/t, was set for a range of steel products, including billet, rebar, wire rod and hot-rolled flats. This duty forced Russian mills to focus on domestic sales in August-September. But domestic buyers showed lower-than-expected buying interest because of mills' very bullish pricing policy in the previous months.

Based on rail data, domestic shipments, including imports, of construction steel (long products, sections and flat products) to traders and end-users fell by 8.2pc on the month and 13pc on the year in September. Volumes in August were down by 13.1pc month on month and by 14.4pc year on year.

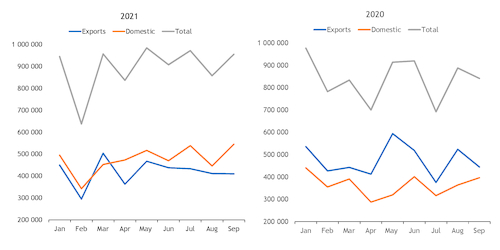

Russian billet shipments were broadly higher this year compared to 2020 (see graph). But it was atypical to see domestic shipments above export shipments, as mills diverted tons to the domestic market instead. A large portion of these volumes were produced before the export duty came into force. And they were eventually put into mills' warehouses because mills were in no rush to export until the duty expired at the end of the year, while domestic demand was comparatively weak.

Mills therefore cut outputs for billet and some other steel products, which led to lower mills' scrap demand for August-September. The bearish price trend and sentiment in the domestic scrap market in September further limited scrap collections.

"There is no shortage in the domestic scrap market at present, although flows are rather slow amid steelmakers' erratic — to some extent — pricing policies. We estimate that most of them have fully or nearly completed winter stocks building, apart from one or two large producers, which have already advocated an extension and an increase of the scrap export duty," Ruslom said.

Last week, Russian authorities requested a number of selected steelmakers to present their position on the need to extend and increase the ferrous scrap export duty. They were required to respond by 21 October. But only some steelmakers have so far responded and some of them were not in favour of an extension, Argus understood.

"Inconsistent pricing, tight availability of railcars in the domestic market, export duties on steel products — some mills are trying to pin everything on exporters and to mask their own failures with scrap export restrictions, for which they were proven not an effective regulation tool for the domestic market over and over again," one exporter said.

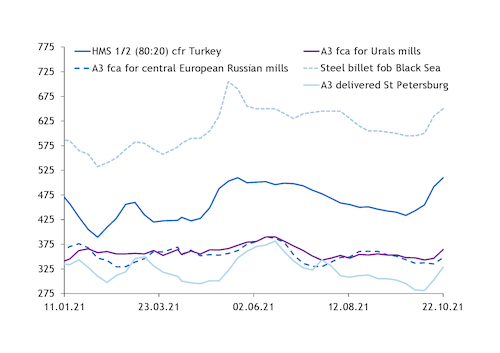

While Russian scrap exporters' dockside purchase prices broadly tracked movements in Turkish ferrous scrap import prices and CIS-origin billet prices, Russian domestic scrap indications often do not follow the seaborne, or even the global, trends, as they sometimes move against what fundamentals would suggest, market participants said.

The fall in exporters' buying prices and scrap exports in August–September reiterated a similar trend in February–March, immediately after Russia hiked its ferrous scrap export duty for the first time this year in January, because of panic buying and selling. Export shipments also increased in July after Moscow extended and increase the export duty.

Mills' scrap buying prices in February-March and July were forced to adjust higher, although the duty was aimed at curbing domestic scrap values. "Mills have no choice but to pay more, when they cannot buy more," a trader said.

In the first nine months of this year, Russian scrap collection totalled 21.97mn t, rising by 21.6pc compared with a year earlier, largely because of stronger collection during April–July.

| Russian 2021 ferrous scrap shipments | 000t | |||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | 9M total | |

| Domestic shipments | 1,502.0 | 1,717.0 | 1,900.0 | 2,398.0 | 2,600.0 | 2,762.0 | 2,477.0 | 2,278.0 | 2,291.0 | 19,925.0 |

| Exports to Belarus | 33.6 | 7.8 | 40.9 | 40.5 | 63.8 | 87.4 | 84.9 | 65.6 | 60.4 | 485.0 |

| Imports from Kazakhstan | 103.8 | 103.5 | 102.2 | 105.0 | 89.0 | 112.8 | 108.5 | 102.1 | 91.3 | 918.0 |

| Exports | 690.5 | 21.7 | 58.1 | 191.0 | 243.7 | 386.3 | 641.2 | 90.9 | 150* | 2,473.0 |

| Collection | 2,122.3 | 1,642.9 | 1,896.8 | 2,524.4 | 2,818.5 | 3,122.9 | 3,094.6 | 2,332.4 | 2,410.1 | 21,965.0 |

| — Ruslom | ||||||||||

| * estimate | ||||||||||