Chile's large-scale copper miners are turning attention to measuring and reducing indirect greenhouse gas (GHG) emissions in their value chain — known as scope 3 emissions — after making progress to address emissions from their own operations.

In January, a working group of eight major copper producers published a guide to ensure the sector uses the same criteria and standards to measure and report scope 3 emissions across the industry. The guide is aligned with international standards but specific to the copper industry.

It provides an overview of the copper value chain, the relevance of scope 3 emissions to the industry and a detailed guide on how to measure and report scope 3 emissions, broken down into the 15 categories defined by the international GHG Protocol standard.

"The guide is for use globally by any copper mining company in the world," said Jorge Barrios, the report coordinator who leads traceability at AltaLey, a public-private initiative that promotes innovation and sustainability in Chile's mining industry.

Scope 3 emissions account for over 50pc of the copper industry's carbon footprint but are the hardest to manage as they are produced by sources that companies do not own or control. They are emitted by upstream suppliers of goods and services to mining operations as well as downstream customers that transport or process mining companies' products.

The wide range and size of companies in the value chain make it difficult to obtain scope 3 emissions data. Some do not have systems to measure the emissions produced by their activities. "Obtaining the information requires management and engagement with innumerable counterparts," stresses Barrios.

The guide will support large-scale copper miners' growing efforts to set scope 3 emission reduction targets. In January, Chile's state copper producer Codelco announced its aim to reduce by 25pc the emissions intensity of strategic operational inputs — such as explosives, refractories and lubricants — by 2030.

Chilean miner Antofagasta has launched a supplier engagement program to raise awareness about GHG emissions to meet its own target of a 10pc reduction in scope 3 emissions by 2030.

Medium and small-scale miners are also interested in the initiative. AltaLey and the national mining society Sonami are working on a project to help small and artisan miners manage and trace their carbon footprint, said Barrios.

The environment ministry's carbon footprint program (Huella Chile) supports GHG emissions management with a tool to monitor, report and verify emissions, including a module aimed at mining suppliers.

Chile's focus on scope 3 emissions gives it a competitive advantage to address global pressure for more transparency about the carbon footprint of supply chains, according to Barrios.

Other GHG emissions

Chile's major miners have also taken important steps to tackle indirect emissions from the generation of purchased electricity — known as scope 2 emissions.

The industry's use of renewable electricity reached 67pc in 2023 and is expected to rise to 78pc in 2026 as companies continue to renegotiate power purchase agreements from fossil fuels, according to the Chilean copper commission Cochilco.

The country's commitment to the energy transition, embedded in its 2022 climate change law, provides a robust platform for the industry to have a fully renewable power supply by 2040, it said.

Miners also have strategies to reduce direct emissions, known as scope 1, mainly from the combustion of boilers, furnaces and vehicles at mining sites. Companies are working with mining equipment manufacturers to test clean fuel alternatives, but economically feasible solutions are still elusive.

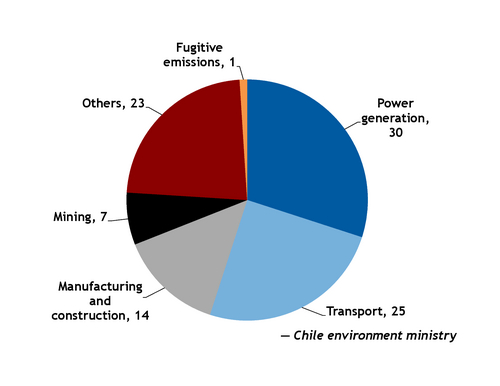

Chile's energy sector accounts for 77pc of the country's GHG emissions. Mining represents 17pc of the energy sector's emissions.