Some European chemical companies are introducing surcharges on their products in the face of spiralling gas and electricity costs, although this is an exception rather than the norm for now.

Exposure varies greatly by product area, technology, business and contracting strategies and market situations, but forward gas and electricity markets suggest it may only be a matter of time before more producers seek action through surcharges, other price and contractual mechanisms or actions to manage demand and operating rates.

Exposure to energy costs varies at steam crackers, the engines of petrochemical production, depending mainly on how they fuel, or price fuels, for their furnaces. Companies integrated upstream will also look across their system. Energy costs, usually a relatively stable factor, do not form part of regular price negotiations. But the large increases — some European gas prices are now five times higher than they were a year ago — have become a concern, with some producers estimating the impact at €30-100/t of ethylene, although each will have a different approach to the calculation.

Some producers sought an energy-related increase in the last monthly contract price (CP) negotiations for olefins. This was resisted but will remain on the agenda next month.

Surcharges are unlikely to be an appropriate mechanism for price increases on intermediate products such as ethylene and propylene, with most producers integrated either upstream, and so benefitting elsewhere in their system, or downstream. The latter is where surcharges have started to be implemented, because of the energy price effects on producers' costs, but this may weaken arguments for price increases in the middle of the supply chain as well.

Rubber up

Rubbers and elastomers have been particularly exposed, because of their relatively high energy requirements. Producer Trinseo has said it will introduce a surcharge of up to €500/t on contract and spot sales of plastics, latex binders and synthetic rubber products manufactured in Europe. Without action "it jeopardizes Trinseo's ability to continue with normal production", it said.

Two other rubber producers implemented surcharges effective 1 October on term volumes. These range from €85/t to €1,000+/t. Average increases for polybutadiene rubber and styrene butadiene rubber are about €240/t.

One of Europe's largest polymer producers, LyondellBasell, told customers last week it would implement a natural gas and electricity surcharge on all PP, HDPE, LDPE, Catalloy and PB-1 orders from 1 November, initially at €50/t. It said that its utility costs have increased by up to €100/t since last year.

Acrylonitrile producers have been exposed through tighter availability and higher prices for ammonia, produced from natural gas. One European ACN producer announced a €50/t surcharge on products.

PVC production is particularly exposed to higher electricity costs because of the electrolysis process required for chlorine, yet only one producer — France's KemOne — has announced a surcharge so far.

Specialty chemicals company Huntsman announced a €125/t surcharge on all sales of MDI in Europe, Africa, the Middle East and Asia, citing the increase in natural gas costs.

In methanol, rising gas prices led to an idling of some capacity as early as the second quarter of this year. More recently, integrated OCI announced a €750/t increase in prices of melamine, a downstream product of methanol, related to the surge in production costs, firm demand and tight market dynamics.

Some PET producers are considering surcharges in response to the higher energy costs, as well as the cost and lack of availability of container shipments from Asia-Pacific. Indorama attempted to introduce a surcharge on feedstock PTA in the second quarter because of the freight issues, domestic production problems and a tight acetic acid market, but faced significant pushback from buyers.

Buyers resistant

Chemical buyers are understandably resistant to the idea of these price increases, having already faced sharp rises this year because of a combination of rising feedstock costs and tight global markets. Crude prices rising above $80/bl in the past week will probably lead to another sharp increase in prices in November, regardless of any energy surcharges.

Still, buyer feel that producers should be able to absorb the cost increases because margins for many products have been high by historical standards based on spot and freely negotiated CPs. However, producers that have been selling a higher proportion of products based on fixed prices or contracts linked to upstream movements may not have benefited as strongly.

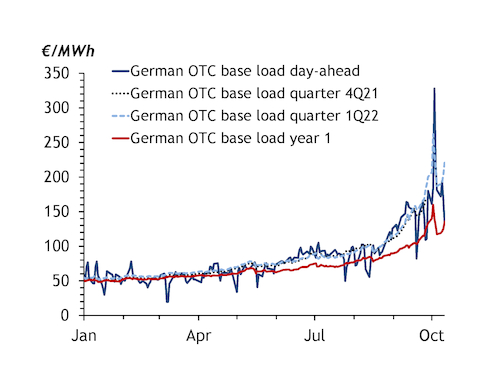

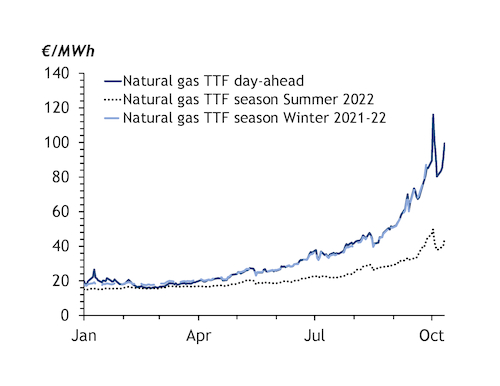

The rise in utility costs may not be temporary, with the effects of higher prompt natural gas and electricity prices on longer-term forward contracts increasing as the situation persists. German year-ahead based load electricity prices and Dutch natural gas contracts for summer 2022 have more than doubled compared with the first half of this year. Surcharges on some products may be part of the short-term solution for some, but it is an issue that everyone may eventually need to address.