Strong demand and diminishing collection volumes are driving tightening supply of natural HDPE bales in the US market, leading to significant price volatility that makes forward planning much harder across the supply chain.

Many fast-moving consumer goods firms have committed to more recycled resin in packaging, and virtually all want to ensure their recycled packaging can be recoloured to fit their brand. This has driven widespread adoption of natural rPE.

Manufacturing rHDPE natural grades means using bales reclaimed from used milk bottles — a reliable food-grade feedstock. But while brands look to use more recycled plastic, supply limitations are holding back the US recycling industry.

Feedstock limits

Legislation and corporate commitments have accelerated use of rHDPE food-grade resin, even as demand for many recycled plastic grades has fallen in recent years. But as reclaimers move to boost production capacity for food-grade polyolefins, including natural rHDPE, feedstock availability is increasingly problematic.

The volume of HDPE bottles recovered for recycling in the US fell in 2021 and 2022, according to research group Stina's Annual Plastics Recycling Study, with collections failing to grow across large swathes of the country. State and local governments have been slow to improve collection systems, and many states, including West Virginia and Tennessee, offer virtually no recycling services.

"It's not the private sector that's dropped the ball, it's state and local governments," KW Plastics general manager Scott Saunders tells Argus. "The brands want more material and reprocessors have expanded production. Meanwhile, I've not seen any major new MRF [materials recovery facility] projects in about 20 years."

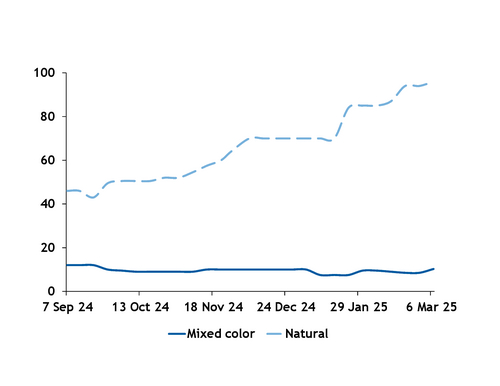

And, as new players have entered the market, there are more companies taking feedstock from a smaller pie. Tight supply has caused the price of natural HDPE bales to rise to 96¢/lb in March 2025 from 35¢/lb in July 2024.

Milk consumption

In the HDPE natural market, bale supply is being further pressured by declining milk consumption. Data from the US Department of Agriculture (USDA) Economic Research Service found that milk drinking in the US has been trending downward for 70 years, with the rate of decline accelerating during the 2010s.

While cow milk consumption is falling, consumption of alternatives — often stored in different forms of packaging — is on the rise. Plant-based milks and ultra-filtered milks, which have become increasingly popular, often use paperboard, glass or alternative plastic packaging instead of natural HDPE. These other packaging types hold back the theoretical production limit of natural rHDPE.

Retail sales of Coca Cola's brand of ultra-filtered milk, Fairlife — sold in a white rPET bottle — exceeded $1bn in 2022.

Ups and downs

Brand owners remain keen to progress towards sustainability commitments, and to preserve relationships with local suppliers. "Brands are currently willing to pay high prices because they don't want to lose their position as a customer and lose allocation of natural rPE for their products," Saunders said.