Overview

The marine fuel sector is decarbonising. International Maritime Organization (IMO) requirements and EU legislation is driving this change alongside consumer demand for low carbon solutions.

These drivers have prompted shipowners to invest in alternative marine fuels including; marine biodiesel, bio-methanol, grey methanol, LNG, ammonia and hydrogen.

Argus provides pricing, insights, and intelligence for the fast-growing alternative marine fuels market with independent news, analysis, and market commentary on emerging changes and trends so you can stay ahead.

Argus Market Highlights: Marine Fuels

Get the latest industry news, insight and analysis sent directly to your inbox.

Sign upSpotlight content

Browse the latest thought leadership produced by our global team of experts.

LNG share of alternative bunker fuel market grows

LNG share of alternative bunker fuel market grows

Sao Paulo, 30 January (Argus) — LNG is leading the charge in the alternative bunker fuel market as shipowners look to comply with greenhouse gas (GHG) emissions reduction regulations such as FuelEU Maritime, RED III, and EU ETS. Starting in 2025, shipowners traveling in to, out of and within EU territorial waters were required to cut greenhouse gas (GHG) emissions by 2pc, with steeper targets scheduled in the coming years. LNG is considered one of the most viable alternative marine fuels for shipowners seeking to comply with emission-reduction regulations in the short and medium term, according to market participants and recent bunker data. The prioritising of LNG as an alternative bunker fuel is justified by ample availability at ports worldwide compared with other alternative bunker fuels, traders said. LNG bunkering infrastructure is available at 222 ports globally , according to industry group SEA-LNG. In 2025, alternative-fuelled vessel orders dropped by 47pc on the year but LNG-fuelled vessels accounted for 69pc of the orderbook and for 31pc of total gross tonnage, according to Norwegian classification agency DNV. LNG bunker fuel sales more than doubled in Spain in 2025 from 2024 to above 8.1TWh, and quadrupled compared with 2023, according to the country's gas transport association Gasnam. LNG bunker loadings from terminals operated by Spanish grid operator Enagas also increased in 2025 . LNG sales for bunkering at the port of Antwerp doubled on the year in the third quarter of 2025. Going a step further Flexibility and fuel availability are key factors determining future vessel order books, market participants told Argus . In September, sales of FuelEU Maritime credit surplus to the requirements of LNG-fuelled vessel owners were at a significant premium to Argus' delivered bunker bio-LNG assessments in Europe. As a result, shipowners with surplus compliance were able to monetise these excess credits by selling them to under-compliant peers. Bio-LNG used in transportation also offers heavy GHG savings that could ensure shipowners comply with the planned International Maritime Organisation (IMO) GHG pricing mechanism . The regulation, if approved in a vote in October, would start in 2028 and requires ships to initially reduce their fuel intensity by a "base target" of 4pc in 2028 against 93.3g CO2e/MJ, the latter representing the average GHG fuel intensity value of international shipping in 2008. This gradually tightens to 30pc by 2035 and defines a "direct compliance target", that starts at 17pc in 2028 and rises to 43pc by 2035. Using LNG as a bunker fuel may help shipowners to comply with the base target until 2031, but not with the direct compliance target. Using bio-LNG, on the other hand, complies with all GHG emissions reduction targets and generates surplus FuelEU Maritime and IMO credits. By Natália Coelho Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Viewpoint: Alternative bunkers' demand to rise in 2026

