Visão geral

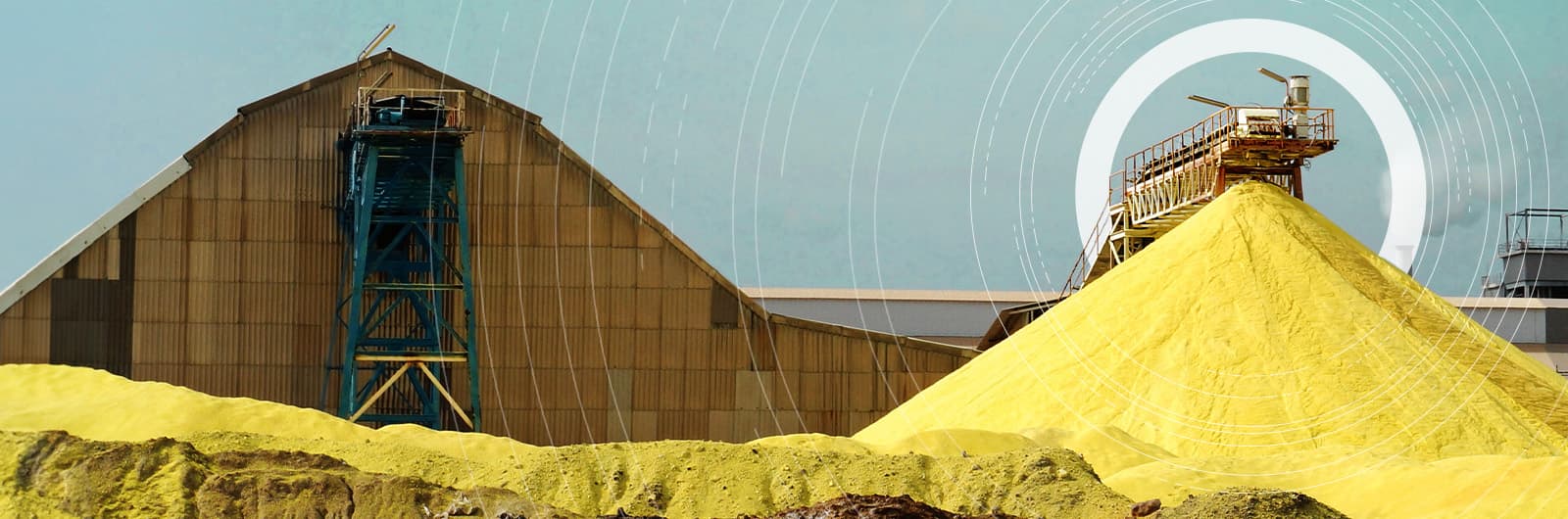

O mercado global de enxofre passou por mudanças fundamentais nos padrões de compra, rotas comerciais e preços nos últimos anos. Contratos de preço fixo e indexação baseada em fórmulas tornaram-se as maneiras dominantes pelas quais os suprimentos são comprados e vendidos em todo o mundo, o que torna avaliações precisas de preços e análises detalhadas essenciais para qualquer participante do mercado de enxofre.

A indústria global de ácido sulfúrico viu mudanças estruturais nos últimos anos e novas capacidades continuarão desafiando o equilíbrio nos próximos anos. Enquanto a demanda será impulsionada por fertilizantes — predominantemente o aumento da produção de fosfato e sulfato de amônio — o mercado continuará exposto a choques de fornecimento de curto prazo, especialmente do setor de metais.

A crescente demanda por materiais de bateria, como níquel e cobalto (devido ao crescimento da produção de veículos elétricos), por sua vez, reforçará a demanda por enxofre e ácido sulfúrico, aumentará a concorrência pela oferta e os preços de impacto.

Nossa ampla cobertura de mercado inclui enxofre formado (tanto granulado quanto granulado), enxofre em pedaços triturados, enxofre fundido/líquido e ácido sulfúrico. A Argus tem décadas de experiência abrangendo esses mercados e incorpora nossa experiência de mercado multicommodity em áreas-chave, incluindo fosfatos e metais, para fornecer a narrativa completa do mercado.

