Liquidity in monthly methanol contracts will likely increase in 2023, with additional market participants looking to take part after several producers and consumers agreed monthly contract prices in 2022.

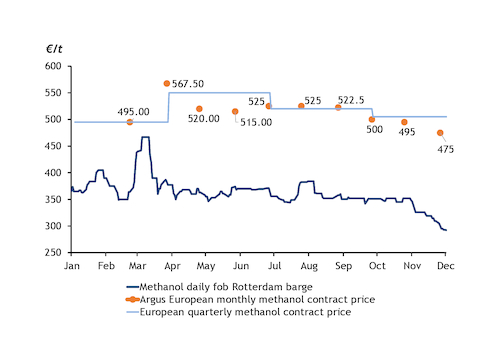

Methanol contracts in Europe are typically settled on a quarterly basis, but market volatility has been cited as one of the drivers for monthly contracts. Argus launched a monthly European methanol contract price (CP) assessment in February 2022 in response to growing market interest.

Europe is the only region to maintain a methanol contract agreed on a quarterly basis, while the US and Asia-Pacific use monthly contract prices. A quarterly contract price can bring an element of stability, but means a value agreed ahead of a quarter is unable to adjust to any market developments for three months.

European methanol contracts typically consist of an outright flat price in €/t, against which producers and consumers agree an individual discount. These discounts can vary but market feedback suggests that they have grown to exceed 30pc in some cases in the last two years, from 15-20pc previously.

Besides increased market volatility in recent years, other drivers for monthly methanol contracts include interest in closer alignment with pricing structures in the Americas and Asia-Pacific in an increasingly globalized supply chain. The development of new downstream applications and new demand for methanol in the past decade has also played a role.

Traditional methanol derivatives — including formaldehyde, acetyls, methacrylates, silicones and other specialty chemicals — are used in a variety of downstream industries, including the automotive and construction sectors. But more recent downstream applications, such as methanol into fuels and methanol-to-olefins (MTO), can leave the market exposed to volatility beyond macroeconomic factors. With them came increasing correlation with more fast-paced pricing of energy markets.

Other petrochemical industries seeking flexibility in a volatile price climate, such as olefins, made a move from quarterly to monthly CPs following the financial crisis in 2008. Aromatics pricing changed in 2002.

Uncertainty

As the covid-19 pandemic bowled over the market in 2020, this year brought new uncertainty, with sanctions, record high gas and utility prices and rising inflation all set to continue to impact market dynamics.

The Russia-Ukraine conflict raised immediate supply concerns in 2022, as Russia has historically been one of the largest exporters of methanol to Europe. Methanol itself was not sanctioned by the EU until October, but buyers in northwest Europe began to step away from purchasing Russian material around March.

Any EU consumers still importing Russian methanol under contracts concluded before 7 October 2022 can no longer do so from mid-June 2023, following a recent extension to the previous deadline of early January. This may impact central and eastern Europe more than other regions, because of the proximity to Russia and long-established supply routes.

So far, an increase in methanol imports from the Americas mostly rebalanced northwest European supply, and while rising natural gas prices had supported monthly methanol contract prices in July, a well-supplied market in Rotterdam led to contract prices for August and September being settled at a rollover or decreases.

By year-end, economic pressures and weakening downstream margins brought lower methanol demand, leading consumers and producers to agree December contracts at decreases.