Northwest Russian ferrous scrap dockside prices have tracked domestic scrap price trends more closely than export markets in the fourth quarter because of lower overseas sales, Argus data show.

Dockside prices in Russia's northwest ports are traditionally less influenced by export prices in periods of slower export demand, when the domestic market usually exerts a stronger influence.

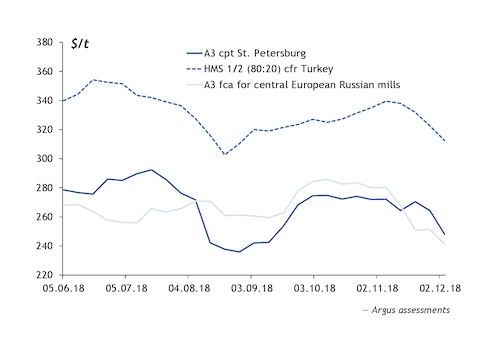

Delivered St Petersburg dock prices for A3 grade scrap have moved more closely in line with fca central European Russian A3 domestic prices since the start of October. Dockside markets in other major ferrous scrap exporting regions increased between 16 October and 13 November in response to a $10.80/t rise in the cfr Turkey HMS 1/2 80:20 price during this period.

But A3 delivered to St Petersburg prices were flat on a rouble-denominated basis and actually weakened in dollar-equivalent terms, falling by $7.89/t to $264.35/t from $272.24/t. This is a stark contrast to the summer months, when St Petersburg dockside price movements correlated extremely closely to the Turkish import price (see graph).

The shift in correlation is down to a fall in overseas sales by St Petersburg suppliers. Argus tracked 137,000t of deep-sea scrap sales to Turkey by St Petersburg exporters in October-November, down by 23pc from July-August.

The lower export activity has caused traditional seasonal factors that pressure Russian domestic prices in late autumn and winter to become the main drivers for dockside prices as well.

Russian steelmakers' demand for ferrous scrap drops off around November every year after they complete purchases of their winter stocks ahead of limited availability of new material from December to March. Some steelmakers have also reduced output because of the end of the high construction season and other seasonal factors.

This typical pattern has occurred this year, with the Argus A3 fca central European Russian mill assessment steadily rising to Rbs18,700/t by 11 October before falling by Rbs2,550/t to Rbs16,150/t on 29 November. The dollar-denominated equivalent decreased by $41.30/t to $241.25/t over the period.

St Petersburg exporters' lower demand caused by their reduced sales to Turkey has allowed them to move prices down just below the equivalent cpt price of Russian domestic fca prices. In times of strong export demand, these exporters will frequently pay more than Russian steelmakers and provide support to both the dockside and domestic markets.

Central European Russian steelmakers' equivalent cpt basis prices currently translate to Rbs17,000-17,200/t after they were heard to have cut their A3 prices further by Rbs500/t earlier this week.

Exporters cut prices as well, but they do not rule out a possibility of slightly rolling prices back up if no further pressure emerges from the domestic market and some export demand returns.

"At present, most exporters have some stocks for operational needs. But in case of regalvanising of demand abroad, they will need to even their prices with those of steelmakers', or their inflows will get stuck," a St Petersburg exporter said.

Softening prices for semi-finished and finished products are also pressuring the Russian ferrous scrap market as steel producers are seeking ways to cut production costs. But the winter decline in domestic scrap supplies and volatility of the rouble could still support prices from falling significantly further.

In the first half of this year, Russian domestic supplies of ferrous scrap totalled 7.49mn t, down by 2.3pc compared with the corresponding period last year.

In 2017, Russia exported 4.98mn t of ferrous scrap, 7pc less than in 2016. Turkey was the largest recipient, taking 2.35mn t and followed by Belarus and South Korea, which bought 1.07mn t and 1mn t, respectively.

The initial forecast for this year's exports was comparable — at 4.9mn–5mn t, but the forecast was lowered to 4.1mn–4.2mn t after the Russian government in July banned export shipments from multiple ports in the country's far east to support scrap supplies to local mill Amurstal.

But a weak rouble relative to the US dollar allowed far eastern exporters to cover additional logistics costs to maintain export volumes in July–December. In January–June, they shipped around 510,000t to South Korea, 2pc up on the year. The weak currency also helped exporters from Baltic and southern ports increase shipments to Turkey by around 60pc on the year to 1.33mn t in January–June.

Consequently, total Russian ferrous scrap export volumes for 2018 are expected to be just below 2017 or flat on the year.