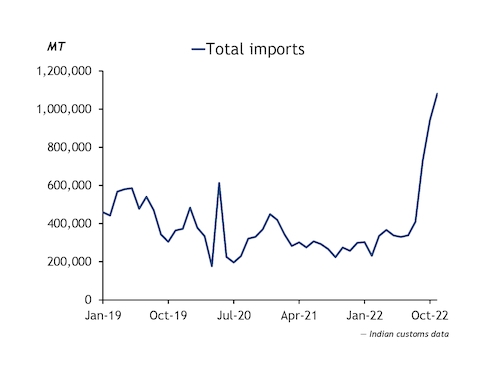

Indian ferrous scrap imports in November surged to more than three times higher than the volumes shipped in the same month the previous year, with flows climbing above 1mn t to the highest total in recent memory.

Ferrous scrap imports into India — listed under HS codes 720449, 720441, 720430 and 720450 — climbed by 319.7pc year on year to 1.08mn t in November last year, customs data shows. This is the highest monthly import total in data stretching back to January 2007.

November imports were 14.5pc higher than October's imports, which standing at 943,101t were the second highest monthly total in that 14-year period.

And September's imports, totalling 728,965t, were the sixth highest total. Over that entire 2007-22 period, India's monthly average imports of ferrous scrap was 404,955t.

The sharp rise in imports from September to November last year came as Indian steelmakers re-entered the ferrous scrap bulk import market in force for the first time in several years. Indian ferrous scrap imports in the years prior to 2022 were almost entirely sourced via container, but a surge in demand combined with a drop in bulk freight rates and a fall in Turkish import pricing in summer last year prompted Indian steelmakers to ramp up bulk cargo purchases at speed.

Higher appetite for overseas scrap was driven by a lack of direct reduced iron (DRI) supply and lower domestic scrap flows. Abundant availability of both weighed heavily on Indian ferrous scrap imports throughout 2021 (see graph).

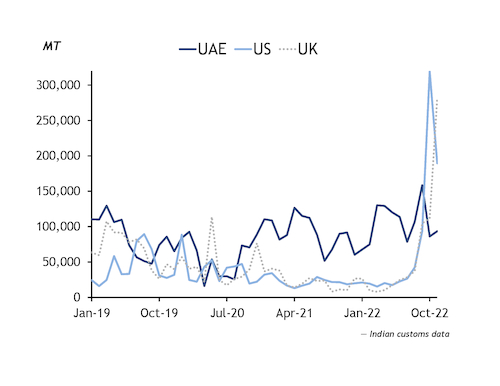

Five deep-sea bulk cargoes left UK ports and arrived into India during October and November, Argus UK vessel tracking data shows. The five cargoes are estimated to have carried 205,000t. And four more cargoes have been tracked to India from the UK arriving in December and January, indicating a potential rise in inflows for December at least.

Before the bulk cargoes were recorded to have arrived from October, no deep-sea bulk cargo has been seen to go to India from UK ports since Argus began tracking the data in January 2019.

And from last July, Indian steelmakers also dipped back into the US bulk market securing a large number of shipments, Argus US vessel tracker data shows. Trade data also shows a number of other deep-sea bulk cargoes, estimated by sharp increases in volumes compared with monthly averages, shipped to India from other countries such as the Netherlands and Venezuela.

Indian demand for deep-sea cargo purchases dropped off sharply from November as steelmakers paused to absorb the vast volumes of tonnage that continued to arrive as a result of their bulk purchasing spree.

Ferrous scrap imports into India across January to November stood at 5.41mn t in 2022, which is up 66.6pc from the same period in 2021. The increase was from a low base, as India's ferrous scrap imports in 2021 hit a 14-year low owing to steelmakers' switch to cheaper DRI and domestic scrap combined with the wider economic impact of the Covid-19 pandemic on the country that year.

Shipments in January-November 2022 from India's top three suppliers, the UAE, US and UK, climbed by 13.4pc, 289.6pc and 182.8pc year on year to 1.16mn t, 787,977t and 660,922t in January-November.

| India's top 10 sources for imported ferrous scrap in 2022 so far | MT | ||

| Country | January-November 2021 | January-November 2022 | Percentage change |

| Total imports | 3,246,247.0 | 5,407,039.0 | 66.6 |

| UAE | 1,023,114.0 | 1,160,181.0 | 13.4 |

| US | 239,806.0 | 787,977.0 | 228.6 |

| UK | 233,702.0 | 660,922.0 | 182.8 |

| Singapore | 202,477.0 | 261,718.0 | 29.3 |

| South Africa | 47,151.0 | 228,347.0 | 284.3 |

| Yemen | 87,851.0 | 193,645.0 | 120.4 |

| Netherlands | 37,971.0 | 151,642.0 | 299.4 |

| Venezuela | 84,089.0 | 149,737.0 | 78.1 |

| Malaysia | 38,918.0 | 128,352.0 | 229.8 |

| — Indian customs data | |||

| Imports listed under HS codes 720449, 720441, 720430, 720450 | |||