Viewpoint: Alternative bunkers' demand to rise in 2026

London, 29 December (Argus) — EU member states' adoption of the bloc's recast Renewable Energy Directive (RED III) and higher penalties for use of fossil marine fuels will boost demand for alternative bunkers in 2026. FuelEU Maritime regulations will keep supporting demand, as in 2025, by requiring a 2pc cut in fuel greenhouse gas (GHG) emissions through to 2029, rising to 6pc in 2030. Shipping emissions will fall under the full scope of the EU Emissions Trading System (ETS) for the first time, including methane (CH4) and nitrous oxide (N2O). The wider ETS scope will raise costs for fuel oil and gasoil bunkers, and also for biofuels, which emit GHGs. RED III rules, including maritime renewable fuel mandates, will shape where and what ships bunker. In northwest Europe, major EU port hubs in the Netherlands and Belgium are set to diverge in their treatment of waste-based biodiesel produced through transesterification and certified under EU RED rules. Used cooking oil methyl ester (Ucome), the most common biodiesel for bunkering blends globally, will not be a mainstay of marine biodiesel blends in the Amsterdam-Rotterdam-Antwerp (ARA) hub. From January, waste-based biodiesel will count towards total obligated fuel volumes in Dutch ports. This will not apply in Belgium, which could allow vessels to bunker there at lower cost in renewable obligation terms. There is also divergence between legislation governing shipping emissions. FuelEU Maritime, unlike some RED III transpositions, places no cap on fuels produced from RED Annex IX Part B feedstocks, including used cooking oil (UCO). FuelEU allows shipowners flexibility on where they procure biofuels to meet their own requirements. Some Dutch suppliers said they will offer Ucome blends in the Netherlands if there is demand for FuelEU purposes, but with a premium to cover domestic RED III compliance. Marine-specific mandates could also push renewable fuel bunkering to other locations and reduce appetite for blends with biodiesel produced using RED Annex IX Part A ‘advanced' feedstocks. Under RED II, supply of such blends generated tradeable renewable fuel tickets called HBE-Gs to count against broader transport mandates, adding value in what had been a non-obligated sector. B30 advanced Fame 0 dob ARA prices, which include a deduction for Dutch HBE-G ticket value, averaged a discount of about $118/t to B30 Ucome dob ARA prices for most of 2025. Singapore eyes EU demand Marine biodiesel bunkering demand in Singapore has risen steadily since FuelEU Maritime was introduced, overtaking Rotterdam sales in the third quarter of 2024. Sales in Singapore totalled 1.16mn t in the first three quarters of 2025, more than double a year earlier. Rotterdam sales fell to 467,772t from 633,902t over the same period. EU anti-dumping duties on Chinese-origin biodiesel, announced provisionally in July last year and later finalised, have driven competitive supply away from ARA ports, consolidating Singapore's leading position for renewable bunkers. Chinese Ucome flows to Singapore remain strong. Exports nearly tripled to 84,024t in the fourth quarter of last year compared with the second quarter, according to China customs data. Shipments this year to October have already exceeded last year's total, reaching 180,122t compared with 173,340t in the whole of 2024. B30 dob Singapore values averaged $732.58/t between 10 April and 3 December this year, compared with $792.90/t for B30 Ucome dob ARA over the same period. By Hussein Al-Khalisy Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

Netherlands slashes 2026 biomarine mandate

Netherlands slashes 2026 biomarine mandate

London, 10 December (Argus) — The Netherlands' government will cut GHG reduction mandates for international maritime and inland shipping supplies from the proposed draft earlier this year , according to a communication from the ministry of infrastructure and water management sent to market participants and seen by Argus , citing delays in Belgian transposition causing concerns of an uneven playing field for fuel suppliers. The statement confirmed that the new renewable energy directive (RED) III mandates will come into effect on 1 January, and will apply retroactively from that date if passed later. Maritime fuel suppliers will be subject to a 2.9pc GHG reduction target in 2026 compared with 3.6pc initially, 0.9pc of which will be a flexible credit allowance that can be fulfilled by overcompliance in other sectors. The inland shipping obligation will be reduced to a 2.5pc greenhouse gas (GHG) reduction target from a previously announced 3.8pc, with 0.5pc flexible credit allowance. The statement added that obligations from 2027 onwards will apply as previously announced in the draft bill. The previously announced ban on 9B feedstocks for international maritime is to remain in place, with the Netherlands to explore whether the overall Annex 9B biofuels cap can be increased to create leeway. Despite an initial agreement between Belgium and the Netherlands to align on marine targets under RED III, some divergence has already emerged as the Netherlands will treat 9B feedstock biofuels as fossil volumes under the maritime obligation — while Belgium may count such volumes as zero when calculating the overall fuel supply. Initial reactions from market participants pointed to expectations of some marine fuels demand shifting from Dutch ports towards neighbouring ports, as the German cabinet passed a version of RED III legislation today that excludes international maritime from the country's targets. Belgium has also yet to finalise its RED III transposition, with updates to come following the conclusion of a public consultation on 14 November. By Hussein Al-Khalisy Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

