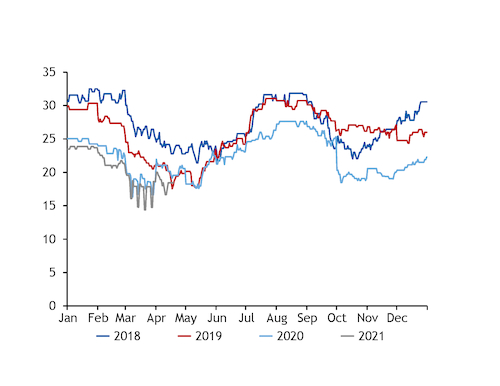

Falling freight rates and easing supply constraints pressured South Korean coal prices this week.

State-owned utility Korea South-East Power awarded Australian and Russian coal in a tender that closed 8 April.

A Russian producer was awarded 320,000t at $68/t fob Taman on a NAR 6,080 kcal/kg price basis, according to one market source, although the calorific value and loading period could not be confirmed. And Switzerland-based Glencore was awarded two Capesize cargoes of NAR 5,700 kcal/kg Australian coal at $76-77/t on a NAR 6,080 kcal/kg basis for May and June loading.

Fellow state-controlled utility Korea Midland Power issued a tender to buy 520,000 t/yr of Australian coal with a minimum calorific value of NAR 5,700 kcal/kg over three years. The tender closes on 12 April.

High-grade coal prices in Asia-Pacific were pressured by a firmer supply outlook, as Australian loadings continue to recover following disruption from rains and outages at Newcastle.

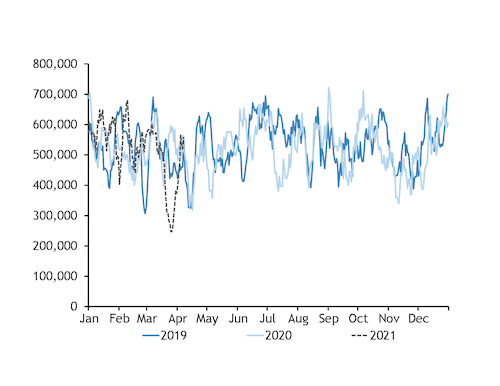

Having loaded no coal over 19-30 March because of two broken shiploaders, exports from the NCIG terminal recovered to an average of nearly 200,000 t/d in the first six days of April, according to data collated by Argus. This was up from an average of around 150,000 t/d in the first half of March before the second shiploader was temporarily suspended.

Loadings from fellow Newcastle port operator PWCS have also strengthened in April, data show.

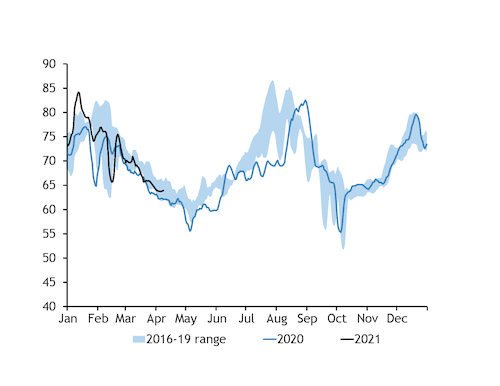

On the demand side, new Covid-19 restrictions, recovering nuclear availability and reduced coal-fired plant availability in Japan look likely to keep coal consumption under pressure in the short term.

In South Korea, daily average peak power demand is running ahead of 2020, and two nuclear reactors went off line unexpectedly for a second time this week. But further short-term coal-fired generation restrictions for April were published today, making any year-on-year growth in consumption this month increasingly unlikely.

Based on the current maintenance schedule, Argus expects average state-owned coal-fired generation to fall below 18GW this month, down from 18.4GW a year earlier. Coal-fired generation in February fell by 2.3GW from a year earlier to 18.5GW, according to data released today by South Korean state-controlled utility Kepco.