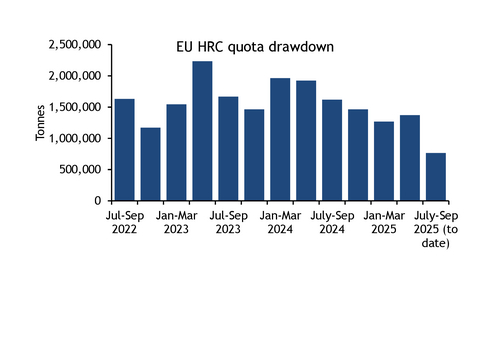

Utilisation of EU hot-rolled coil (HRC) quotas is currently at its lowest level in the past few years, according to EU data.

Less than 780,000t of HRC has been utilised across other countries and those with their own individual quotas. This number excludes imports from countries exempt from the safeguards. Quota utilisation in the current quarter is down sharply from 1.6mn-1.7mn t reached in July-September in the previous three years.

Turkey still has around 140,000t of its quota available, and it is likely to be mostly utilised based on the country's sales to the EU in the past month or so. But this would still leave overall quota usage substantially below previous periods.

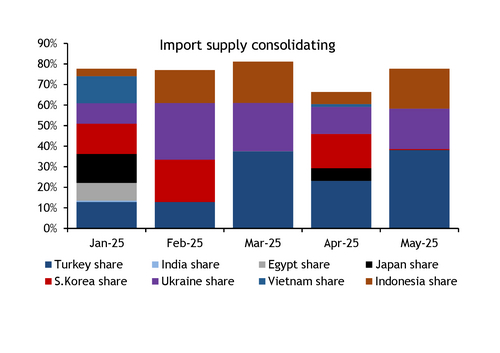

The fall is probably driven by the impact of previously implemented policies, such as the reduced cap on the 'other countries' quota and the dumping measures against Egypt, Japan and Vietnam, but also due to generally weak EU demand. Those three countries, combined with India, regularly comprised 40pc or more of overall EU HRC imports last year, but their highest combined share this year was just 7.5pc in April, according to Eurostat data. Currently, Turkey and exempt countries constitute the bulk of EU HRC imports.

The sharp fall in quota utilisation poses questions for the commission in its implementation of post-safeguard measures. Eurofer has asked for a 50pc drop in import volumes effective January 2026, with no exemptions to the quotas and a 50pc out-of-tariff tax. The measures aim to reduce the share of import supply to 15pc from 30pc recently. Last year, the EU imported 8.5mn t of HRC, so Eurofer is essentially asking for volumes to be capped at about 4mn-4.5mn t.

The association's calls have been supported by 11 EU member states, who are seeking a 40-50pc cut in quota volumes.

But a sharp drop in quotas could reduce supply from an already historically low level, based on current quota usage.

There are notable exempt countries shipping sizeable volumes to the EU on a regular basis. Ukraine sells more than 100,000 t/month into the EU, while volumes have grown exponentially from Indonesia. In addition to this, there have been a couple of cargoes per month exported to the EU from other exempt countries such as Saudi Arabia, Malaysia, China, Thailand and others.

Indonesia was the largest, shipping more than 320,000t of HRC to the EU over May and June, according to export data, and the number could be higher in July, August and September as multiple buyers purchased from the country.

Low prices from one mill in the country had sparked concerns that a dumping investigation could be on the cards, although these rumours have reduced recently. Some sources suggested a year's worth of import data is necessary to open a probe. Participants expect any measure that replaces the safeguard, even if it contains exemptions, are likely to cover Indonesia because of the dramatic surge in shipments. Legal sources suggest the new mechanism will not follow WTO safeguard rules, meaning all countries could be in scope.