Propane has moved back to a steep discount to naphtha heading into summer but the spread could contract again in time for winter, write Efcharis Sgourou and Peter Wilton

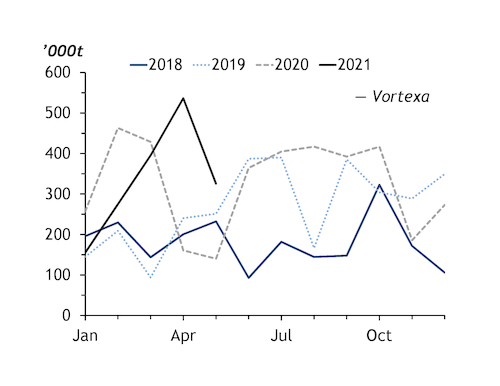

The return of a wide propane discount to naphtha in northwest Europe in spring resulted in petrochemical consumers ramping up their use, after higher propane prices from low refinery utilisation limited demand over winter.

The return of low LPG consumption at the region's flexible ethylene crackers during winter, and returning demand in spring and summer as prices fall back ushers a return to seasonal patterns not seen since before the US shale boom. The sharp growth in US LPG production and exports resulting from the shale boom stripped the seasonality from the market by keeping northwest European prices low over winter, when heating consumption peaks.

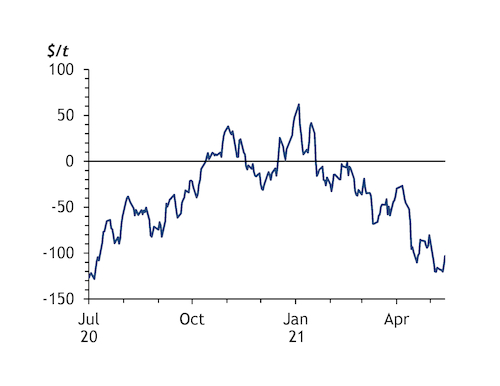

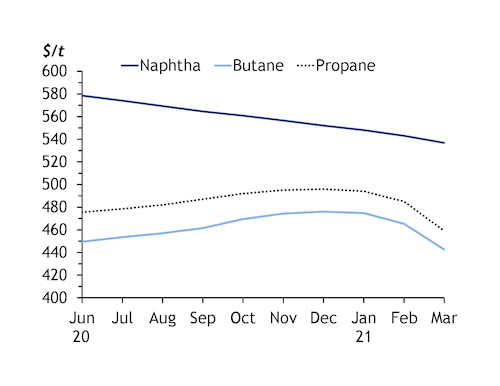

Propane prices in January held a relatively strong premium of $19.90/t over naphtha. This has since slipped to a discount of $81/t in April, and about $111.50/tas of 17 May, prompting flexible crackers to switch back to cheaper propane from naphtha. The spread's flip is reflected in the diverging move of propane and naphtha spot prices in northwest Europe, with cif Amsterdam-Rotterdam-Antwerp (ARA) propane falling by $26/t from January to $483.75/t in April but naphtha equivalents rising by $58.75/t to $559.75/t.

Western European crackers have been operating at near capacity since the final quarter of last year — when Argus estimated utilisation was 97pc. No data are available yet for the first quarter but polymer demand has not eased. Stronger demand, wide margins, and a series of global production and logistics issues have contributed to higher demand for cracker products. The planned maintenance schedule this year is also typical, or even light, with about 2.5pc of capacity off line, peaking in May and October, compared with 2.2pc in 2020 and 4.2pc in 2019's relatively heavy turnaround schedule. But this excluded the extended shutdown of petrochemical producer Sabic's Wilton LPG, ethane and naphtha-fed cracker in the UK, which started in the fourth quarter of 2020. If this remains off line in 2021, the average off line capacity will rise to 6.6pc, peaking at 10.6pc in May.

Summer fade

Naphtha's strength over propane could weaken in the summer months as petrochemical and gasoline blending demand for the former slows. The northwest European naphtha forward curve shows steep backwardation — prompt prices above future prices — from May until December. May naphtha's premium to June stood at $4/t as of 17 May, with $4-5/t backwardation each month until the end of the year. The May cif ARA propane swap in contrast was at a $2/t premium to June as of 17 May before reversing to contango — prompt prices below future prices — from July until December. This suggests propane's discount to naphtha will narrow from next month until the end of this year. Propane's strength is partly being driven by low regional refining rates and concerns over US LPG inventories heading into winter. Refinery utilisation in the EU 15 and Norway rose slightly to about 72.5pc in April from the low-70pc range in previous months. It has fluctuated at 68-73pc since the start of the Covid-19 pandemic from a more typical 79-84pc.

In the US, low propane inventories are expected to support prices during the summer and into 2022. US stocks fell sharply over winter as domestic output dropped by 40,000 b/d in October-March, while consumption rose by 96,000 b/d, according to consultancy IHS Markit. Stocks have started to climb since but remain significantly below a year earlier and the five-year average. US upstream independent Antero Resources recently said domestic propane prices could strengthen significantly over winter after it reported achieved NGL prices of $40.72/bl, or 70pc of WTI, in the third quarter, 91pc higher than a year earlier on strong demand as the Covid-19 recovery gathers pace. This could raise the price of US imports to Europe, potentially narrowing or reversing the propane-naphtha spread.