A Argus apoia os participantes do mercado com:

- Avaliações de preços (diárias e semanais para enxofre, semanais para ácido sulfúrico), dados proprietários e avaliações de comentários de mercado

- Previsão de curto e médio a longo prazo, modelagem e análise de preços de enxofre e ácido sulfúrico, oferta, demanda, comércio e projetos

- Suporte de projeto de consultoria sob medida

Últimas notícias sobre enxofre e ácido sulfúrico

Navegue pelas últimas notícias do mercado sobre a indústria global de enxofre e ácido sulfúrico.

Brazil’s Jan PPI contracts on fuels, food

Brazil’s Jan PPI contracts on fuels, food

Sao Paulo, 4 March (Argus) — Prices paid to Brazilian producers fell by 4.33pc in January from a year earlier, mostly pushed down by the food sector and fuels, according to government statistics agency IBGE. The decline in the producer price index (PPI) slowed from a 4.51pc contraction in December but quickened from 3.36pc in November and smaller contractions the prior two months. The disinflation in PPI suggests that consumer price inflation, which accelerated to 4.44pc in January from 4.26pc in December, may soon be easing. The food sector, which accounted for more than half of the total PPI index result, fell by 9.84pc in January from a year earlier, after a 10.48pc annual loss in December, extending a negative streak begun in September, IBGE said. Sugar products and pork were among the main negative drivers, while falling sugar prices were mainly affected by a weakening dollar to the Brazilian real over the last year. IBGE's research manager Murilo Alvim said. As for crude and biofuels, producer prices for the sector fell by 7.64pc in the last 12-months, following a 5.64pc annual loss in December and marking an eight-month low, IBGE data show. Metallurgy producer prices fell by 4.91pc in January from a year earlier, following an 8.06pc annual loss in December. The index ticked up by 0.3pc from December. Brazil's PPI posted 10 consecutive monthly declines from February-November 2025, IBGE said. Copper and gold contributed the most to inflationary pressures within metallurgy in the monthly comparison, adding up to its 2.73pc. As for chemicals, sulfur-based fertilizers and other imported feedstocks raised producer prices to a 1.7pc gain from December, Alvim said. PPI measures average prices offered by suppliers to domestic producers of goods and services without considering taxes and freight costs. By João Curi Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Indonesia halts long-term MHP offers on Hormuz crisis

Indonesia halts long-term MHP offers on Hormuz crisis

Singapore, 4 March (Argus) — Indonesian nickel mixed hydroxide precipitate (MHP) producers have stopped offering long-term contracts so that they can assess the potential impact of sulphur supply disruptions from the Middle East following the Iran conflict. Market uncertainty surrounding sulphur feedstock availability has pushed some trading firms to stop offering MHP cargoes, regardless of delivery time, given expectations of further upside in prices. Some producers are still offering spot cargoes for loading next month and producers will continue to honour quarterly contracts for January-March delivery. MHP payables were steady at 89–90pc through the first quarter ahead of the lunar new year, before trades edged down to 89–89.5pc as sulphur prices softened. First-quarter contract payables from major Indonesian producers were settled at around 90pc. Second-quarter offers are expected to face upward pressure, and producers may shorten contract terms from quarterly to monthly amid the uncertain outlook. Sulphur accounted for 44pc of MHP production costs in March, compared with nickel ore at around 33pc, according to market participants. Indonesia relies heavily on sulphur shipments from the Middle East, with high pressure acid leaching (HPAL) plants dependent on sulphuric acid produced domestically from imported sulphur. The country received 3.95mn t of sulphur from the Middle East last year — 74pc of its total 5.35mn t of imports — driven by rapid growth in MHP capacity. HPAL facilities produce MHP for use in nickel sulphate production and downstream battery materials processing. With vessel transits through the strait of Hormuz now effectively stalled, reports have emerged of shipment delays for cargoes bound for Indonesian buyers, heightening concerns over potential impacts on HPAL operations and MHP production. One Indonesia-based producer said it is evaluating the potential impact of delayed sulphur deliveries on near term output. Indonesia is the dominant global MHP supplier following the shutdown of most western HPAL plants since late 2023. The country hosts roughly 10 operating MHP projects with combined nameplate capacity of about 440,000 t/yr of nickel. Argus forecasts Indonesian MHP capacity to increase to 694,000 t/yr in 2026, with several HPAL projects scheduled to start up this year. But a one third cut to the 2026 work plan and budget (RKAB) nickel mining quota to 260-270mn t of nickel ore, is expected to slow both capacity additions and output growth. The impact on the sulphuric acid market is less significant, as Indonesia sources all of its sulphuric acid from within the Asia-Pacific region. The country imported 1.09mn t of sulphuric acid last year. While reduced sulphur availability could prompt buyers to substitute sulphur with sulphuric acid, the flexibility to do so is limited by the difficulty in obtaining import permit licences. Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

