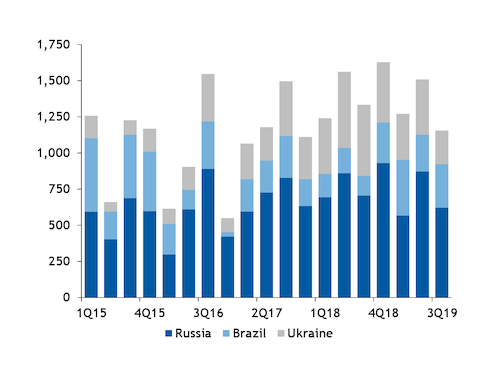

US demand for Brazilian basic pig iron (BPI) rose to a four-year high for the year through September, displacing Russian and Ukrainian imports in a competitive price environment.

The US imported 941,497 metric tons (t) of pig iron from Brazil over the first three quarters of 2019, roughly doubling volumes from the same period of 2018, according to US Commerce Department data.

US consumers had shifted consumption in recent years towards Russian and Ukrainian suppliers after two producers in northern Brazil closed, tightening international supply, according to market sources.

But US steelmakers that have typically eschewed southern Brazilian higher-phosphorus BPI have increased their consumption from the region, boosting overall Brazilian shipments. Higher-phosphorous BPI typically requires blending other raw materials to maintain acceptable phosphorus levels in a mill's melt.

A space for southern Brazil

Over the first nine months of 2019, US mills reversed this trend, lifting imports of higher-phosphorus BPI because of its discount to lower-phosphorus BPI (0.10pc maximum) and wide margins between scrap and BPI.

Argus launched price assessments for fob northern Brazil BPI at $300/t and fob southern Brazil at $290/t on 7 November to reflect resurgent exports from the country and to complement its existing cfr New Orleans and fob Black Sea assessments.

Brazilian exports of BPI from the southern ports of Vitoria and Rio de Janeiro, the two main origins for high-phosphorous pig iron to the US, rose to 470,115t in 2019, up from 173,879t a year earlier, according to data from the Ministry of Development, Industry and Foreign Trade of Brazil.

Northern Brazil exports, which have lower-phosphorous levels comparable to Black Sea producers, to the US climbed by 58pc year over year to 473,489t.

At the same time, imports from Russia slid by 8.5pc to 2.07mn t, and those from Ukraine were down by 34pc to 929,975t.

US market participants have mixed views on how much non-Brazil imports the southern producers would displace going forward, but the recent entrance of China as a more regular buyer of BPI in the international market has lifted the value of alternative suppliers for price-conscious US consumers.

Chinese imports of basic pig iron rose to 304,009t over the first three quarters, up from 55,871t in the prior year period and on track for a seven-year high. Since early October, Chinese consumers imported an over 250,000t of BPI, according to market sources.

Long-term, US consumption of BPI and scrap substitutes is poised to increase as new electric arc furnace flat-rolled steel production comes online.

Scrap, DRI substitution

Still, overall US consumption of BPI was down in the first three quarters amid a weak steel market and adequate supplies of DRI.

Steel mills have shifted as much as possible to ferrous scrap as spreads between BPI and #1 busheling, its closest equivalent, widened to historical levels in the third quarter. A generally weak ferrous scrap complex was largely responsible for the widening and was a major factor in US BPI prices falling to a three-year low in mid-October of $295-300/t cfr New Orleans.

US mills also lifted their reliance on DRI this year. Steel mills can replace BPI with DRI but generally avoid the increased logistics costs for shipping the cargo, which can re-oxidize and explode in certain situations.

Over the first three quarters, imports of DRI declined by 2pc to 1.3mn t. Imports from Trinidad and Tobago, the location of Nucor's Point Lisas DRI plant, rose by 5.5pc to 1.22mn t, even with a planned outage of the facility that kicked off in September.

Still, exports slid by 24.5pc to 553,228t, resulting in a roughly 149,000t net increase in imports. This drop was primarily the result of lower volumes from Corpus Christi, Texas, where Voestalpine operates a hot-briquetted iron (HBI) plant.

By Zach Schumacher