Overview

The lifting of US sanctions on Venezuela has triggered a new flow of Venezuelan crude into the US Gulf. These grades are being sold by merchant traders on a “delivered US Gulf” basis. Oil produced in Venezuela is heavy, sour, and asphalt-rich, and requires specialised refining units, such as cokers, for full processing. US Gulf coast refineries were built for this purpose, and have the appetite to process large volumes of these crudes.

Argus has launched three new price assessments for Venezuelan crude oil to better reflect the new market. Effective Monday, 9 February, Argus assesses Merey, Hamaca, and Boscan, all on a “delivered US Gulf” basis. See key price pages for more details.

Price assessment details

Argus Merey del USGC

While offers have emerged for Venezuelan crudes in India, Asia and Europe, trades for Merey have only been completed in the USGC, where multiple refiners have purchased cargoes of the grade. Transactions have occurred on a delivered USGC basis and against the Ice Brent pricing benchmark, which is widely used to price Latin American grades on the water.

Argus Boscan del USGC and Argus Hamaca del USGC

Due to a current lack of liquidity for these two grades, Argus prices will initially be assessed on the basis of other market information for similar grades in the region, general tendencies in the sour markets around the USGC and quality spreads to Merey, which are widely discussed by market participants and are relatively stable. Should activity for these grades pick up, Argus will also take into consideration any bids, offers and deals that emerge in the spot market to further inform the assessments.

Expectations are that sales will remain concentrated around the USGC on an Ice Brent basis for the foreseeable future. Argus will also publish an equivalent differential for all three Venezuelan grades against the Argus WCS Houston price, given Venezuela crude is a close alternative to Canadian supplies, and more specifically WCS. This WCS basis price will allow for hedging as there are actively traded futures swaps based on the Argus WCS Houston price on both major exchanges. These financial contracts settle on the month average of Argus WCS Houston daily published prices.

Related news and analysis

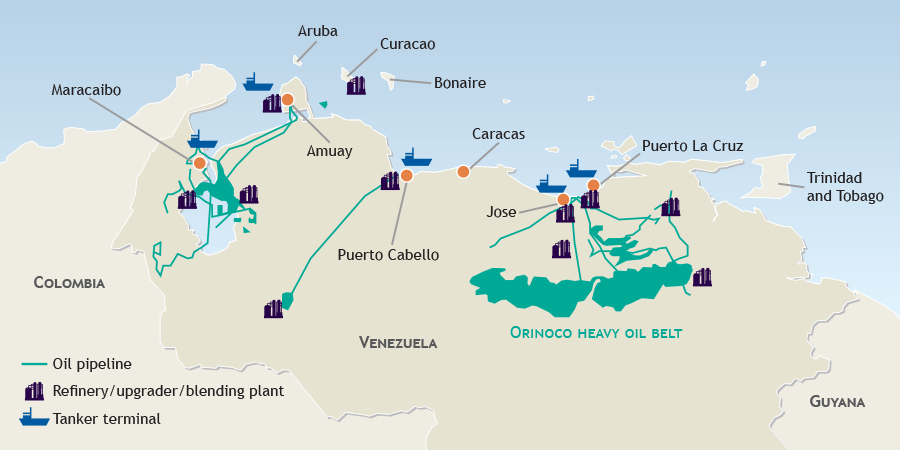

Map: Primary Venezuelan oil assets

Explore our related products

Key price assessments

Timeline: Key Venezuela sanctions dates