Chinese iron ore buyers have shifted heavily to portside markets to swell its premiums to seaborne prices, as they de-risk amid a nearly 29pc drop in seaborne prices over the past six weeks.

The Argus PCX 62pc Fe portside iron ore fines index fell by 17.5pc to 730 yuan/wet metric tonne (wmt) free-on-truck (fot) Qingdao, from Yn885/wmt on 1 July. By comparison, the Argus ICX 62pc seaborne index fell by 27.3pc to $89.85/dry metric tonne (dmt) from $123.65/t on 1 July and by nearly 29pc from a 3 July peak.

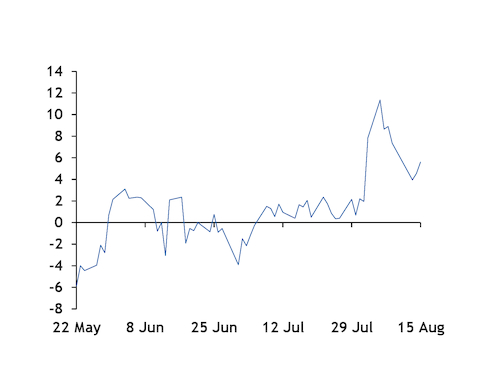

The faster declines in seaborne prices flipped the PCX seaborne equivalent from a discount to a premium to the ICX in early July, then sent it to as much as $11.35/dmt above the ICX on 5 August. It has since fallen to a premium of $5.80/dmt today.

The PCX premium to the ICX has exceeded $10/dmt only four times since its launch in 2014. Each occurrence has coincided with a rapid decline in seaborne markets.

Mill buyers said they have reduced their risk by shifting to a "hand-to-mouth" procurement that relies on smaller volume purchases for immediate delivery. Seaborne trade by contrast is for cargoes for delivery at least two weeks out.

The other driver for the premium is eroded economics for seaborne trades for the current month. Spot seaborne prices have fallen below the ICX's month-to-date average of $96.84/dmt, deterring buyers from indexing to August. "The seaborne market is not active as there is no profit to land August cargoes at ports," a trader said.

Mills are also cautious about iron ore demand in September when increased output restrictions ahead of anniversary celebrations of the founding of the People's Republic of China in October. This has further reduced spot interest for September-indexed cargoes.

Market participants looking to hedge immediate portside price exposure or trade the differential between portside and seaborne markets have limited options. SGX seaborne iron ore derivatives can be traded against domestic iron ore futures on China's Dalian commodity exchange (DCE), but liquidity on the DCE is confined to only a few months of the year and rolls before the start of the month.

The most active DCE contract is now January 2020, which closed up by 0.1pc at Yn626.50/t today on volume of 2.2mn lots. The second-most active contract for September 2019 closed up by 1.6pc to Yn737/t, but the volume is limited at 139,138 lots.