European cobalt prices have continued to rise this week despite a lack of demand in China owing to the coronavirus outbreak, with market participants expecting further upward momentum in the near term.

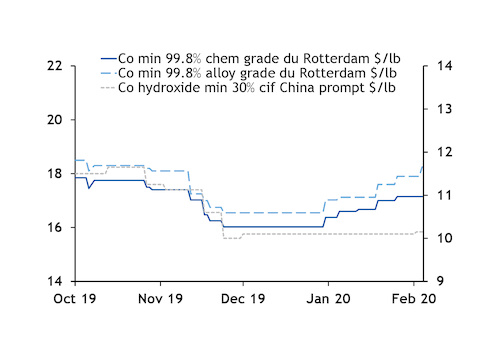

Alloy grade cobalt metal prices rose to $17.75-18.75/lb duty unpaid in Rotterdam on 13 February, up from $17.50-18.30/lb on 11 February, according to Argus assessments. European traders received requests from Asian buyers looking for alternative sources for cut cathode because of Chinese production halts. A steady stream of demand has also come from US and EU super alloy producers.

Chemical grade metal prices are holding broadly steady at $16.80-17.50/lb duty unpaid in Rotterdam because of ample availability of briquette material. Broken cathode supply is expected to tighten in the coming weeks following the closure of the Chambishi refinery in Zambia.

"The cobalt complex is pretty tight right now," a trader said. "After a period of destocking over the past six months, buyers are regularly coming to us. There is no major restocking, but demand is steady. The situation in China is just creating deferred demand."

Most market participants expect a rise in buying interest following the Chinese lunar new year holiday. There was some buying expected from financial funds and state actors, but the coronavirus outbreak has delayed purchasing decisions.

There are some fears of a surge in selling activity as Chinese refineries return, keen to raise cash after missing weeks of business. Further downstream, there could be a surge in buying from battery makers and cathode producers running low on material after supply disruptions. Spot liquidity is expected to increase significantly once the crisis subsides.

Tighter hydroxide supply fuelling price growth

The large stocks and production surpluses of 2019 are coming to an end and tighter supply is taking hold in the hydroxide market. Glencore's closure of its Mutanda copper/cobalt mine at the end of last year removed around 25,000t from the market.

A ramp-up at the Katanga mine is expected to fill some of that gap, but Glencore's overall cobalt production guidance for 2020 is 25,000-33,000t, down from 46,000t in 2019. Other mines may fill that gap, including ERG's RTR Metalkol project, which is expected to ramp up to around 15,000t of annual output this year in phase one. The ramp-up has been slower than expected because of impurities in the hydroxide output.

Producers have been signing long-term supply deals that tie up large amounts of hydroxide stock. Glencore has just agreed to supply Samsung SDI with 21,000t of hydroxide between 2020 and 2024. This follows a deal with China's GEM for 61,200t between 2020 and 2024, South Korea's SK Innovation for 30,000t between 2020 and 2025 and Belgian chemical producer Umicore for an undisclosed amount.

In the medium term, the government of the Democratic Republic of Congo (DRC) has said it will set up a body to purchase artisanal mined cobalt hydroxide. Artisanal production accounts for around 25pc of the DRC's output, but refineries are increasingly wary of buying it because of the loose regulations involved with its mining. It is usually sold at a discount to large-scale produced cobalt. If the government follows through with its plan, which some market participants question, it will support the price of hydroxide coming from the region.