QatarEnergy rolls over March sulphur price

QatarEnergy rolls over March sulphur price

London, 4 March (Argus) — State-owned QatarEnergy Marketing has rolled over its March Qatar Sulphur Price (QSP) at $520/t fob Ras Laffan/Mesaieed. The announcement was expected on 1 March, but was deferred following the 28 February US-Israel attack on Iran and the subsequent counter-attacks on the wider region. It remains unclear if product can be exported through the strait of Hormuz, which has been effectively closed to shipping since the conflict started. Several vessels have been hit by drones and missiles, and some maritime insurance providers have pulled insurance provisions as a result. QatarEnergy announced on 3 March that following a 2 March drone attack on Ras Laffan, the supplier would halt sulphur production alongside LNG and all associated products. Sulphur offer prices to delivered markets have since risen substantially from other origins bypassing the region, but buyers are taking a wait-and-see approach. But Middle East volumes would be subject to much higher freight costs as a result of heightened risks and backlogs, while vessels have built up on either side of the strait waiting to transit to either load sulphur, or to deliver loaded cargoes to consumers outside of the region. Port loadings have mostly continued as usual, and if traffic opens in the coming days the disruption could be resolved relatively quickly, but the risk of a prolonged conflict in the wider region is increasing uncertainty of sulphur availability among buyers. By Maria Mosquera Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Sulphur jumps to $615-630/t fca Dar es Salaam

Sulphur jumps to $615-630/t fca Dar es Salaam

London, 3 March (Argus) — Argus assessed spot sulphur prices at the key hub of Dar es Salaam, Tanzania at $615-630/t fca on 3 March — an increase of just $20/t since 27 February as stocks in the port are ample. Four ships carrying a combined 181,000t of sulphur — enough to make roughly 540,000t of sulphuric acid — discharged at the port in February, and sulphur warehouses in Dar es Salaam are at 60-70pc capacity. Sulphur prices in Africa are likely to rise sharply, as elsewhere in the world, owing to the near-stoppage of shipping out of the Middle East Gulf and shutdown of major refineries in the region, as a result of the escalating US-Iran conflict. Global seaborne sulphur supply could fall by as much as 50pc. Nearly all sulphur imported by southern African buyers last year came from the Middle East and it will be hard to replace these lost supplies. Costs to deliver sulphur by truck from Dar es Salaam to the key mining hub of Kolwezi in the Democratic Republic of Congo are at about $280/t this week, implying delivered sulphur prices of around $900/t dap Kolwezi. This suggests a sulphuric acid price of nearly $300/t, at typical conversion ratios of 3:1 for sulphur to sulphuric acid. Additional sulphur cargoes are on their way to Dar es Salaam, having already transited the strait of Hormuz. But trading firms could decide to divert these shipments to other regions as Middle Eastern supply tightens. Several sulphur cargo bulkers are currently in the strait, with destinations not yet clear. These include: African Lorikeet , loaded on 27 February in Ruwais with around 61,000t of sulphur. Nejat , loaded on 3 March in Ras Laffan with around 18,000t of sulphur. Rui Fu Bang, loaded on 25 February in Shuaiba with around 33,900t of sulphur. By Fenella Rhodes and Bede Heren Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Destaques do mercado de fertilizantes da Argus

O pacote gratuito de Destaques do Mercado de Fertilizantes da Argus inclui:

• Boletim informativo bisemanal sobre fertilizantes • Vídeo de atualização mensal do mercado • Revista bimestral de foco em fertilizantes

Spotlight content

Browse the latest thought leadership produced by our global team of experts.