The Asia ferrous scrap complex saw an underwhelming first quarter as ongoing geopolitical tensions, a banking crisis, weak construction activities and sluggish steel demand weighed heavily on scrap procurement appetite.

High inflationary pressures and recessionary fears continued to have detrimental effects on the global economy in 2023. Staggering inflation has driven many nations to tighten monetary policy and lift interest rates, which consequently increased the raw material purchasing costs for some buyers when raw material suppliers were forced to keep offers high because of higher inflation and energy costs.

The situation was further exacerbated by a banking crisis in the US and Europe, which led market participants to fear further rippling repercussions in Asia.

In Asia, the reopening of China's borders and the relaxation of Covid-19 rules in China failed to spark a lift-off in the ferrous steel and scrap arena. Market participants initially held an optimistic outlook on the Chinese market after the lunar new year holiday in February, which is typically the peak construction season in March. Further optimism arose when the national congress held talks of potential stimulus policies to boost the post-Covid Chinese economy.

But actual steel consumption in the peak construction season was weaker than initially expected because of a stagnant property market. This led to lower domestic billet prices, which fell by 270 yuan/t ($39/t) from 14 March to Yn3,800/t on Tuesday. China's steel Purchasing Managers' Index (PMI) fell by 1.7pc from February to 48.4 in March, while the country's official manufacturing PMI declined by 0.7pc.

The bearish sentiment from China extended to regional markets and cheaper steel offers emerged in the seaborne market, which weighed on southeast Asian steelmakers' margins and in turn demand for ferrous scrap.

Vietnam, a major buyer of ferrous scrap in the Asian seaborne market, has stayed inactive since February when the recovery of the Chinese steel market proved to be unsustainable. The combination of lingering strict regulations on the domestic property market, elevated financing costs and stagnant export markets led Vietnamese steelmakers to maintain low utilisation levels and refrain from large-scale purchases from the seaborne market. Vietnam's finished steel production dropped by 16.3pc on the year across January-February, the Vietnam Steel Association said.

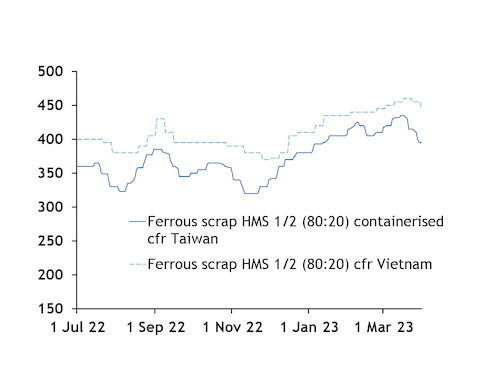

In the first quarter, the cfr Vietnam deep-sea bulk scrap price was seen largely on an upward trajectory, backed by firmer US domestic demand and prices. This led scrap exporters to adopt a bullish near-term outlook on scrap prices and withhold offers or sell only in limited tonnages. Many scrap traders also pointed out that it was difficult to procure scrap cargoes themselves in February-March. The HMS 1/2 80:20 cfr Vietnam index, which was launched on 1 July, rose as high as $460/t in the week of 13-17 March before tapering off to $445/t cfr on 31 March on sluggish steel demand, Argus data showed.

South Korean mills were passive in ferrous scrap imports on stable domestic scrap supply and tepid construction steel sales. Domestic scrap prices in Korea were range-bound in the first three months and this week stood at about $10-15/t below levels at the beginning of the year.

Taiwan — a beacon of hope?

As regional buying remained suppressed in other Asian regions, Taiwan saw sporadic, modest increases in imported scrap prices in the first quarter of the year as US scrap prices firmed up on heightened domestic demand.

Local mills chased offers after the lunar new year holiday to catch the construction season wave ahead of the energy restriction period that typically spans across June-September.

The Argus containerised HMS 1/2 80:20 cfr Taiwan assessment breached a near eight-month high of $425/t on 8 February and later moved to a nine-month high of $435/t on 15 March. But prices have since come under increased pressure and fell to $395/t cfr on 31 March. The benchmark settled at a quarterly average of $411.04/t in the first quarter of 2023, rising 17pc on the quarter, but down 16.8pc on the year.

"Taiwan imported scrap prices see-sawed in the first quarter of the year," a trader said. "There were prolonged periods when [Taiwanese] buyers were away on the lunar new year holiday. US domestic prices rose in March, so there weren't many export offers, and then came an influx of cheap billets from southeast Asia, so prices and sentiments were very mixed."

In January-February, Taiwan's scrap imports totalled 469,051t, marking a 2.2pc rise year on year. The bulk of the imports came from the US, Japan and the Dominican Republic, Taiwan's customs data showed.