Even strict enforcement of new regulations may fail to deter STS activity, with viable alternative locations nearby, writes Sean Lui.

Sanctioned vessels from the so-called shadow fleet continue to operate off Malaysia, despite a government pledge to curb illegal ship-to-ship (STS) transfers.

A significant number of sanctioned vessels remained in the East Outer Ports Limits (EOPL) area, officially known as the Tompok Utara anchorage, in late August, according to vessel tracking platform Kpler. The EOPL, off the east coast of peninsular Malaysia near the Singapore strait, is known for STS activity involving sanctioned vessels and cargoes, most of which subsequently head to China.

Of the 84 vessels anchored at the EOPL on 19 August with their Automatic Identification Systems (AIS) switched on, 52 were under sanctions, an analysis of Kpler data shows. This may even understate shadow fleet activity, as such vessels typically switch off their AIS to mask "dark activity", market participants say.

The sanctioned vessels remained in the area despite Malaysia's foreign minister, Mohamad Hasan, saying on 11 July that the country plans to fully enforce its ban on "illegal" STS transfers of crude.

The Malaysian Marine Department issued several new regulations as part of the crackdown, such as closing the EOPL. These regulations were also conveyed by the Singapore Shipping Association to members in a notice on 31 July. "Vessels engaged in unauthorised STS activities risk detention, penalties and possible legal action by the Malaysian government," the notice said.

Some market participants are not surprised at the figures for sanctioned vessels. "The transshipment of sanctioned oil has been going on for several years without anyone really saying anything," a shipbroker says. "So it comes as little surprise that even though some regulations have now taken form, it appears to be more bark than bite." Another shipbroker adds: "It is one thing to impose new regulations and another thing to enforce them."

Malaysian authorities could be holding back on enforcement action for now because of the sensitive nature of such a move, some market participants say. "Enforcement of such regulations will have repercussions on several fronts, particularly politically, and it is imperative that Malaysia is clear in the line that they are going to draw," a freight analyst tells Argus.

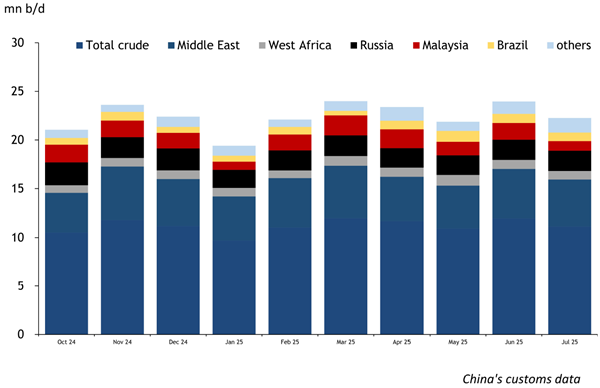

Malaysia has emerged as a key regional hub for STS transfers in recent years. Market participants say large amounts of sanctioned crude from Iran and Venezuela are transferred in the country's waters and then shipped to China. Vessels engaging in the trade pay fees to entities in Malaysia, providing a revenue source to the country. China's imports from Malaysia stood at 1.72mn b/d in June, according to the latest available Chinese customs data (https://direct.argusmedia.com/newsandanalysis/article/2712644). This far outstrips Malaysia's domestic production of about 490,000 b/d in the first half of this year.

Dabbling in lucrative waters

The STS trade obscures China's hefty imports from Iran. Customs data show that China has not imported any Iranian crude since June 2022, but actual deliveries were about 1.25mn b/d in the first seven months of this year, Argus estimates. Most of these imports undergo STS operations off Malaysia, where they are transferred from floating storage at Linggi near Malacca and at Tanjung Pelepas in the Singapore strait.

The start of enforcement action could push STS operations to alternative locations in nearby Indonesian territorial waters, such as Nipah and Karimun, market sources tell Argus. "There could be some inconvenience because the STS trade involving sanctioned oil and ships has been running like clockwork, but dabbling in sanctioned oil continues to be lucrative and should give charterers and shipowners the motivation to get through that rather easily," a market participant says.

Author: Sean Lui, Senior Fright Reporter, Argus Freight