Overview

The marine fuel sector is decarbonising. International Maritime Organization (IMO) requirements and EU legislation is driving this change alongside consumer demand for low carbon solutions.

These drivers have prompted shipowners to invest in alternative marine fuels including; marine biodiesel, bio-methanol, grey methanol, LNG, ammonia and hydrogen.

Argus provides pricing, insights, and intelligence for the fast-growing alternative marine fuels market with independent news, analysis, and market commentary on emerging changes and trends so you can stay ahead.

Argus Market Highlights: Marine Fuels

Get the latest industry news, insight and analysis sent directly to your inbox.

Sign upSpotlight content

Browse the latest thought leadership produced by our global team of experts.

Webinar: SAF Horizons - Global Market Dynamics, Policy Shifts, and Forecasts

Webinar: SAF Horizons - Global Market Dynamics, Policy Shifts, and Forecasts

Webinar: Zooming into the US feedstock market and futures contracts

Webinar: Zooming into the US feedstock market and futures contracts

Oil Under Pressure: A webinar series exploring the shifting dynamics in the oil market

Oil Under Pressure: A webinar series exploring the shifting dynamics in the oil market

Webinars

Biofuels Waste-Based Feedstocks Market Overview and Outlook

As of mid-2025, the waste-based feedstocks market for biofuels in Europe and Asia is experiencing a mix of stability and pressure, shaped by regional dynamics, policy shifts, and changes in global trade flows.

On demand Webinar - 25/06/12SAF Horizons - Global Market Dynamics, Policy Shifts, and Forecasts

We will hear from our freight experts as SAF policy and demand create global trading opportunities in this market.

On demand Webinar - 25/05/21Zooming into the US feedstock market and futures contracts

North America market updates, including recent regulatory changes like 45Z that are driving these markets

On demand Webinar - 25/05/06A webinar series exploring the shifting dynamics in the oil market

Explore how tariffs could influence global oil demand and reshape production dynamics.

Related documents

Alternative marine fuels key prices

Argus Marine Fuels features a comprehensive range of alternative marine fuels prices (in $/t VLSFO, $/t HSFO, and $/t MGO equivalents and $/mn Btu).

Latest events

Argus Green Marine Fuels Europe Conference

Argus Green Marine Fuels Europe Conference

Argus Sustainable Marine Fuels Conference

Argus Sustainable Marine Fuels Conference

Argus Biofuels Europe Conference & Exhibition

Argus Biofuels Europe Conference & Exhibition

Global alternative fuels vessel databases

Argus Marine Fuels includes access to proprietary data in three downloadable databases, providing essential insights into the changing marine fuels market:

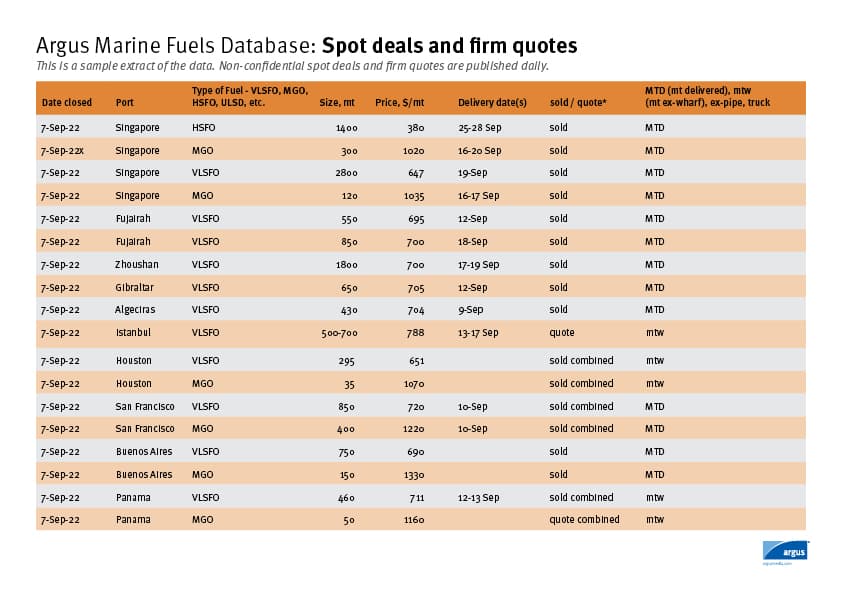

Spot deals and firm quotes

This list of spot deals gives buyers and sellers understanding where they stand price-wise compared with their competitors. Argus’ daily deals/quotes detail the port, type of fuel, size of the deal, price, delivery method and delivery dates. It does not include counterparties’ names.