Participants diverge on IMO adoption delay

Participants diverge on IMO adoption delay

Sao Paulo, 17 October (Argus) — Market participants had mixed views on the delay in voting on the adoption of the International Maritime Organization's (IMO) net-zero framework, comprising a global emissions pricing mechanism for international shipping. Delegates at the IMO's Marine Environment Protection Committee extraordinary meeting postponed the vote on adopting the net-zero framework for a year on Friday during an extraordinary meeting in London. Some traders and shipowners said that the proposed greenhouse gas (GHG) pricing mechanism is too "optimistic" and that alternative bunker fuel supplies are still scarce. Another participant said the delay was expected, considering opposition from the US and others. A European market participant also called attention to the existence of regional regulations, such as the FuelEU Maritime and the EU emission trading system. The EU previously said there are review clauses built into existing maritime regulations, which would mean that the EU can review or amend if IMO matches its ambitions . The International Chamber of Shipping's secretary general Thomas Kazakos said that he is "disappointed" that IMO members were not able to agree on a way forward. "Industry needs clarity to be able to make the investments needed to decarbonise the maritime sector, in line with the goals set out in the IMO GHG strategy", Kazakos added. Danish industry, business and financial affairs minister Morten Bodskov described the outcome as a "sad day for the green transition", adding that a global agreement is needed "as soon as possible". It is "crucial" for European shipping companies, who need "clear and predictable conditions for the green transition", he said. Another trader said that the delay was discouraging and claimed that as long as US president Donald Trump is in office, the GHG global pricing mechanism proposal will not be approved. Also, shipowners are making investments in alternative-fuelled vessels, another participant said. The European Community Shipowners' Associations and the Global Maritime Forum also lamented the outcome. By Natália Coelho Send comments and request more information at feedback@argusmedia.com Copyright © 2025. Argus Media group . All rights reserved.

Development of B24 marine biodiesel in Asia: Guangzhou vs. Singapore

Development of B24 marine biodiesel in Asia: Guangzhou vs. Singapore

European renewable fuel tickets explained

European renewable fuel tickets explained

Fueling the future: SAF pricing market insights, and outlook

Fueling the future: SAF pricing market insights, and outlook

Webinars

Biofuels Waste-Based Feedstocks Market Overview and Outlook

As of mid-2025, the waste-based feedstocks market for biofuels in Europe and Asia is experiencing a mix of stability and pressure, shaped by regional dynamics, policy shifts, and changes in global trade flows.

On demand Webinar - 25/06/12SAF Horizons - Global Market Dynamics, Policy Shifts, and Forecasts

We will hear from our freight experts as SAF policy and demand create global trading opportunities in this market.

On demand Webinar - 25/05/21Zooming into the US feedstock market and futures contracts

North America market updates, including recent regulatory changes like 45Z that are driving these markets

On demand Webinar - 25/05/06A webinar series exploring the shifting dynamics in the oil market

Explore how tariffs could influence global oil demand and reshape production dynamics.

Related documents

Alternative marine fuels key prices

Argus Marine Fuels features a comprehensive range of alternative marine fuels prices (in $/t VLSFO, $/t HSFO, and $/t MGO equivalents and $/mn Btu).

Latest events

Argus Green Marine Fuels Europe Conference

Argus Green Marine Fuels Europe Conference

Argus Sustainable Marine Fuels Conference

Argus Sustainable Marine Fuels Conference

Argus Biofuels Europe Conference & Exhibition

Argus Biofuels Europe Conference & Exhibition

Global alternative fuels vessel databases

Argus Marine Fuels includes access to proprietary data in three downloadable databases, providing essential insights into the changing marine fuels market:

