German gas conversion fees may rise next gas year following the introduction of a single Germany VTP (Trading Hub Europe), as combined conversion account balances have fallen further below the required liquidity buffer.

Market area managers NCG and Gaspool will combine their conversion accounts — which detail the costs and revenues from conversion activities and related fees — when the market areas merge, scheduled for 1 October. And the aggregate balance will be one of the factors used to determine the conversion neutrality charge and quality conversion fee applied from 1 October.

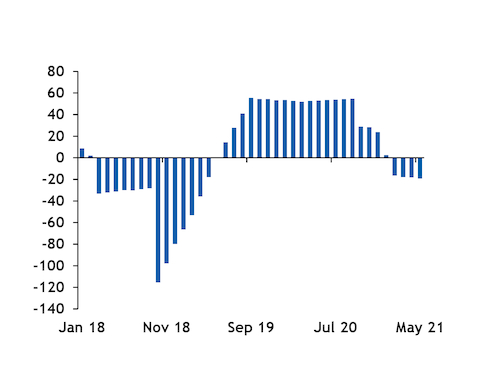

Gaspool's conversion account balance has remained well above the market's required buffer over the past months. But NCG's balance fell below its required buffer at the start of 2021. And the deficit has widened in recent months, increasing the likelihood of a hike in the fee (see graph).

Combining the two accounts at the end of May would leave a balance of €192mn, against a combined liquidity buffer of €212mn.

Higher conversion fees starting from October would contrast with the current gas year, when charges either remained unchanged or decreased.

NCG kept its conversion neutrality charge — a socialised cost levied on all gas entering the market to cover the operator's expenses related to quality conversion — unchanged at zero for this gas year. And Gaspool reduced it to zero.

NCG already charges the maximum quality conversion fee — charged for virtually converting supply to low-calorie from high-calorie through balancing actions — of €0.45/MWh permitted under German regulations, but Gaspool charges only €0.39/MWh.

The market area managers are not permitted to charge for virtual conversion of low-calorie gas to high-calorie supply.