Medium Range (MR) clean tanker rates from northeast Asia have been on a downward trend since hitting a record high on 6 May because of weaker demand and a rise in tonnage supply.

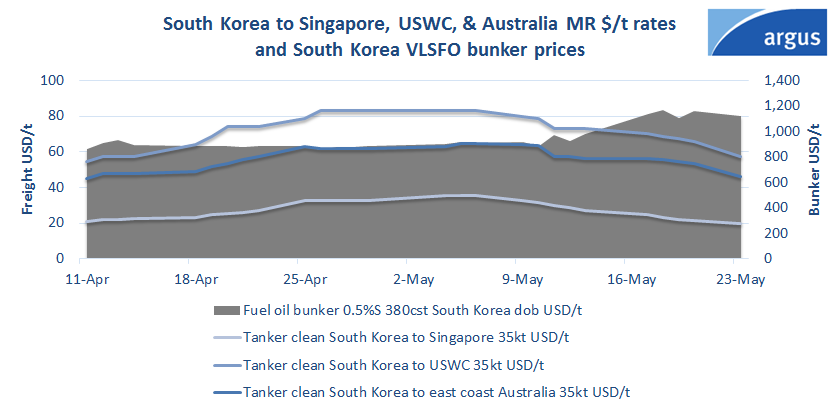

Lump-sum freight rates for 35,000t shipments from South Korea to Singapore and to the US west coast (USWC) fell by 44pc and 31pc to $700,000 and $2mn respectively on 23 May, from $1.25mn and $2.9mn on 6 May. The Worldscale rate for a similar-size shipment from South Korea to Australia fell by 28.75pc from W400 on 6 May to WS285 on 23 May.

Freight rates were unable to stay at record highs because the factors that led to their surge in early May did not persist, a shipbroker said. Several charterers emerged with requirements at the same time, with spot demand elevated by regional holidays during the period. Vessel supplies were also thin as some shipowners had ballasted their ships to the US Gulf coast when rates were also high in April.

Daily spot chartering activity has fallen by about 50pc in the week of 23 May compared with the week of 25 April, Argus data show. And at least 21 vessels are expected to be available over the next two weeks, compared with 18 on 26 April. These have pushed freight rates off their record highs.

Freight rates may hold at current levels in the short term as shipowners are unlikely to cut offers with South Korean bunker prices close to record highs. Prices of very-low sulphur fuel oil with a 0.5pc sulphur content in South Korea rose by 23.6pc from $906.50/t on 6 May to $1,120.50/t on 23 May.

Demand is likely to come from Indonesia and South Korea because of fire incidents at refineries there. A fire hit Indonesian state-owned refiner Pertamina's 260,000 b/d Balikpapan refinery on 15 May, prompting it to seek gasoline blendstocks. South Korean demand for clean petroleum products could move up after S-Oil's 580,000 b/d Onsan refinery caught fire on 19 May.

China has also granted a new batch of export quotas for oil products, which could increase its exports in the short term. But exporters have received only 130mn bl of export quotas this year, 55pc lower compared with 290mn bl for the first two batches last year.

Chinese refiners are struggling with rising product stocks because of Covid-19-related restrictions, particularly after an outbreak in Shanghai in late March led to a more than two-month lockdown. Shanghai is a key product trading hub in the country.