Japan's thermal coal imports rose by 3.4pc on the year in March, supported by lower nuclear availability and stable power demand. But the outlook for coal burn remains weak amid a lockdown scheduled to end on 6 May and the prospect of stiffer competition from LNG imports.

Japan imported 9.9mn t of thermal coal last month, according to finance ministry data, up from 9.1mn t in February and 9.6mn t in March 2019. The year-on-year increase was driven by stronger receipts from Indonesia, Russia and Australia.

Indonesian supply rose by 29.9pc on the year to 1.4mn t, while Russian supply grew by 17.8pc to 1.2mn t. Australian imports rose by 1.9pc to as much as 7.1mn t, although this figure may include imports from Colombia, South Africa and Canada, which are not differentiated in preliminary data. Imports from the US fell by 15.7pc to 249,000t.

LNG imports fell by 0.3pc on the year to 7.2mn t in March, although imports were up by 8.5pc from February. LNG imports in January-March fell by 2.9pc on the year to 21.4mn t, while coal imports fell by 3.3pc to 28.7mn t.

Fossil fuel demand was probably supported by a 2.2GW year-on-year drop in Japanese nuclear availability last month. Lower nuclear availability reduced generation by 2.2GW on the year in the first quarter as a whole — the equivalent of 1.6mn t of additional NAR 5,800 kcal/kg coal burn in 42pc-efficient plants, or 550,000t of LNG use in 55pc gas-fired plants, assuming either fuel were to fully offset lower nuclear generation.

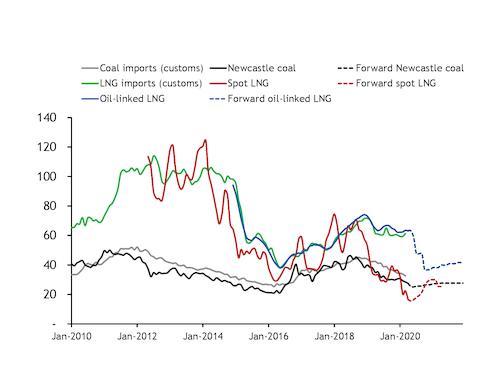

Coal burn has been supported by competitive prices against gas in recent years, but the oil price crash should improve the competitiveness of imported LNG in the coming months. While some US oil prices turned negative on 20 April, benchmark Brent crude has traded at $20-30/bl in recent weeks, down from $60/bl in January.

Given the prevalence of oil-indexation in Japanese long-term LNG contracts and the way these contracts are structured, a sustained spell of low oil prices should filter through to LNG import prices towards the end of this quarter (see chart).

Although generation costs for plants running oil-linked regasified LNG might not fall below those for competing coal-fired units, the spread between the two fuels is poised to narrow. There is also no shortage of spot LNG supply at historically low prices that are competitive with coal for power, so buyers that can increase their proportion of spot LNG purchases are likely to do so.

Power demand steady, for now

The outlook for power demand is weak, with Japan having declared a state of emergency until 6 May.

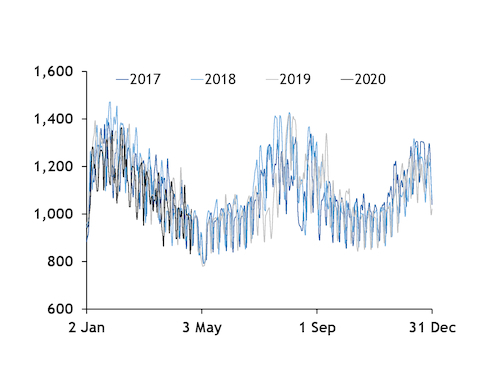

But demand in the past couple of weeks has remained close to recent seasonal averages in the Tokyo, Shikoku and Tohuku grid regions, which together have accounted for around 45pc of overall consumption.

Power demand in these three regions averaged 988 GWh/d on 1-20 April, down by just 4pc on the year.

Below-average temperatures across much of the country may have partially offset coronavirus-driven declines in demand from other sectors. Temperatures have a 40pc chance of remaining below normal on 18 April-17 May, according the Japan Meteorological Agency, although the impact of this is likely to be limited, as the winter heating season transitions into the summer cooling period.

Japan's electricity demand is likely to fall in the short term as offices, leisure facilities, shops and a number of industrial plants — such as steel and car manufacturers — shut down.

Government-affiliated think-tank the Institute of Energy Economics Japan said electricity demand in a city of 10mn people could fall by 39,300 MWh/d, or a quarter, if a complete lockdown is imposed.

Industrial power and steel demand are likely to be hit by a slowdown in manufacturing. Major carmakers have begun implementing output cuts at assembly plants, while the ministry of economy, trade and industry has projected steel demand from the domestic car sector at 2.6mn t in April-June, down by 8pc on the year and 6pc on the quarter.

J-Power has postponed maintenance at the 1.05GW unit 1 of its Tachibanawan coal-fired power plant. The unit was originally due to come off line for maintenance from 18 April to 25 June, and the works have yet to be rescheduled.

In the longer term, the 870MW Takahama 3 nuclear unit is now scheduled to come back on line on 22 December, following maintenance and counter-terrorism upgrades. Nuclear availability is scheduled at 5.2GW in May and 4.4GW in June, down by 27.7pc and 35.6pc on the year, respectively.

By Alex Thackrah