More crackers in Asia are planning to slash run rates, a decision propelled by weak cracker margins. South Korean petrochemical producer KPIC plans to reduce operating rates from 100pc to 85pc by the end of this month.

KPIC is the latest in a slew of crackers cutting run rates in light of poor cracking economics, after fellow South Korean petrochemical producer LG Chemical reduced run rates at all its three crackers in Yeosu and Daesan from 90pc in December to 80pc in January. Argus understands that the decision to cut runs is still on the table for other cracker operators in northeast Asia.

Cracker operators in southeast Asia are also further reducing run rates. Argus understands that a key Singapore cracker operator is running at 85-90pc, while other producers plan to reduce rates in February. Crackers based in Thailand, Indonesia and the Philippines have also lowered operating rates to 70-95pc.

High feedstock prices, low ethylene prices

Feedstock naphtha prices or the Argus Japan naphtha price on 10 November rose to the highest in seven years at $802.50/t, while ethylene prices or the Argus cfr northeast Asia ethylene price stood at $1,145/t on the same day.

Some crackers in southeast Asia, particularly non-integrated facilities, had cut their operating rates by 5-10pc, citing low cracker margins.

Market sentiment for ethylene, the main product of crackers, has worsened since and prices for ethylene have been steadily slipping on weak downstream demand. The Argus fob northeast Asia prices for ethylene fell below $950/t for the first time in seven months on 12 January, settling at $930/t, according to Argus' latest assessments.

This occurred while feedstock naphtha prices barely came down from the record highs in November, riding on recent gains in crude oil prices. Argus Japan naphtha prices stood at $762/t on 12 January. The ethylene-naphtha spread, or the Argus northeast Asia ethylene premium to Argus Japan naphtha price, also fell to a 20-month low of $203/t on the same day. Producers typically require a spread of about $350/t to break even.

Record-low cracker cash margins

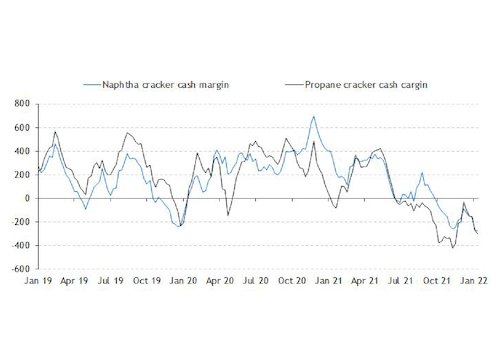

Naphtha cracker cash margins or the Argus northeast Asia ethylene-naphtha gross spot margin, extended declines last week to a record-low of -$275/t, the lowest on Argus records since 2016.

Margins have been remained in negative territory since September, when Argus Japan naphtha prices rocketed and exceeded $700/t.

Cracker margins for propane, which could replace naphtha as a feedstock for the cracking pool, also fared poorly and gave producers little alternative. Propane cracker margins have been in negative territory since June 2021, when sky-high natural gas prices had a knock-on effect on prices of propane and butane. Margins stood at a two-month low of -$301/t last week.

Weak margins had sparked market chatter of crackers planning to cut runs and resulted in a relatively quiet week in the naphtha spot market that saw muted buying among petrochemical producers.