Tight seaborne iron ore supply is supporting floating prices across all the fines segments in spot trade into China, even as mills shift to lower-cost ores.

Thin profit margins have shifted Chinese mills' appetite to lower-cost ores, including medium-grade brands Jimblebar fines (JMBF) and Mac fines (MACF) sold by Australian mining firm BHP Billiton. This demand has narrowed their floating discounts in spot trade. Discounts for sub-60pc Fe brands have also narrowed in contracts and in portside trade, including for SSF fines sold by Australian producer Fortescue Metals.

But floating prices for higher-priced medium-grade ores have risen, supported by tight seaborne supply. Floating premiums for Brazilian mining firm Vale's BRBF fines have reversed declines this month, as have Newman fines (NHGF) sold by BHP and PB fines (PBF) sold by Australian mining firm Rio Tinto.

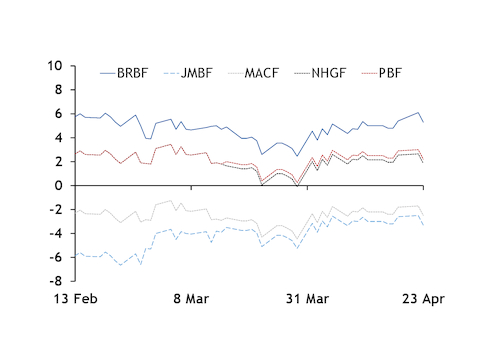

Argus launched implied floating premium indexes for the most liquid seaborne brands today. The new indexes track their implied premium or discount to prompt-month forward prices (see graph). This relationship is more important to physical and paper iron ore markets, which have become more linked over the past year from physical markets increased use of floating trades over fixed-price trades.

Argus implied floating premiums are calculated by subtracting the Argus-assessed prompt month forward price from the Argus value-in-market (ViM) seaborne brand adjustments.

The Argus implied floating premium for BRBF fell by 80¢/dry metric tonne (dmt) to $5.30/dmt today from $6.10/dmt yesterday. This premium to the prompt month has risen in April from late March, when it traded as low as $2.45/dmt. Premiums for NHGF and PBF have also risen, and discounts for JMBF and MACF have narrowed.

Portside prices have also risen. BRBF's portside prices have an average 4.12pc premium to the Argus PCX 62pc portside price for the month to date — up from a 2.6pc premium in March and the highest since October.

Brazil's scrutiny of tailings dams has reduced Vale's output, and cyclone flooding has reduced output in Australia's Pilbara region. But China's steel prices have risen modestly on the back of increasing spring construction demand, and domestic metallurgical coke prices have fallen to widen steel profit margins. This has facilitated sustained demand for all grades of iron ore during the supply crunch.

"We have better profits now and prefer to buy medium and high grades," a north China-based mill buyer said. "But with IOCJ prices increasing so much in the past two weeks, we need to recalculate our costs, but have not decided whether to change our blending ratios."