Iron ore lump premiums have risen above the 20¢/dry metric tonne unit (dmtu) cfr Qingdao, an increase muted by expected looser winter restrictions on steel production.

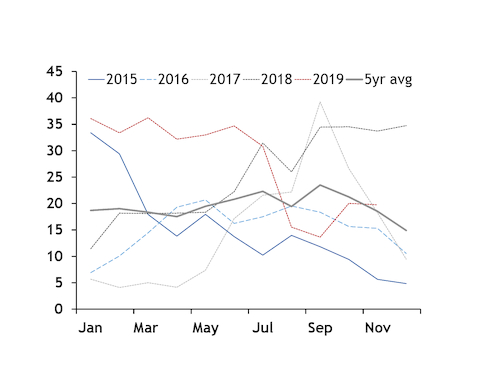

The Argus 62pc iron ore lump premium at 20.2¢/dmtu cfr Qingdao yesterday is more than double the recent low of 9.6¢/dmtu in early September. North China mills increase use of direct-charge iron ores in winter including lump and pellet. Winter pollution policies also increase demand from mid-November to mid-March, although a relaxation of these policies is limiting the demand increase for lump by allowing more sintering to remain on line. The lump premium is slightly higher than the five-year average of 18.53¢/dmtu for November but well below the 33.7¢/dmtu average in November 2019.

Beijing is sticking to last year's policy that gives localities more flexibility for reducing winter emissions. But steel mill buyers remain cautious that the policy could still be tightened.

"Lump is seeing more spot activity. The demand season for lump might further support the lump market, especially after additional winter restrictions if they are announced," a Beijing trader said. "The price gap between fines and lump might widen further."

Pellet spot markets saw demand pick up before lump, but now mills have lifted pellet ratios to their upper limit, so lump use is increasing. A fall in coke prices has reduced the need for pellet's higher productivity, making it more cost effective to use more lump in the furnace, a Shanghai trader said.

Iron ore lump is sold into China based on a premium for every 1pc Fe in the lump on top of the underlying 62pc fines prices. Yesterday's lump premium of 20.2¢/dmtu equates to an outright premium of $12.50/dmt on top of the Argus ICX 62pc fines index. The ICX was assessed at $83.25/dmt yesterday for a 62pc Fe lump outright price of $95.75/dmt cfr Qingdao.

The lump premium rose to an average of 20.03¢/dmtu in October from 13.63¢/dmtu in September. This average has fallen to 19.75¢/dmtu so far this month, with iron ore prices under negative pressure from rising iron ore port inventories.

Seaborne lump premiums are still half the 41.50¢/dmtu hit in early July when most prices hit 2019 highs before increased supplies from Brazil and Australia sent prices tumbling over the next two months.

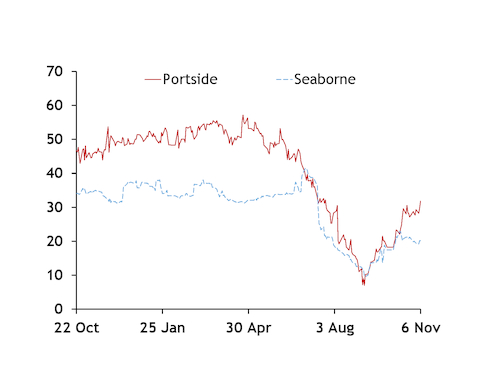

Seaborne lump premiums may get support from portside markets where premiums have risen to the highest level since mid-July. PB lump sold at Yn790/wet metric tonne (wmt) in Shandong yesterday, a Yn140/wmt ($20/t) premium to PB fines sold at Yn650/wmt in Qingdao. On a per 1pc Fe basis this equates to a nearly 32¢/dmtu premium, 60pc higher than seaborne at 20.2¢/dmtu. Portside premiums held higher than seaborne premiums until in August. But portside prices now regaining a significant premium may encourage more trading firms to buy seaborne lump cargoes to land at ports.

Price weakness for fines may also be contributing to the widening gap between fines and lump. A build-up of portside fines inventories has weighed on mainstream 62pc fines prices just as restrictions lift lump and pellet demand, an east China trader said.

PB fines prices have fallen from Yn730-760/wmt in September.