UK-Australian resources firm BHP is on track to meet the top of its iron ore production guidance for the 2021-22 fiscal year to 30 June, although it warns that workforce shortages could drag on output in the second half from the potential impact of Covid-19.

BHP shipped 144.04mn t of iron ore on a 100pc basis during July-December, putting it halfway to the top of its 278mn-288mn t guidance for 2021-22. But it warned that the easing of the Western Australia (WA) border restrictions proposed for 5 February may introduce short-term disruption to the operating environment as Covid-19 moves through the state, which has been largely free of the pandemic to date. The warning follows the firm's experience of labour shortages cutting its metallurgical coal output in Queensland because of the widespread transmission of Covid-19 in the east Australia state.

BHP shipped 73.22mn t of iron ore on a 100pc basis during October-December, which was up from 70.81mn t for July-September and a similar level in October-December 2021. The increase reflected the three-year ramp-up of the 80mn t/yr South Flank iron ore project to a peak rate of 45mn t/yr, with the mine on track to hit full capacity by June 2024.

This ramp-up increased the proportion of lump ore sold by BHP and offset sales disruption caused by skills shortages, particularly of train drivers, caused by WA border closures. It also countered weaker shipments caused by major maintenance on a car dumper at Port Hedland and the train load out facility at the Jimblebar mine.

The firm in on track to exceed production guidance for 2021-22 of 3mn-4mn t for its 50pc share of the Samarco mine in Brazil. Samarco, which restarted in December 2020 after being closed for five years because of a fatal tailings dam collapse, produced 4.12mn t on a 100pc basis during July-December, putting it ahead of BHP's expectation that it would reach 8mn t/yr for January-June 2022.

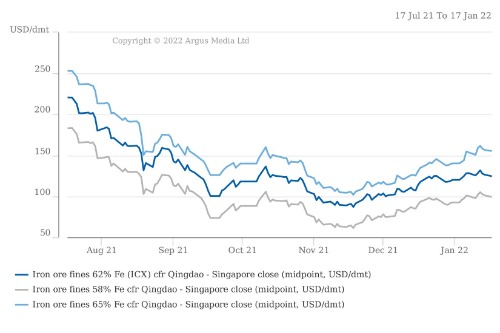

BHP expects to come in at the bottom of its cost guidance of $17.50-18.50/t for 2021-22. It achieved an average received price of $113.54/wet metric tonne (wmt) fob Port Hedland during July-December, down from $158.17/wmt for January-June.

Argus assessed the ICX iron ore price on 18 January at $126.65/dry metric tonne (dmt) cfr Qingdao on a 62pc Fe basis, up from $90.70/dmt on 17 November but down from a high of $235.55/dmt on 12 May. Argus assessed 58pc Fe at $102.45/dmt cfr Qingdao, up from $64.30/dmt on 17 November but down from a high of $207.10/dmt on 12 May.

| BHP iron ore sales | (mn t) | |||||

| Oct-Dec 2021 | Jul-Sep 2021 | Oct-Dec 2020 | 1H 2021-22 | 1H 2020-21 | FY 2021-22 target | |

| WA sales | ||||||

| Lump | 17.8 | 17.6 | 16.7 | 35.4 | 33.8 | 74-84 |

| fines | 46.8 | 45.0 | 46.1 | 91.8 | 94.5 | 162-181 |

| Total | 64.6 | 62.6 | 62.8 | 127.2 | 128.3 | 246-255 |

| Total (100%) | 73.2 | 70.8 | 70.8 | 144.0 | 144.1 | 278-288 |

| Brazilian sales | ||||||

| Samarco | 0.9 | 1.1 | 0.0 | 2.1 | 0.0 | 3 to 4 |

| Source: BHP | ||||||

| Target is for production not sales. The lump/fines split is an estimate based on BHP's plan for 30-33pc lump from WAIO | ||||||