Premiums for low-alumina BRBF iron ore fines have risen to five-month highs on the back of tighter supply during Brazil's rainy season.

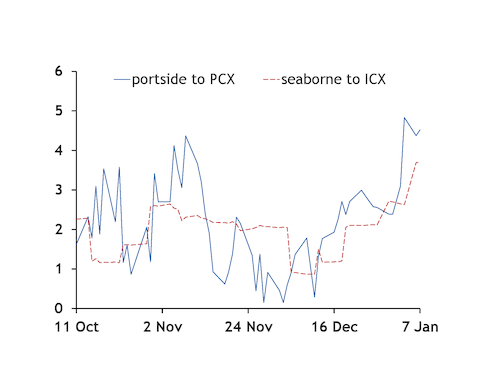

Differentials for Brazilian mining firm Vale's BRBF 63pc Fe basis have more than doubled in portside markets to a 4.5pc premium to the Argus PCX portside 62pc index over the past two weeks. Fixed-price deals have widened the seaborne differential to a 3.7pc premium to the Argus ICX 62pc cfr Qingdao index this week.

BRBF traded at $96/dry metric tonne (dmt) on 6 January, at $94.35/dmt on 2 January and $91.65/dmt on 27 December, expanding its premium to the ICX at $94.25/dmt, $92.90/dmt and $90.50/dmt respectively on those days.

The Argus value-in-market brand adjustment for BRBF 63pc basis has rebounded to its highest since August, to a premium of $3.48/dmt to the ICX from a 2019 low of 86¢/dmt below the ICX in early September. It rose to a 2019 high of $7.68/dmt above the ICX in early July.

Tighter supply of BRBF, blended from Vale's northern and southern system fines, has been the main support to its premiums. Vale has signed more long-term contracts with mills for BRBF, and mills have increased the ratio in the blast furnace, reducing supply and lifting the floor on demand.

BRBF 63pc basis traded at a premium of 31 yuan/wet metric tonne (wmt) to the PCX 62pc index at Qingdao on 7 January, up from near parity in late November-early December. The premium to 61pc basis PB fines has widened to Yn33-40/wmt this week from Yn18-20/wmt in mid-December at Shandong ports. BRBF traded at Yn720/wmt fot Qingdao compared with PB fines at Yn680/wmt fob Qingdao, both on 7 January.

"The price difference to PB fines has widened and we think it might enlarge further in the short term because of decreasing supply from Vale," said a Beijing-based trader.

BRBF supply was disrupted in 2019 by Brazil's October-March rainy season that slowed northern system output, and by a January 2019 dam accident that shut down southern system mines. Another rainy season will pose a risk to northern system supplies of 65pc Fe IOCJ fines that are blended to produce BRBF.

Wider profit margins have also supported prices for all higher-grade ores including pellet, lump, IOCJ and Newman fines. Chinese rebar margins are around Yn200-300/t, down from Yn500-700/t in early December during the winter lull in demand.

By Kitty Xie and Chris Newman