Wood pellet imports to the UK fell by 41pc on the year in September because of no pellet-fired power generation at contract-for-difference (CfD) subsidised units and high stocks, but arrivals could pick up over the remainder of the year.

Imports fell to 399,000t in September, well below the 2020-22 average for the month of 674,000t.

Zero generation at CfD units — which have a combined capacity of over 1GW — explains most of the drop. Output at these units has been minimal or zero for all of the 12 months from October 2022, as the scheme was unprofitable for generators.

UK biomass-fired generation in September was 1.2GW on an average hourly basis, down from over 2GW a year earlier, Remit data show.

But imports will probably pick up over the rest of the year, as biomass-fired generation in the UK and elsewhere in northwest Europe rose significantly in October, mostly because of the UK's CfD units ramping up generation and other European units returning from major outages.

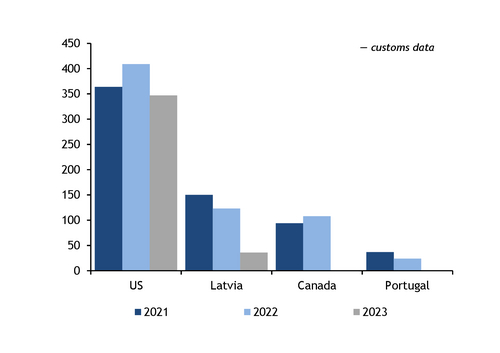

UK imports from North America posted the biggest drops in September, falling by a combined 170,000t, with Canadian receipts down to near zero. Canadian exports experienced some disruption in the third quarter because of industrial action at ports and wildfires. Vessel traffic restrictions at the Panama Canal also probably discouraged shipments from Canada's west coast to the UK.

Latvian shipments dropped by 87,000t on the year and imports from Portugal fell to zero for the first time since at least 2014.

Pellet inventories have also held near or at capacity for most of the year to September at UK and other European generator sites, because of overall lower power burn, paring demand and weighing on spot prices. The Argus-assessed 90-day spot price for industrial wood pellets delivered on a cif NWE basis averaged $206/t in September, down from $427/t a year earlier, when panic buying and concerns over supply availability after sanctions on Russian and Belarusian product firmly supported prices.

Total third-quarter UK imports dropped sharply to 1.2mn t from 1.9mn t a year earlier.

UK port throughput down

Wood pellet throughput at the UK's major import terminals each dropped on the year in September. Loadings at the port of Tyne, which serves the nearby 299MW MGT Teesside wood pellet-fired plant, fell by over 100,000t to 78,000t. MGT's unit has returned on line for some periods since October this year, when CfD generation became profitable in the UK. The plant had also tested some generation in the fourth quarter of 2022 but returned to an extended outage following technical difficulties with a boiler.

Throughput at the port of Immingham, Lincolnshire — which serves UK utility Drax's plant in north Yorkshire — fell to 208,000t in September from 240,000t a year earlier.