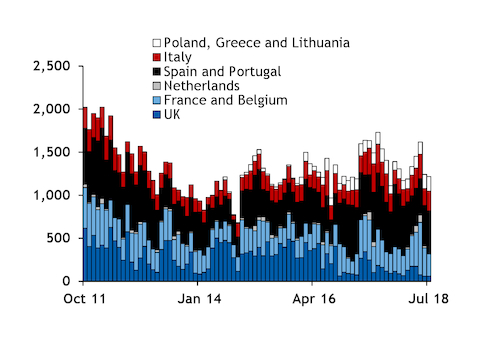

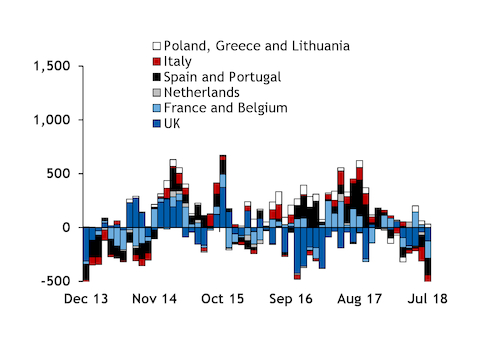

European LNG sendout slipped in July, with the biggest year-on-year drop since December 2013.

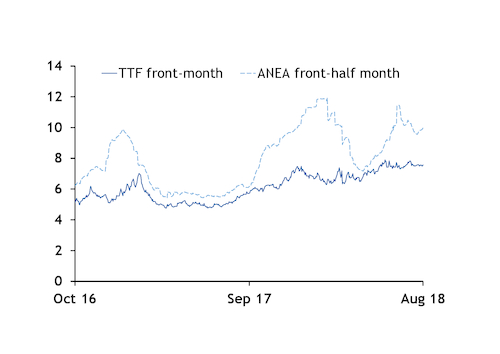

Firm demand and prices because of hot weather in other regions drew supply away from Europe. ANEA near-curve prices opened a wide premium to the NBP and TTF hubs in June, encouraging re-exports in July and minimising gross deliveries to northwest Europe.

UK, French, Italian and Spanish sendout each fell by more than 100 GWh/d from July 2017, and this was only partly offset by higher Polish regasification because state-run PGNiG has increased its contractual commitments this year.

UK LNG receipts have been slow this summer, with South Hook sendout close to its typical minimum of 5mn m³/d.

France and Spain drove European re-exports, resulting in sendout tumbling after northeast Asian LNG prices climbed. Both France and Spain have a steady influx of contractual supply, allowing gross receipts to feed reloads when arbitrage opportunities open.

ANEA prices for delivery over the coming months have retained a wide premium to European hubs. This could offer an incentive to continue minimising LNG imports and delivering cargoes to more profitable regions, while France has organised more re-exports this month.