Record low natural gas prices in Japan cut coal's cost advantage over gas for power generation, paring Japanese demand for seaborne coal imports in September.

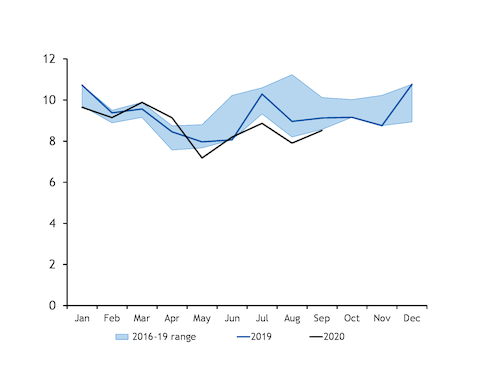

Japanese thermal coal imports fell by 7pc — or 607,000t — on the year to 8.5mn t in September, according to provisional finance ministry data. Coal imports in January-September fell to at least a seven-year low of 78.5mn t, down from 82.5mn t during the same period last year and the 2016-18 average of 83.5mn t.

But Japanese LNG imports rose by 1pc on the year in September and were more robust than coal receipts in the third quarter, with import costs softening significantly as oil-linked prices continued to fall. Thermal coal imports fell by 11pc on the year in July-September, while LNG arrivals were down by only 4pc. This contrasted with the first half of 2020, when coal and LNG receipts fell by 2pc and 5pc, respectively.

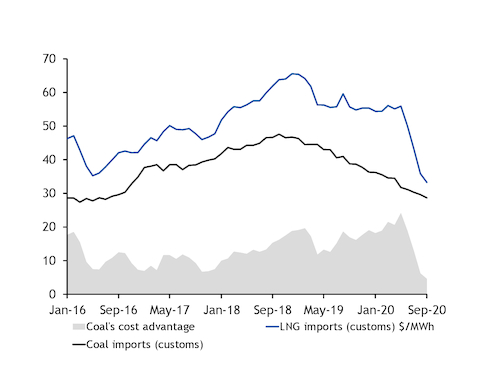

Japanese import data suggest that competition between coal and gas has been intensifying since May, with delivered LNG prices falling to their lowest since January 2005. This has probably boosted fuel-switching potential in Japan, although competition between the fuels may have peaked in September as oil-linked values are now expected to recover gradually following the upward trend in crude prices since late April.

The average value of Japanese LNG imports dropped to $5.51/mn Btu in September, according to customs data, which was down by 8pc on the month and 42pc on the year. But the value of Japanese coal imports fell less sharply, dropping by 4pc on the month and 29pc on the year to $71.97/t.

Based on these costs, the implied tax-inclusive generation cost for a 60pc gas plant and a 38pc coal plant would be $33.26/MWh and $28.69/MWh, respectively, Argus estimates. The sharper fall in gas prices narrowed coal's cost advantage to at least a five-year low of $4.57/MWh in September, compared with $6.22/MWh in August and $16.92/MWh a year earlier.

Heightened competition between gas and coal could support Japanese gas burn in the fourth quarter, but coal could rebuild its cost advantage in the new year as oil-linked import costs gradually recover.

Argus' forward indicative Japan-delivered oil-linked LNG price is set to edge up to around $6.13/mn Btu in December and $6.74/mn Btu in the first quarter of 2021. These prices imply generation costs for 60pc-efficient gas plants of $37-41/MWh, which would be $10-13/MWh higher than coal-fired generation costs based on forward NAR 6,000 kcal/kg fob Newcastle prices of around $58/t.

But this would still imply much sterner competition between the two fuels compared with last winter, when coal's cost advantage was around $26/MWh in December-March. Coal accounted for 45pc of the combined generation from coal and gas last winter, according to data from the Japanese energy ministry.

Japan continues to diversify supply mix

Australian coal bore the brunt of the lower Japanese demand for seaborne coal, with an increasing preference for Indonesian and Russian coal compounding the decline.

Imports of Australian coal fell by at least 316,000t on the year to a maximum of 5.9mn t in September, although this may include smaller amounts from South Africa, Colombia and other origins that are not differentiated in the provisional data.

This would have reduced January-September flows from Australia to Japan by more than 3mn t on the year to 53.3mn t, finance ministry data show.

But imports from Indonesia and Russia remained firm. Japanese receipts from the two countries were broadly flat on the year in September at 1mn t and 1.3mn t, respectively. Imports of Indonesian and Russian coal in January-September were 1.1mn t and 945,000t higher on the year.