Europe can breathe a sigh of relief on the one-year anniversary of the greatest price spike in the history of European gas trading.

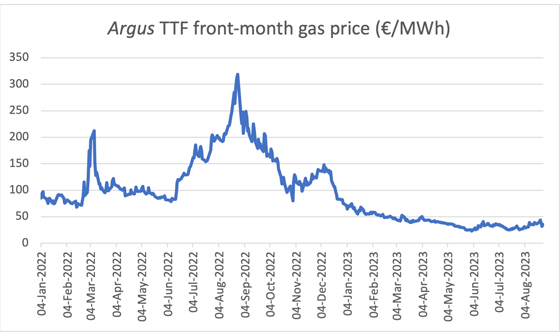

The value of gas delivered on a front-month basis to the Netherlands’ Title Transfer Facility (TTF), the hub at which much of Europe’s wholesale gas trading activity is concentrated, hit an all-time high of €319/MWh on 26 August 2022. This contract has never been higher, before or since (see Argus TTF graph).

Successive price spikes last year reflected the global gas market’s struggle to rebalance as it took in the risk and then reality of the near withdrawal of Russian gas from Europe. Russian state-owned gas giant Gazprom had announced on 19 August 2022 that it would shutter the Nord Stream pipeline to Germany for three days from the end of that month, for what it called routine maintenance. In the end, exactly as market participants had feared, Gazprom closed Nord Stream indefinitely.

Twelve months later, and Europe’s gas market is almost unrecognisably calm. The TTF is at just over 10pc of where it priced on that record-setting day. Indeed, the gas market’s major quandary this summer is how to deal with an abundance of supply — seasonal storage is full over two months before the northern hemisphere’s heating season begins.

The threat of strikes in Australia cutting exports of liquefied natural gas (LNG) to Asia did bring a little turbulence back to European gas markets this month. Any disruption might pull some cargoes away from Europe, and given the steep contango at the TTF, sellers will have eyed the opportunity cost of relinquishing supply that could be sold at a much higher price in November or December. But the price gains are a drop in the ocean compared with this time last year.

Who can we thank for this return to calm in Europe’s gas market — besides the weather gods, for granting us a mild winter? The market itself. Eye-watering gas and power prices, as painful as they were for Europe’s citizens — and for governments forced to bail out failing energy companies and cushion the effect on our heating and electricity bills — forced a significant reduction in gas demand. This happened across households, the commercial sector and industry.

Moreover, the fact that the TTF disconnected, and rose to well above other European gas markets, and above delivered LNG prices in Europe and Asia, did not signify, as some politicians and policymakers were quick to suggest, that the TTF was a broken index which had to be replaced. That price fragmentation — which has now all but vanished — was a reflection of bottlenecks in Europe’s gas grid, which was struggling to replace Russian piped gas with LNG arriving in boats. Faced with a shortage of regasification capacity, Europe could not physically get any more LNG into its terminals, and the routes to move gas from LNG-import heavy countries like Spain and the UK into European countries addicted to Russian gas — Germany, most of all — were clogged. The resulting large geographical price spreads incentivised the build-out of LNG import capacity and upgrades of gas transmission capacity between European countries.

It is tempting for Brussels to take credit for the work the market has done — particularly after it rushed a slew of regulations into law last year aimed at containing the price surge, under pressure from politicians with angry electorates. That temptation has been too great to resist for some. Miguel Gil Tertre, chief economist at the directorate general for energy at the European Commission, on 25 August waxed lyrical about “decisive EU policy action” in such areas as “storages (sic), demand reduction, joint purchasing, diversification, renewables, LNG benchmark”.

In reality, regulatory interventions in the gas market have at best complemented and at worst undermined the market’s work.

One example of a measure with no tangible impact is the commission’s platform that matches gas buyers and sellers. The commission patted itself on the back for this tool which supposedly makes the market more transparent, but has shared no evidence that additional deals were made through the platform that would not have been done already.

On the more dangerous side was the commission’s much-debated wholesale gas price cap. While the cap was eventually set at a level extremely unlikely to be triggered, traders have unresolved questions about how the cap might affect their ability to hedge on exchanges.

Meanwhile the market has essentially ignored the so-called “LNG benchmark” painstakingly created by energy regulator ACER, because it relies for its manufacture on a mechanistic average of LNG spot market transactions in Europe. As ACER has discovered, despite making their reporting mandatory, such transactions are few and far between, since the majority of LNG imports are contract-based. Spot deals can and have become as rare as Loch Ness Monster sightings when Asian demand surges – with the effect that ACER’s number is dependent on stale data, and has at times become a random walk dependent on how recently the agency was able to capture an elusive trade.

Given the far-reaching potential costs of overregulating the market, it would be a mistake for the commission to interpret the recent fall in prices, which was largely the result of factors outside of its control, as a justification for even more regulation. Some are even suggesting that volatility could be tamed by imposing a requirement for a greater proportion of exchange-traded TTF futures to be settled through physical delivery — a move that would severely undermine the role of exchange trade as a tool to manage the price risks inherent in physical transactions. It would be much more prudent to take a step back and let the market keep doing its job.

Author Natasha Fielding, Editor, European Natural Gas