Medium Range (MR) clean tanker freight rates from the Mideast Gulf to Africa have risen on a surge in clean product demand, caused by a South African refinery outage and worries about a potential unrest in Kenya following the upcoming election.

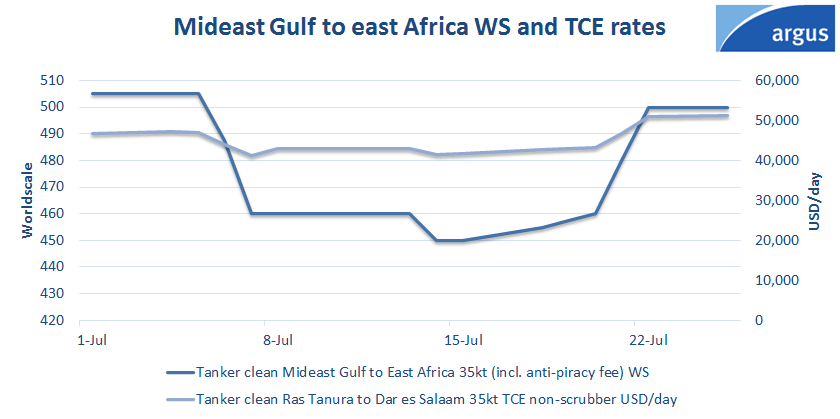

MR rates for 35,000t shipments from the Mideast Gulf to east and South Africa — which includes anti-piracy fees — have risen by 9pc to WS500 and WS490 respectively on 25 July, from WS460 and WS450 on 7 July. Argus' time charter equivalent (TCE) rates for 35,000t shipments from Ras Tanura to Tanzania's Dar er Salaam have risen to $51,305/d from $41,129/d over the same period.

Argus recorded 23 MR fixtures from the Mideast Gulf to east and South Africa over 7-25 July, compared to 19 MR fixtures over the same time period from 18 June to 6 July.

Clean petroleum product imports to South Africa are similarly projected at a six-year high of 1.69mn t in July, of which at least a third originated from the UAE and India, according to preliminary data from Vortexa. Demand from South Africa was supported by South African petrochemicals and energy firm Sasol's force majeure on the supply of refined oil products, following the shutdown of its 107,000 b/d joint venture Natref refinery in Sasolburg on 16 July.

The shutdown meant only one of South Africa's refineries was operational — Sasol's 150,000 b/d coal-to-liquids plant at Secunda, which represents about a fifth of the country's total refining capacity. This has likely led to South Africa seeking to import more oil products in the mid-late July period.

East African demand has also been firm despite high fuel prices in the past months because of the Russia-Ukraine war, with the governments of Kenya and Tanzania — the biggest fuel importers in east Africa — taking steps to reduce the burden of increasing prices on the general public and to ensure stable supplies.

Some countries may also be seeking to import more fuels to secure the supplies ahead of Kenya's general election on 9 August. Market participants fear that the election may cause unrest and disrupt fuel supply through Kenyan ports to its landlocked east African neighbors. Kenya facilitates the onward movement of about 900mn litre/month of petroleum products to Uganda, South Sudan, the Democratic Republic of Congo, Rwanda and Tanzania. Uganda had already started thinking about ensuring sufficient fuel imports in January, well ahead of the election. The country currently receives 95pc of its petroleum products via the Kenyan port of Mombasa. The Ugandan government is keen to avoid a repeat of 2007, when violence after Kenya's election led to a widespread fuel crisis in east Africa.