Corrects port name in fourth paragraph

Colombian coal producers may be forced to declare force majeure in the coming weeks if heavy disruption to mining and rail transportation continues. In the Atlantic basin, this could result in stronger demand for Russian coal or reloads in the Amsterdam-Rotterdam-Antwerp (ARA) region.

Colombia has extended a national lockdown to 26 April from 12 April, which will likely result in sustained interruptions to production at coal mines. Key producers have announced severe cuts in output since restrictions to prevent the spread of the Covid-19 pandemic were introduced in late March, despite mining being exempt from the lockdown, and have faced additional pressure from local communities.

The country's largest miner, Drummond, has seen significant production cuts, as employees were prevented from entering mines by local communities. The firm is currently operating at reduced capacity to haul small amounts of coal from the mine to load on trains.

The company has so far continued loadings to meet its export obligations, mostly using stocks at Puerto Drummond, which were about 900,000t late last week. But Drummond has informed clients that it may have to halt loadings in the coming weeks if the situation at mines does not change, a market source said.

Drummond's exports fell by 1mn t on the year to 2.3mn t in March. Exports to the Netherlands accounted for half of the decrease, and the country has taken only one Capesize vessel from the company since May last year amid a sharp decline in coal burn in northwest Europe. Data suggest most of the remaining destinations to which Drummond's exports fell were not regular long-term customers.

But the company may have to fulfil 1.7mn t of contractual obligations in April, and as high as 2.4mn t and 2.3mn t for May and June, respectively, assuming exports to long-term clients are flat from a year earlier, Argus estimates.

Export data suggest that other Colombian producers may have up to 2.5mn t of export obligations for April, and 3.4mn t and 2.5mn t for May and June, respectively, assuming they are flat from a year earlier. But Colombian exporters may be unable to deliver such commitments if production continues to be suspended, as stocks at ports are depleting quickly.

Indigenous groups have been blocking the 150km (93-mile) Cerrejon coal railway in the northern La Guajira province since 25 March, which forced CMC, the marketer for Cerrejon's coal, to declare a force majeure on four vessels waiting at Puerto Bolivar on 30 March, according to a letter sent to customers.

Glencore subsidiary Prodeco and Murray Energy unit CNR also suspended production on 24 March as local residents blocked workers' transit routes, although Prodeco said it has ample stockpiles at its Caribbean ports to meet contracts in the near term. Its Puerto Nuevo terminal has more than 2mn t of coal stockpiled, while CNR's Rio Cordoba port had just 180,000t left in inventory and is planning to ship more from mines.

That said, demand for seaborne coal may also fall in destination countries because of restrictions to prevent the spread of the coronavirus, and buying counterparties may ask for at least some cargoes to be deferred, offering some relief to Colombian suppliers.

Alternative supplies for Turkey

Colombia's key long-term partners in Latin America, Europe and the Mediterranean may be forced to look for alternative supplies in the event of a temporary interruption in Colombian deliveries.

Turkish utilities — Colombia's largest customer — have reported no interruptions in Colombian supplies so far, as loadings continued at contracted levels in March, but uncertainty about the future has prompted at least one plant to consider alternative sources.

Turkish power plants may seek to buy coal from Russia, which is conveniently located to promptly deliver supplies from Black Sea or Baltic ports.

Buyers could also look for reloads from ARA terminals, depending on how these compete with Russian supplies. ARA stocks close to multiple-year highs combined with weak coal burn in Europe — as generation margins remain deeply negative and coronavirus pressures power demand — have pushed Europe-delivered coal prices to a wide discount to the fob Baltic ports market since late March.

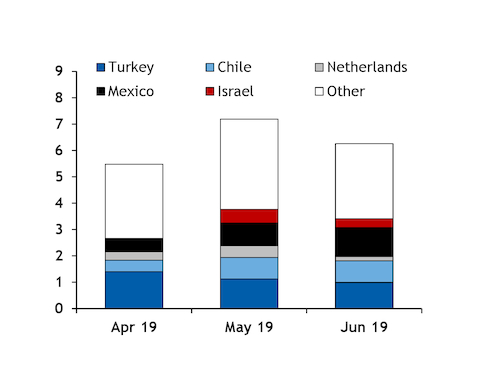

Colombia exported 17.5mn t to Turkey in 2019, covering most of the power sector's 20mn t/yr of seaborne coal consumption. Loadings totalled 1.4mn t in April, 1.1mn t in May and 990,000t in June last year. Some of these may have to be met by other origins in the event of a halt in Colombian deliveries, assuming demand is flat year on year.

That said, Turkey's power demand has fallen significantly in recent days, dropping by 10pc on the year to an average of 28GW, which is weighing on imported coal burn. This is as stricter restrictions are applied to limit the spread of the coronavirus. Employees are still allowed to commute to work, but many businesses are opting to close, weighing on demand for power.

Colombia's other long-term coal trading partners, which include Chile, Brazil, Mexico, South Korea, the US and a number of European countries, may also seek alternative supplies should Colombian loadings slow or halt in the coming weeks. Australian and Indonesian coals, recently oversupplied amid a lockdown in India and weak demand in China, could provide buyers with some cheap alternatives. The recent fall in Richards Bay fob prices could make that another viable alternative for these destinations.