The US shale industry will look back at April-June as perhaps the worst quarter in its history, with most firms shutting in wells amid a slump in oil prices and demand. Yet while activity may now be bottoming out, the path to recovery looks choppy.

Leading US upstream independent ConocoPhillips has joined other shale producers with relatively strong balance sheets — such as Parsley, EOG Resources and Marathon Oil — in beginning to lay out plans to restart shut-in production. From this month it is reviving some of the 225,000 b/d oil equivalent (boe/d) of output it curtailed in the second quarter. It expects to report second-quarter production of 960,000-980,000 boe/d, in line with a year earlier but about 5pc below the first quarter. Around 65pc of its curtailments were in the lower 48 states.

A Federal Reserve Bank of Dallas survey of 115 upstream firms shows that 36pc planned to restart the bulk of their shut-ins in June and 20pc in July, with only 13pc putting it off to November or later. Key Bakken operator Continental Resources — one of the biggest cutters in the depths of the downturn, with curtailments at 70pc of production in May — will restore its July output to 50pc of its pre-pandemic level. It expects to report second-quarter output of 200,000-205,000 boe/d, down from 361,000 boe/d in the first quarter.

Amid the gradual restoration of output, the EIA has slightly increased its US crude production estimates for 2020 and 2021. It latest Short-Term Energy Outlook(STEO) forecasts output of 11.63mn b/d this year, up by 0.6pc from the previous forecast. And it has increased its projection for 2021 by 1.6pc to 11.01mn b/d. June production was about 11mn b/d, down by 1.9mn b/d from the record 12.9mn b/d reached in November 2019. And volumes this year are still expected to be down by 600,000 b/d compared with 2019 — the first annual drop since 2016.

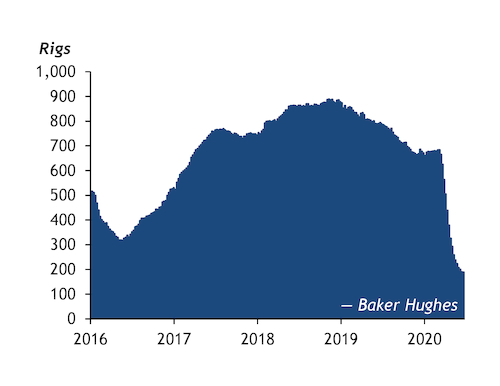

The higher forecasts come amid a recovery in crude prices — with Nymex WTI trading above $40/bl — a far cry from the epic crash to minus $37.63/bl on 20 April. The EIA's STEO expects WTI to average $37.55/bl this year, up by about 7pc from the previous forecast. And as crude markets strengthen, the US oil rig count may finally be bottoming out after hitting a new historic low of 185 as of 2 July, a fall of 73pcsince the start of March, US oil service firm Baker Hughes says (see chart).

Rebase diving

But the host of challenges means the road ahead will be checkered. A key headwind is access to capital, as companies' borrowing ability shrinks further. Access is expected to decline as banks lower the value of producers' oil and gas reserves — often the main asset against which they raise funds — based on futures prices. In an indication of the scale of the cutback that producers are facing, Houston-based independent Talos Energy says its base value fell by 14pc to $985mn in the latest review, from $1.15bn. Overall, credit rating agency Moody's expects a decline of 20-30pc in the spring redetermination.

A lack of funds means that companies may struggle to juggle the need to service debt and invest in production. Reinvestment of cash flow is becoming topical, as operators may set spending targets well below cash flow to guarantee free cash flow through market cycles, US energy investment bank Tudor Pickering Holt says. Elevated debt levels mean the industry has little choice but to use more cash to reduce loans.

The strain is already beginning to show. US oil and gas bankruptcies rose to 18 in the second quarter, the highest quarterly level in four years, law firm Haynes and Boone says. "It is reasonable to expect that a substantial number of producers will continue to seek protection from creditors in bankruptcy even if oil prices recover over the next few months," it says.