Adds wider market context in paragraphs 9-13.

Heavy rains in north China's key coal producing Inner Mongolia region last week disrupted coal mining and transportation in Erdos, where many open-cut and underground mines are located. Tighter supply from mines in the region has helped to push up coal prices.

Fob mine prices of NAR 5,500 kcal/kg coal produced in Erdos rose by around 8 yuan/t ($1.20/t) from a week earlier to Yn224-230/t on 19 August, according to the Inner Mongolia Coal Exchange Centre.

The exchange centre — founded with the support of China's coal industry association and the Inner Mongolia government — is the only coal exchange approved by the region's government. The fob price is a component of its weekly Erdos steam coal price index, which rose by 2.17pc to Yn235/t at the end of last week.

Heavy rains since 14 August have flooded open-cast mines in Erdos, forcing almost all such mines to close temporarily. Most of the underground mines in the region have also had to shut to avoid flooding or mine collapses.

There are 153 operating open-cut mines and 174 underground mines in Erdos with a combined production capacity of 742mn t/yr, according to data released by the local coal industry bureau in January. But the bureau has not disclosed the capacity of the mines that have been adversely affected by the heavy rainfall. Inner Mongolia produced around 405.5mn t in the first half of this year, according to data from China's statistics bureau.

Rainfall in several parts of north China has been around historic highs, with levels in Erdos reaching as much as 150mm during 10-18 August, China's national meteorological administration (CNMA) said.

Heavy rainfall should ease gradually from today, CNMA forecasts indicate. But prices may continue to be supported if utilities seek to rebuild stocks quickly after coal mine operations and transportation return to normal.

Coal mines in several regions in China were affected by heavy rainfall this month. Coal trucking operations from the key coal producing counties of Lüliang and Yangquan in Shanxi province were impacted earlier in August when local authorities closed several highways after a road collapse resulting from a storm.

Market pressure remains

But weakening coal consumption at utilities may help to slow the steady price rally since the start of this summer. Combined coal burn at six key coal-fired coastal utilities — Huaneng, Datang, Zhejiang Power, Guodian, Shanghai Power and Yudean — in southeast China has averaged less than 701,000 t/d since 15 August, after reaching a two-and-a-half year high of 777,000 t/d on 4 August.

Changes in industrial demand are likely to exacerbate this trend. The municipal government of eastern China's Hangzhou has repeatedly stated its intention to cut activities at polluting enterprises ahead of an upcoming G20 summit on 4-5 September. Zhejiang province, of which Hangzhou is the capital, as well as neighbouring Jiangsu province and Shanghai municipality have also asked companies to close operations or reduce emissions during the period. Shanghai has instructed coal-fired power plants to stock up on "high-quality, low-sulphur" coal for the period.

With 70pc of power demand still coming from such large enterprises, and this region accounting for 16-19pc of China's overall thermal power generation in any given month, the closures threaten to have a marked impact on the country's power market, which will in turn affect coal demand. Zhejiang, Jiangsu and Shanghai generated around 62TWh of thermal power, including coal, gas and other generation fuels, in August last year. Assuming a business-as-usual scenario under which output would remain at this level, and based on plants operating at 38pc efficiency using NAR 5,500 kcal/kg coal, a reduction of just 10pc in power demand could result in coal consumption falling by as much as 2mn t in August compared with a year earlier.

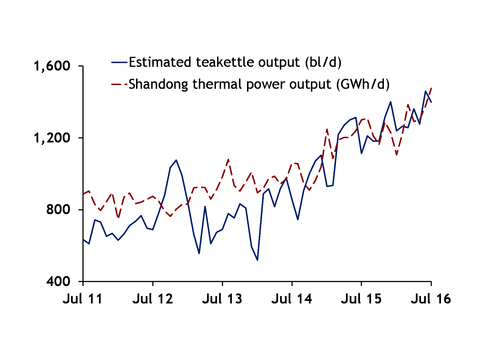

Meanwhile a directive today from China's economic planning agency the NDRC mandating local authorities to strengthen inspection of China's large coastal teakettle refining industry, could put further pressure on power demand. Authorities will "strictly restrict" the amount of imported crude that refineries can use if their attempts to shut down outdated capacity do not meet government requirements, the NDRC said. Additional rules are expected to increase teakettle refineries' tax liabilities, as the government seeks to reduce tax evasion in the industry.

The new rules could weigh on output from the refineries, which have bolstered thermal power demand in northern China's Shandong province ever since the NDRC allowed certain refineries in the province to use imported crude in late May 2015. Any slowdown in Shandong's power output could weigh on the wider coal market. The province's thermal generation increased by 23.3TWh, or 24pc, in the first half of this year from a year earlier, to 121.3TWh — a stronger rate of growth than in any other part of China, and a boon to the struggling coal market.