European petroleum coke demand is in structural decline just as new coking capacity comes on line in the region, reducing the continent's role in the seaborne market as early as next year.

Cokers in Belgium, Poland and Turkey have recently come on line and are providing new supply. But demand is unlikely to rise from today's levels, speakers said at the Cemprospects 2019 conference in Krakow, Poland, last week.

Cement, the main coke-consuming industry in the region, is in a period of weakness. Cement market analyst Arnaud Pinatel's firm On Field Investment Research predicts no growth in the western European market next year.

At the same time, increasing carbon dioxide regulatory costs will push cement makers to reduce capacity and further adopt alternative fuels over the long term.

"The main challenge for the European cement industry is CO2," Pinatel said.

Regulators are setting ambitious goals for carbon reduction. Policy plans, such as the IEA's low-carbon transition roadmap for the cement industry, will be difficult to meet with existing technology. The plan seeks a 24pc cut from current levels by 2050. But the incoming European Commission president, Ursula von der Leyen, has said she would like to see reductions of more than half by 2030.

The IEA's proposal relies heavily on assumptions that industries will adopt carbon capture and storage (CCS). But this technology is costly. It remains largely theoretical, with no commercial-scale projects operating in Europe.

A more feasible means of reducing carbon footprint is to further increase reliance on alternative fuels, such as biomass and repurposed waste. European cement makers are already getting almost half their fuel from alternative sources, said Nikos Nikolakakos, European cement association Cembureau's environment and resources manager. This amounts to about 11.5mn t/yr of such fuels. These fuels are typically lower cost and provide a valuable waste-reduction benefit. Roughly 250mn t/yr of waste is produced in Europe, and some countries are considering landfill taxes as an incentive to repurpose waste.

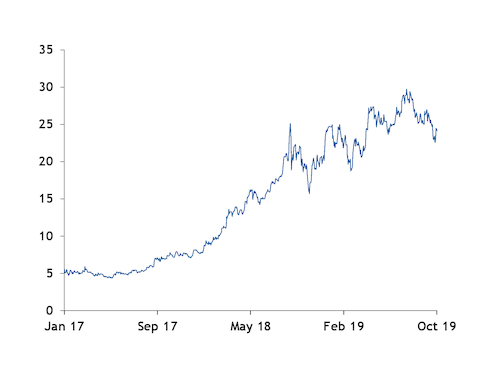

European cement makers will have to try and meet ambitious carbon reduction goals even as prices of carbon credits in the EU emissions trading scheme (ETS) have risen substantially over the past two years. The prompt price peaked at €29.76/t of CO2 equivalent (CO2e) on 23 July, the highest level since assessments began in 2008. This was up by 72pc from a year earlier and almost six times what it was in July 2017.

Although prices have softened since the summer, largely on concerns over the effects of the UK leaving the EU, they remain around €24/t. And investment bank Berenberg forecasts prices will end this year at around €45/t and average €65/t next year.

This price is well above what Pinatel views as an inflection point.

"If the CO2 price moves above €30/t, it will be more competitive to import from outside the EU than to produce locally," Pinatel said.

This assumes that the EU does not implement a CO2 border tax, which von der Leyen has pledged to do. Such a tax would also weigh on nearby markets such as Turkey, which are not part of the ETS, but rely on exporting cement and clinker to the EU. While such a tax could in theory support coke demand in Europe, it would likely replace the free allocation policy on which cement makers heavily rely.

European cement makers receive a certain amount of free allowances under the trading scheme, as long as they are operating their plants at least 51pc of capacity. While there was a surplus of allowances until 2017, the market tipped into a shortage in 2018. This shortage is expected to widen significantly in 2021 and beyond. The high prices for credits lead companies to only produce what is covered under their free allowances. And this encourages companies to close some of their plants to more easily meet this capacity threshold.

Shutting down capacity can have the further benefit of increasing a company's overall proportion of alternative fuels. Some European cement producers are shutting plants that largely rely on carbon-intensive fuels like petroleum coke and coal in favor of facilities that are able to run mostly on alternatives.

All realistic carbon-reduction solutions will lead to less clinker production over time, which will mean lower overall fuel needs for the industry, Pinatel said.