Europe's LNG sendout stepped down in June from a year earlier, driven largely by northwest Europe, but has recovered slightly so far this month.

Combined European sendout fell to 2.46 TWh/d in June from 2.88 TWh/d a year earlier, and was also slower than in May. It was the lowest for any month since August 2019.

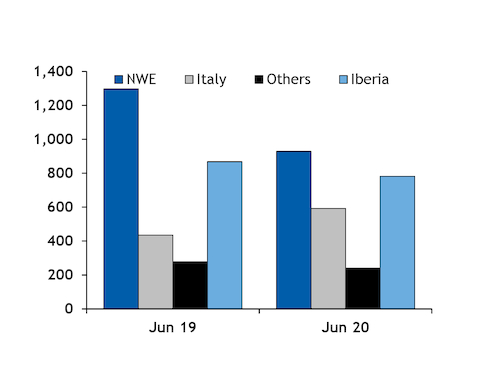

The decrease was driven mostly by slower sendout across northwest Europe. Combined UK, Belgian, Dutch and French sendout fell to 929 GWh/d from 1.3 TWh/d in June last year and was well below the 2.1 TWh/d recorded in May.

Low European injection demand and a fall in power-sector gas demand on the year may have curtailed Europe's ability to absorb strong LNG sendout last month. Combined power-sector gas demand in France, Germany, Belgium, Italy, the Netherlands, Spain and the UK edged down to about 2.3 TWh/d in June from 2.31 TWh/d in June last year.

And low gas demand globally in the wake of the Covid-19 pandemic eventually forced a supply-side response, particularly from the US, with June loadings down considerably. This tightened supply availability in the Atlantic basin for delivery to Europe.

Sendout fell the most in France and the Netherlands, offset only partly by a rebound in UK regasification.

The UK received eight cargoes last month, up from five a year earlier, and most were directed to the 15.6mn t/yr South Hook terminal.

Demand remained largely muted across northeast Asia, with economies slowly recovering from the outbreak. And South Hook has an agreement with Qatari state-owned Qatargas to receive deliveries when a more profitable destination cannot be found, resulting in the UK facility acting as terminal of last resort for Qatari LNG.

Sendout fell more in France than in any other European country, to 289 GWh/d from 671 GWh/d a year earlier. Deliveries to the regulated terminals slipped to six from 12 a year earlier.

France was less able to absorb strong supply in June than in April-May because of high underground stocks, with brisk LNG receipts earlier in the summer having driven a quick stockbuild.

The drop in LNG sendout elsewhere in Europe was less pronounced.

Iberian sendout — combining Portugal and Spain — slipped to 782 GWh/d from 860 GWh/d a year earlier. Portuguese sendout was up on the year, more than offset by a drop in Spanish regasification. But as opposed to other countries, Iberian regasification accelerated from May as increased consumption lifted the scope to raise sendout. High daytime temperatures in the region boosted electricity demand for cooling purposes, while the end of the countries' lockdowns bolstered consumption further.

And Italian sendout edged up to 440 GWh/d last month from 434 GWh/d a year earlier. LNG imports were up, even as temperature-adjusted consumption stayed low in the wake of the pandemic.

But Italy may have limited capacity to receive further strong imports in the coming months. The stockbuild was particularly quick in April-May, and while it slipped below average last month, inventories have remained well above recent-year averages.

LNG sendout rebounds in early July

Europe's LNG sendout has started to rebound in recent days, but potential for sustained quick regasification could depend partly on how much more demand can recover in the coming weeks.

Combined European sendout averaged 2.6 TWh/d on 1-6 July, about 135 GWh/d higher than in all of June.

A rise in European prompt prices may have increased the incentive for firms to regasify their supply.

But Europe may not be able to absorb any further increase in regasification in the coming weeks, amid limited spare capacity in continental storage facilities.

And demand across Europe could remain muted for the rest of this year. The European Commission expects EU-27 real GDP to shrink by 8.3pc this year and increase by 5.8pc next year, assuming there is no second wave of Covid-19 infections. But fresh outbreaks have already been reported across the continent, prompting new lockdowns, such as in Spain's Galicia and Catalonia regions.