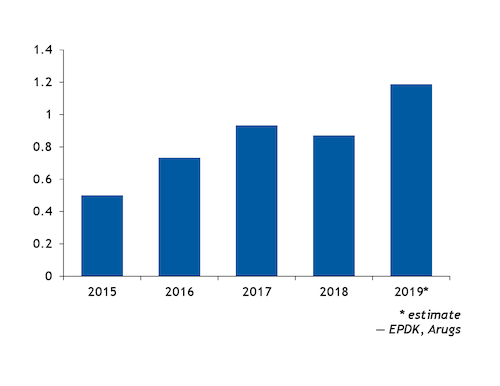

Turkey's domestic coke production is on track to increase by 37pc to around 1.2mn t in 2019 from last year, as the start-up of a new coker adds pressure to seaborne demand.

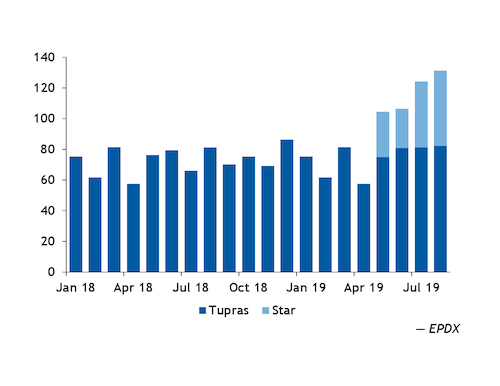

Azeri state-owned Socar's 200,000 b/d Star refinery in Turkey, which started its coker in late April, produced 147,000t in May-August, according to the latest data available from energy regulator EPDK.

Output especially increased in August as the coker unit ramped up, jumping to 49,000t from 30,000t in May. And the refiner plans to produce around 60,000t/month when the coker unit is at full capacity.

Star's strong August production added to output from Turkish refiner Tupras, which started up its coker in 2015, to result in a record monthly production of 131,000t. Total domestic green coke output from the two refiners stood at 663,000t in January-August. This suggests that Turkey is on track to produce at least 1.2mn t for the full year, assuming September-December output will be at least in line with August levels. This would well exceed last year's output of 870,000t and would be the highest for any year since Tupras' coker start-up in 2015.

Star expects annual production of 700,000t when operating at capacity, on par with Tupras' capacity. This suggests there is scope for output to increase to 1.4mn t in 2020, if cokers at both refiners operate at full rates. And it could rise even higher, given Tupras' output has been well above nameplate over the past two years (see chart).

Almost all of the refiners' domestic coke was sold and consumed internally this year.

Stronger domestic production expected for the remainder of 2019 is likely to continue pressuring Turkey's import demand, adding to an already weak appetite for solid fuels. Demand from key industrial users — primarily cement, steel and iron plants — has fallen significantly this year. Factories have been running at low utilization rates in line with a slowdown in economic growth in Turkey.

Cement production fell by 30pc to 31.9mn t in January-July from a year earlier, the latest data from Turkey's cement producers' association show, as a plunge in domestic sales could not offset a small increase in exports. The country's sluggish economic growth has badly hit the construction sector, a key downstream market for cement. The IMF expects the economy to grow by just 0.2pc on the year, slowing from 2.8pc in 2018.

Import demand down

Turkish seaborne coke receipts plunged by 41pc year on year to 2.2mn t in January-September, posting annual losses for the fifth consecutive month in September, customs data show. That said, receipts from Europe rose by 172pc over the same period to 492,000t, as the start-up of the ExxonMobil-run Antwerp refinery's coker in late December 2018 boosted deliveries to Turkey. In contrast, receipts from all other regions fell for the period, with US Gulf supplies seeing the largest drop, by 1.6mn t.

A more volatile freight environment has given European suppliers a competitive advantage to Turkey so far this year. And Turkey imposed a 4pc tariff on US coke imports in mid-2018, which has rendered US Gulf material even less competitive.

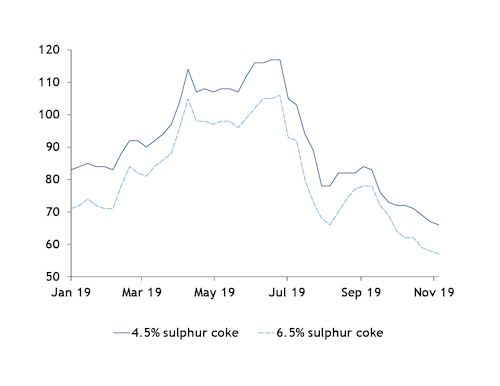

Coke imports failed to increase even though Turkey-delivered prices have become cheaper compared with seaborne coal in the second half of this year (see chart), as weaker demand and ample domestic coke supplies likely offset any increase from coal-to-coke fuel switching by industrial users.

By Erisa Senerdem