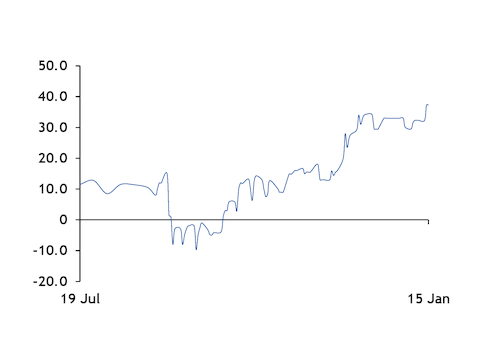

The Turkish deep-sea ferrous scrap import price's premium over the Taiwanese containerised import price rose back to the $30/t level in mid-December 2019 for the first time since early February, as the price recovery in the Asia-Pacific containerised market significantly lagged the rebound in the bulk market.

The Argus daily ferrous scrap HMS 1/2 80:20 cfr Turkey assessment yesterday sat at a premium of $37.30/t over the daily containerised HMS 1/2 80:20 cfr Taiwan assessment.

The global seaborne scrap market weakened last year and came under severe pressure in the third quarter in particular. The Turkish import assessment fell on 30 September to last year's low of $221.20/t before it rebounded and rose above $300/t in late December for the first time since the end of May. The price registered a 37pc gain in October-December 2019.

But the Taiwan containerised import price failed to recover at the same rate, rising by only 20pc from $225/t on 30 September to $270/t on 31 December.

The low scrap price increase in the Taiwanese market was driven by the country's mills gaining bargaining power in the seaborne scrap sector and low domestic rebar pricing relative to their Turkish counterparts.

Taiwan influence in Asia-Pacific strengthens

Taiwanese mills were able to limit US exporters' drive to raise prices in the fourth quarter of last year by diversifying their supplier base.

Taiwan in October became less dependent on scrap from its two largest suppliers — the US and Japan. The country reduced the combined share of these two countries in its import market to 62.09pc in October from 68.29pc in July-September and 66.57pc in January-September. The US and Japan's lost share mostly went to Canada, Australia and the Dominican Republic, which saw their Taiwanese market shares rise to 7.75pc, 5.95pc and 3.41pc, respectively.

At the same time, Taiwan's share of US containerised export and Japanese export portfolios increased.

The US exported 358,000t of containerised scrap to Taiwan in October-November, raising Taiwan's share of US container exports to 32.98pc from 29.63pc in the third quarter. Taiwan comfortably sits as the largest buyer of US containerised scrap, while Malaysia, the country's second-largest buyer, accounted for only 21.21pc of US containerised scrap export in October-November.

Taiwanese mills in November booked multiple cargoes from Japan, taking advantage of Japan's weak domestic scrap market and a significant fall in demand from buyers in Korea, which is the largest overseas buyer of Japanese scrap. Taiwanese mills were then able to use these bookings to pressure other suppliers.

Taiwan's influence on Japanese scrap suppliers is likely to remain strong in the near term, as sales to Taiwan accounted for 11pc of Japan's exports in November, compared with just 5.52pc in October. South Korea and Vietnam remain the two largest buyers of Japanese scrap but their share and volume both dropped in November and there are limited signals that demand from South Korea and Vietnam will rise significantly in the near future.

Japan does not offer export data categorised by means of transport. Its scrap exports to Korea are likely made mainly by bulk shipment, while sales to Vietnam are in both bulk and containerised shipment.

Taiwan's influence on the Asian seaborne market during the fourth quarter of 2019 was further boosted by disruption to Indonesian scrap imports. Indonesia placed a temporary moratorium on all scrap imports in late November as it began implementing a new policy aimed to establish provisions on the imports of hazardous and toxic materials as industrial raw materials. The government lifted the moratorium and resumed imports in late December. Further details surrounding the new policy remain under development but the government has yet to release additional guidelines for proposed waste threshold standards or the timing of implementation. Indonesia imported more than 2.5mn t of ferrous scrap in 2018 and the country's absence from the market in the fourth quarter released additional supply into the entire Asian container market.

Sluggish domestic demand curbs Taiwan rebar gains

Taiwanese mills were able to raise domestic rebar offers by about 4pc from the second half of October last year to the beginning of this month.

Offers from Taiwan's domestic benchmark buyer Feng Hsin Steel were 15,300 New Taiwan dollars/t ($511.89/t) on 6 January, up from NT$14,700/t on 21 October 2019.

But mills' counterparts in Turkey achieved a gain of close to 6.5pc in domestic prices during the same period, under Argus' weekly domestic rebar ex-work assessment.

The slower increase in Taiwanese domestic rebar prices reflected sluggish domestic demand. Many construction projects were halted or delayed in the fourth quarter by heavy rainfall. In addition, many investments and projects were slowed down as firms awaited the result of the presidential and parliamentary election that took place on 11 January.

Competitively priced imported billet also limited some Taiwanese mills' ability to raise rebar prices. A number of mills that produce rebar from scrap in the final quarter of 2019 frequently expressed concern about the increased availability of competitive seaborne billet from the Middle East, Russia and Asia Pacific. Taiwan imported more than 300,000t of semi-finished steel products in October, compared with the monthly average of 284,000t in January-September, the country's custom data show.

By Chi Hin Ling