A shortage of containers and container ships from China to Europe has pushed up freight rates between the regions, lifting prices for manganese, silicon and magnesium.

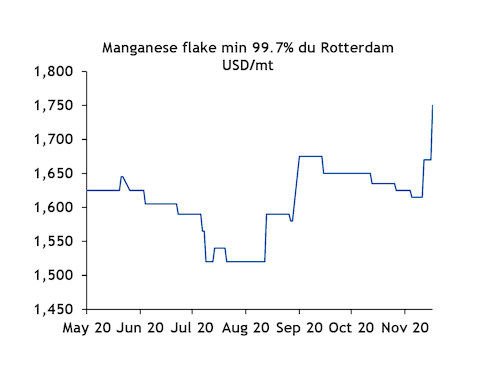

The impact has been most pronounced for manganese flake. Prices have steadily risen over the past 10 days and deals as high as $1,820/t duty unpaid Rotterdam were heard. Argus-assessed prices for 99.7pc manganese flake rose to more than an eight-month high of $1,750-1,820/t du Rotterdam on 19 November.

Upward pressure is also building in the silicon and magnesium markets, and at such a pace that one market participant considered offers for silicon metal to no longer be valid one day after being put forward. Another European silicon market participant put China-Europe freight costs at roughly €40/t at the end of the third quarter, but now says freight costs are at around €140/t and in some cases €200/t.

One participant noted that per-container freight prices previously stood at $1,000, but that this has more than doubled, with quotes at $2,200. Producers and sellers are also expecting freight prices to rise to $3,000 per container in the near term, which would add $55/t to manganese prices.

Argus assessed prices for 5-5-3 minimum 98.5pc Si silicon at €1,730-1,800/t ddp Europe works on 19 November, with offers on 17 November at €1,770-1,800/t ddp. Prices on 17 November stood at €1,700-1,750/t. Prices for 99.9pc magnesium rose to $2,180-2,250/t du Rotterdam on 19 November, up sharply from $2,020-2,110/t on 17 November. Market participants attributed the uptick in both prices to the jump in freight rates, as metal demand itself is static.

These movements are causing some end-users to delay purchases.

"Final users are concerned about prices — they are not going for big orders. They are just looking to buy on the short term," a silicon trader said. He added that delays in shipment from China could cause problems in the future. Other participants were only seeking back-to-back deals, and view holding stock in warehouses too much of a risk, given the rising prices.

China's recovery tightens container availability

China has ramped up industrial output in recent months, advancing its Covid-19 recovery. China's imports of minor metals have increased, while exports have fallen.

The rise in freight rates has impacted other markets outside minor metals, particularly import prices for Asian ferrous scrap.

Freight rates might remain elevated in the near term, with China's industrial output expected to rise next year, according to the International Monetary Fund, with GDP expected to grow by 8.2pc.

But the IMF does not see Europe's GDP growth levels returning to December 2019 levels next year, with many countries reimposing lockdowns to tackle the second wave of Covid-19.