The French day-ahead base load this month is on track to expire below expectations in the over-the-counter (OTC) market amid strong nuclear output and slower demand recovery.

French day-ahead spot prices delivered, on average, at €35.67/MWh on 1-19 November, €4.73/MWh below where the French November base-load contract expired in the OTC market at the end of last month. At the same time, French week 47 base load last week expired at €35.20/MWh whereas the week 48 contract was last assessed at €42/MWh, implying that the French spot could average around €37/MWh in November.

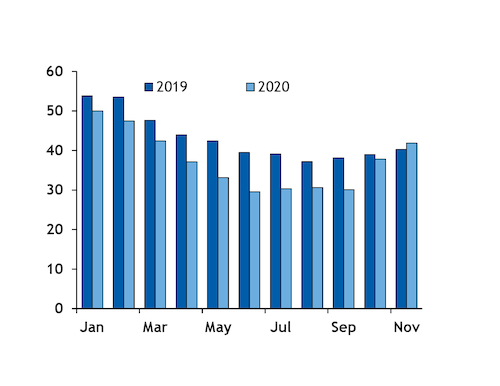

French nuclear output has risen to an average of 41.86GW so far this month, up from 37.86GW in October and 40.26GW a year earlier. This was also the first time French nuclear output was above 2019 levels this year (see chart).

An average of 17.2GW of nuclear capacity — out of a generation fleet of 61.1GW — is scheduled to be off line this month, down from 23.2GW in October and its lowest since February. This is also lower than a year earlier when an average of 21.5GW was off line throughout November.

Demand has slowed its recovery so far this month as France re-entered a nationwide lockdown at the end of October. Power consumption edged up to 51.45GW on 1-17 November from 50.82GW a month earlier but was considerably below 60.12GW a year earlier. Demand recovery quickened in late summer and at the start of the fourth quarter, with levels in October rising for the first time above 2019 levels.

Milder weather further weighed on demand recovery this month. Minimum temperatures in Paris averaged 9.1°C on 1-17 November, 1.5°C above seasonal norms for the period. In comparison, minimum temperatures averaged 10.3°C last month, on par with long-term levels for the period. French demand increases by 2.4GW for every 1°C drop in temperatures, according to estimates from grid operator RTE

Higher nuclear, paired with weak demand, displaced some thermal generation, with higher marginal costs from the French power mix. French gas-fired output rose to 4.83GW this month from 3.1GW in October but was considerably below 6.93GW a year earlier. And coal-fired output fell to a four-month low of 47MW in November and much lower than 654MW a year earlier.

A relaxed supply-demand balance also provided support to French power exports this month, with net outflows scheduled at 8GW on 1-18 November, against 2.63GW in October and a net importer position of 369MW a year earlier. This was also the highest level since May.

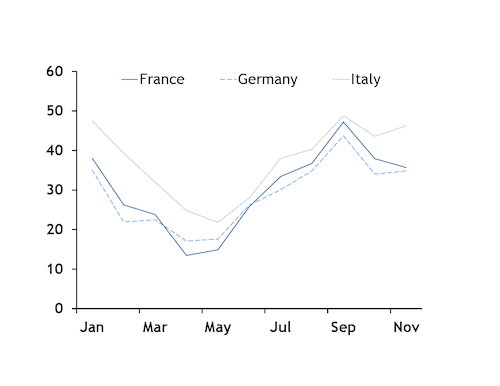

And the French spot has narrowed its premium to Germany to just €0.83/MWh this month whereas France November base load expired at a €4.30/MWh premium to the German equivalent. At the same time, the French spot widened its discount to Italy to €10.61/MWh in November, €8.51/MWh higher than the French November contract discount to the Italian market at the end of last month (see chart).