US benzene (BZ) demand is expected to remain steady in the first quarter of 2026 because of low operating rates for BZ derivatives, sources said.

Operating rates for BZ derivatives were low in 2025 because of weak demand and a busy turnaround season, with several styrene monomer (SM), cumene and phenol producers conducting turnarounds. At least one US Gulf coast styrene producer is expected to perform a turnaround in the first quarter that is estimated to run 20-30 days, another source said.

Ethylbenzene (EB) demand into gasoline blending may finally see its seasonal lull, as high-octane, low-Reid vapor pressure (RVP) blendstocks are typically in low demand from October-March, when US gasoline specifications allow high-RVP blendstocks like butane to enter the blend pool.

In late 2025, EB demand remained steady into gasoline blending because of strong demand for high-octane aromatic blendstocks to offset low-octane light naphtha, which was blended into the gasoline pool to keep up with the demand for US gasoline exports. But, with expensive feedstock BZ heading into 2026, EBSM producers cannot sell EB above breakeven levels, which caused EBSM producers to reduce operating rates, sources said.

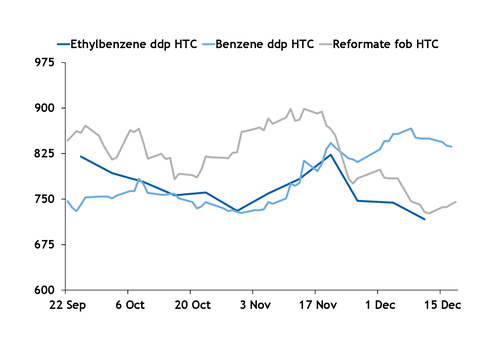

When spot BZ reaches a premium to feedstock reformate prices, EB becomes a less competitive blendstock because of its production cost (see chart). This disposition of ethylbenzene's value as a blendstock opens competition for other aromatic blendstocks like toluene and mixed xylenes to enter the gasoline pool.

North American EBSM operating rates are expected to remain at 48-60pc in early 2026, according to a generic Argus model with operating rates informed by market participants.

SM export demand is anticipated to remain limited. The arbitrage to Europe is closed for December-loading cargoes to arrive in January, Argus data show. Buying interest could emerge from Latin America, which typically takes 20,000-25,000 metric tonnes (t) of SM from North America every two or three months, depending on polystyrene (PS) production rates.

Cumene demand is expected to remain flat in 2026 on steady, though sluggish, downstream demand for phenol and acetone, which have big shares in the construction, automobile, appliances and resin industries. A source said sellers are taking customers' spending and borrowing power into deeper consideration when exploring spot and new contract opportunities to mitigate selling risk.

Phenol is anticipated to see little fundamental change in 2026, sources said. There are few expected phenol turnarounds for maintenance in the first half of the year, and sources expect consumption to remain comparable to 2025. New housing permits declined in 2025 compared to 2024, according to US Census Bureau data, which led to fewer homes being built and less phenol demand. About half of all phenol produced in the US goes into the construction sector.

Phenol and cyclohexane demand from the automotive industry may decline in 2026 on lower automobile manufacturing leading into the new year. Domestic automobile production trailed lower throughout 2025 as many producers were operating below full output rates. In August, US automobile production dipped below 100,000 units for the first time since January, according to the US Bureau of Economic Analysis (BEA). Before January, monthly domestic automobile production last dipped below 100,000 units in September 2021. The automotive industry makes up nearly 22pc of phenol consumption.

Benzene supply is expected to remain low in 2026 on reduced US production and fewer imports because of US tariff policies that add costs for traders.

On production, some market participants expect selective toluene disproportionation (STDP) unit operating rates to remain low in 2026 because BZ prices rose in late 2025 on tight supply, not strong demand, sources said. Though STDP margins look healthy on paper moving into 2026, if STDP operators raise production rates, the higher BZ supply would depress prices and margins to the point where STDP operators decide to turn run rates down again or idle their units, another source said.

The US is historically in a net BZ deficit and usually relies on BZ imports to add supply when BZ production lags demand. With US tariff policies adding costs to those imports, shipments of BZ from Europe and Asia have largely declined. Market participants said they expect this trend to continue in 2026 without changes to US tariff policy.