South Korea delivered coal prices rebounded sharply this week on the back of strength in the Australian market.

Argus assessed NAR 5,800 kcal/kg coal with maximum 1pc sulphur content at $78.00/t fob Newcastle and $88.44/t cfr South Korea this week, up by $9.19/t and $7.08/t, respectively. These prices equate to $81.77/t and $92.71/t on a NAR 6,080 kcal/kg basis.

The delivered price rose less sharply than the loaded despite firmer freight rates. The average Capesize freight cost from the east coast of Australian to south China increased by $1.80/t on the week to 14.69/t during Monday-Thursday, compared with a $12.89 weekly average last week.

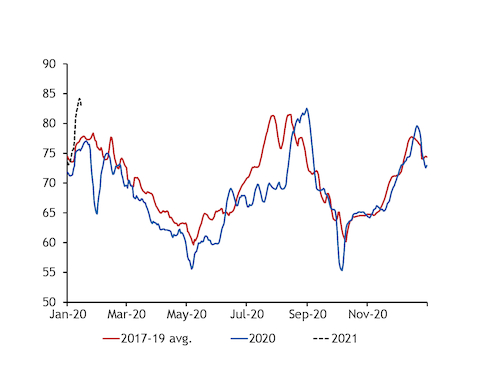

Above-average temperatures in South Korea this week and ongoing limitations on coal-fired generation may have partly offset the strength in the wider Asia-Pacific market. Seoul's temperatures were 5.73°C and 5.50°C above the seasonal average on Wednesday and Friday, respectively, and had been projected to remain above the seasonal norm for most days for the next 15 days as of yesterday, based on Speedwell weather data.

But Speedwell revised its forecast lower today and the capital's temperatures are forecast to fall 2.70°C below the historic norm tomorrow and nearly 6°C below the average on 19 January.

Unseasonably cold winter weather last week boosted peak power demand in South Korea, which reduced the country's peak-hour reserve margin to a six-year January low of 8GW over 7-8 January. Sources familiar with the matter said the supply crunch could prompt the government to relax seasonal coal plant restrictions, although no formal statement has been issued by the government.

Seoul's winter policy requires some units to be fully suspended and limits output from remaining plants to 80pc of their capacity. This latter restriction is likely to be the one to be relaxed in the event of further sharp peaks in electricity demand, market participants said.

South Korean utilities' tender activity rose sharply this week following the festive break. Independent power producer GS Donghae Electric Power (GSDEP) closed a tender seeking a maximum 300,000t of thermal coal for loading in February-April. A 120,000t cargo of NAR 5,825 kcal/kg coal was awarded to its sister trading arm at around $86.50/t on a NAR 6,080 kcal/kg basis for February loading from the Dalrymple Bay Coal Terminal (DBCT) in Queensland, Australia.

The same company was also awarded 60,000t of NAR 4,750 kcal/kg Russian coal at around $80/t fob Shakhtersk on a NAR 6,080 kcal/kg basis for April loading. GSDEP also procured 120,000t of NAR 6,000 kcal/kg Russian coal through an international trading company at around $91/t fob Vostochny on a NAR 6,080 kcal/kg, for March loading.

State-owned utilities were also active and procured tonnes through a joint tender organised by Korea South-East Power (Koen) that closed yesterday. Koen procured five Capesize vessels of minimum NAR 5,600 kcal/kg Australian coal for loading in March. An Australian trading company won two Capesize vessels of NAR 5,900 kcal/kg coal at around $79/t fob Newcastle on a NAR 6,080 kcal/kg basis, and four other multinational trading companies were awarded one Capesize cargo of NAR 5,700 kcal/kg each, with prices in a range of $80-85/t on a NAR 6,080 kcal/kg basis.

Koen purchased, on the same day, three Panamax cargoes of NAR 4,990 kcal/kg Indonesia's Tarakan coal from a South Korean trading company at around $73/t on a NAR 4,990 kcal/kg basis. Koen also procured today an additional two Capesize shipments of low-CV coal from Australia's Rolleston mine at around $79.50/t on a NAR 6,080 kcal/kg basis for loadings in March-April.