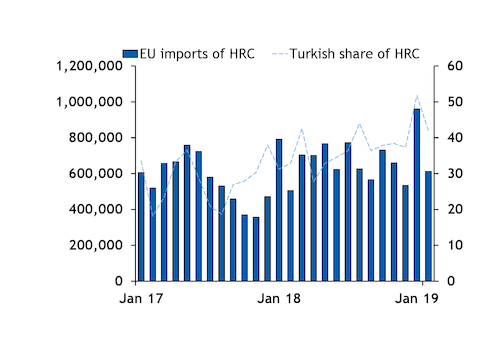

EU hot-rolled coils (HRC) imports continued to grow year on year in February, but fell sharply compared with January.

EU arrivals were up by 21pc compared with February 2018 and down by 36pc on the month at 612,600t, on fluctuations in supply from Turkey and Russia. February imports from Turkey rose by 54pc compared with a year earlier to 257,000t and Russian imports increased by 14pc to 116,900t.

Turkish producers normally sell HRC for shipment two months in advance — for example, in April they sell June shipment material. Uncertainty about the definitive EU safeguard quotas at the end of 2018 slowed HRC sales to the EU, which was reflected in lower February imports, but customs data suggest that more than 700,000t of HRC was cleared to enter the EU in March.

In the period 1–16 April 517,000t was imported, customs data show. If the daily average rate persists until the end of the month, April imports will be likely to come close to the all-time monthly high reached in January, when 963,700t arrived in the EU.

Meanwhile, supply of hot-dipped galvanised steel increased by 59pc on the year to 551,600t in February — the highest amount since May 2017. The majority of this was imported from China and Turkey. Cold-rolled coil arrivals were up by 18pc to 193,900t — Turkey and Ukraine were the largest suppliers.

Rising imports and lower EU flat steel demand, owing to a slowdown in the automotive and construction industries, saw HRC exports rise by 10pc on the year to 255,700t in February. More than 95,000t was exported to Turkey — the largest recipient of EU HRC.