Higher domestic scrap usage and lower scrap generation have been the main factors keeping domestic scrap demand in Japan above seaborne demand so far this year, and they are expected to persist and continue to limit scrap export availability.

Japanese ferrous scrap exports fell by 17.3pc year on year to 5.8mn t in the first nine months, as domestic mills kept collection prices much higher than the workable level in the seaborne market.

Exports in October-December are expected to slip further while most suppliers prioritise domestic sales at a higher price. "This September was the only month that I had no export contract in the past 10 years, October is not much better," a Japanese trader said.

"In past years, scrap suppliers will consider cutting prices if overseas buyers stay quiet for more than one month. But it is not the case for this year," another Japanese trader said. "It seems that Japanese domestic mills are able to absorb the quantity [that would normally be exported]."

After a mild price correction during July to mid-September, Tokyo Steel increased its domestic scrap collection prices aggressively in response to the intensified scrap competition in the domestic market. Collection prices rose by ¥11,000/t ($96.80/t) at its Tahara plant and ¥9,000/t at its Utsunomiya plant between mid-September and the end of October.

Most overseas buyers found it difficult to follow the rapidly increasing Japanese scrap prices, as finished steel prices did not rise in line with the cost of raw materials.

Tokyo Steel is likely to keep purchasing scrap until the end of this year, as it has a full order book, particularly for hot-rolled-coil (HRC).

Another Japanese trader suggests the outlook on Japanese prices remains bullish. "Japanese scrap prices have [a] higher probability to stay firm in November and December based on experience in previous years," the trader said.

Higher scrap usage and lower generation

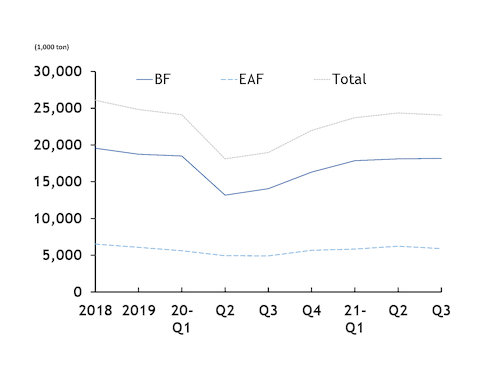

Although Japan's monthly crude production in 2021 so far was still lower than its average monthly production before the pandemic, it strongly recovered and grew by 18pc in January-September compared with the corresponding period last year. The tight supply-demand fundamentals became more noticeable this year as mills used more scrap.

Japanese blast furnace (BF)-based mills increased the scrap usage ratio in converters this year, pushing HS and shindachi prices higher. And it consequently meant less quantity is available for exports. The price spread of H2 and HS fob Japan rose to ¥8,000-14,500/t this year from a typical ¥4,000/t in the past few years, according to Argus assessments. Some BF mills are also testing adding lower-grade scrap such as H2 in converters amid an extremely tight supply of prime grade scrap, market participants said. Production from electric arc furnace (EAF)-based mills has also increased steadily this year.

And September's overall crude steel production hit the highest level in two years. It rose by 25.6pc on the year to 8.1mn t.

Lower scrap generation was another driver that boosted scrap prices.

Scrap collections and processing in the past six months were disrupted by Japan's Covid 19 state of emergency measures, which were fully lifted on 1 October. And earlier this year, many construction projects were postponed in preparation for the Tokyo Olympic Games. These events led to a tight supply for obsolete grade scrap, while supply for shindachi scrap was limited by reduced automobile production. Automakers in the country were forced to cut output many times this year amid a shortage in semiconductors and parts.

Market participants expect scrap available for exports will further decrease in the future, while domestic scrap demand will rise as the country continues its decarbonisation plan.

Tokyo Steel announced plans to resume operations at its HRC production line in Okayama by the end of 2022 because of growing demand for products from EAFs.

Nippon Steel will close some BFs in the next few years and replace part of the capacity with a large-scale EAF mill. The new mill is scheduled to start operation before 2030, and will use scrap and direct-reduction iron as feedstocks.