View sample data

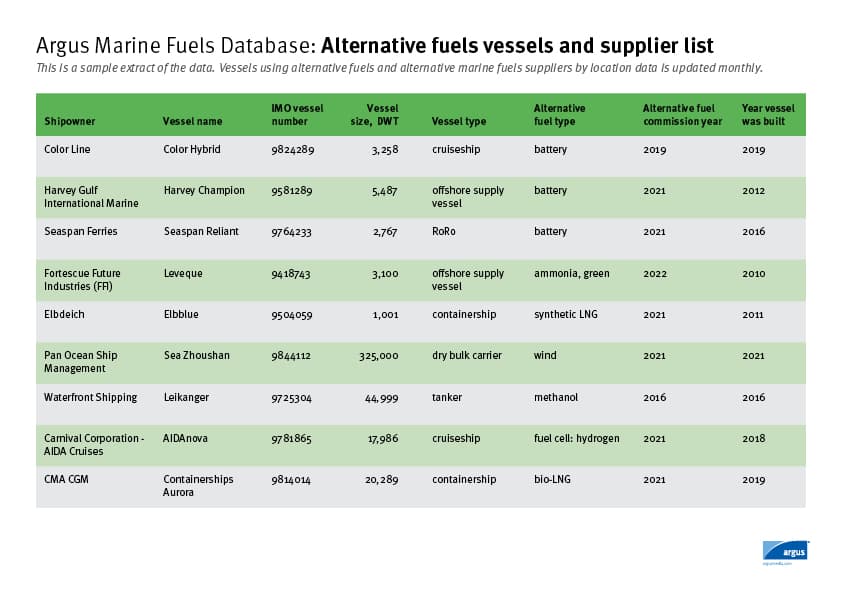

Alternative fuels vessels and supplier list

Argus lists vessels that are burning alternative marine fuels, including methanol, biofuels, ammonia, hydrogen, LNG, LPG, as well as those running on batteries. The database is updated every month.

View sample data

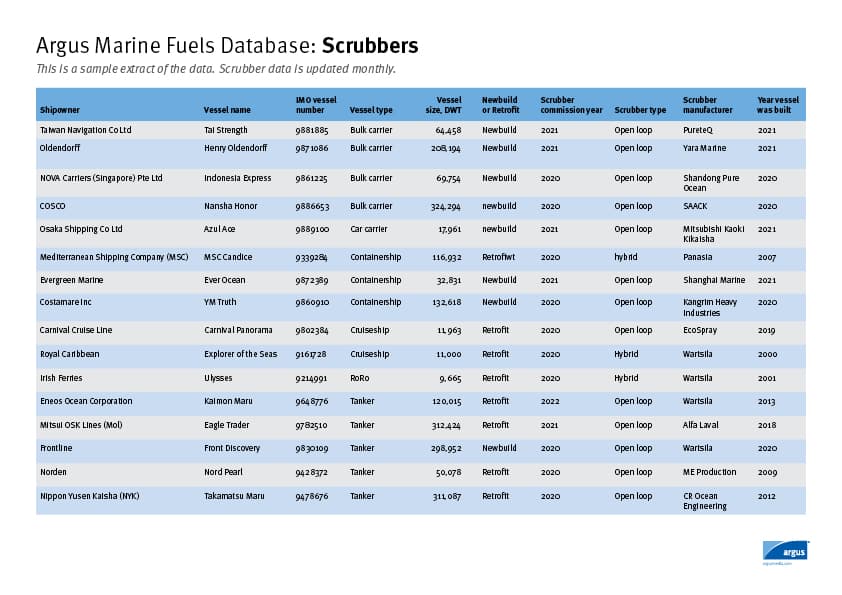

Scrubbers

The database is updated every month. It contains over 4,300 records and counting.

View sample data