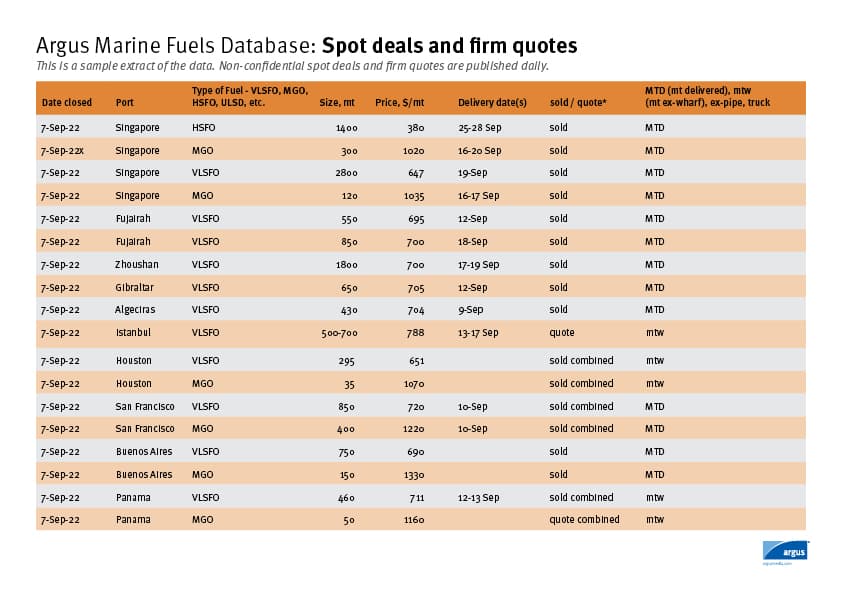

Spot deals and firm quotes

This list of spot deals gives buyers and sellers understanding where they stand price-wise compared with their competitors. Argus’ daily deals/quotes detail the port, type of fuel, size of the deal, price, delivery method and delivery dates. It does not include counterparties’ names.

View sample data

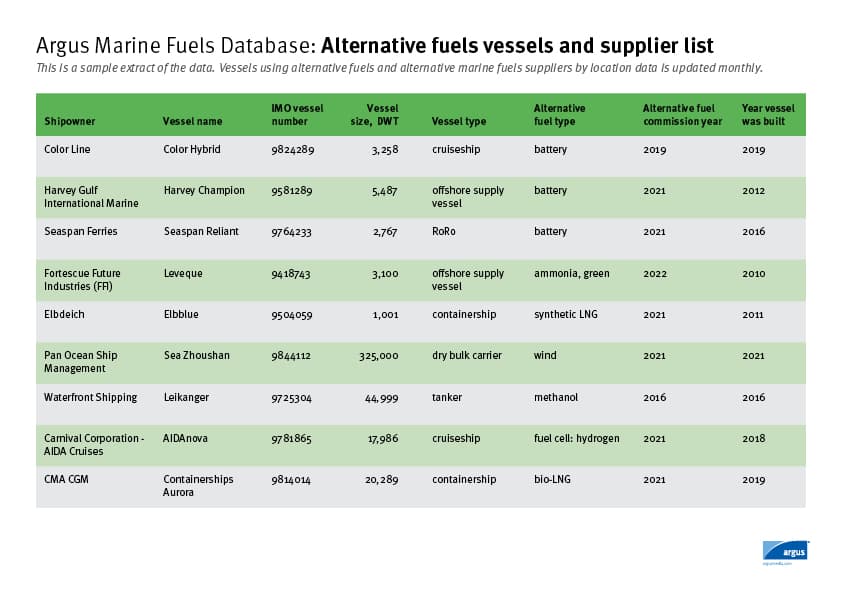

Alternative fuels vessels and supplier list

Argus lists vessels that are burning alternative marine fuels, including methanol, biofuels, ammonia, hydrogen, LNG, LPG, as well as those running on batteries. The database is updated every month.

View sample data

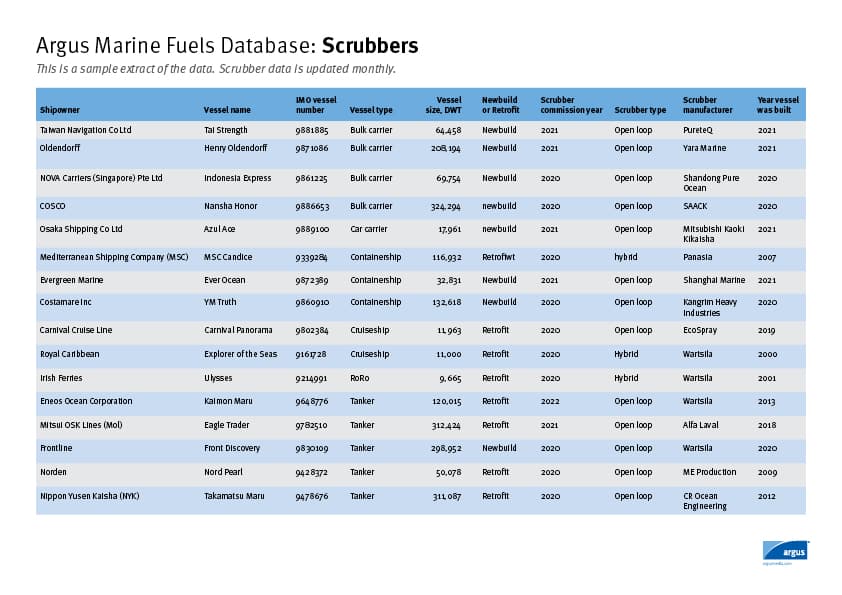

Scrubbers

The database is updated every month. It contains over 4,300 records and counting.

View sample data