Tight coal and vessel availability across the Asia-Pacific region boosted the South Korean coal market this week, although demand is waning amid firmer nuclear availability and flat power demand.

Stormy weather and the rapid spread of Covid-19 variants across Asia-Pacific are disrupting shipments in key exporting countries, with the vessel queue at Australia's key Newcastle loading port standing at 44 as of today, according to market participants.

Heavy rainfall across Indonesia's key Kalimantan mining region is also tightening regional availability, which was already grappling with the government having reinstated domestic market obligation sales requirements earlier this month. A total of 34 Indonesian coal producers were initially banned from exporting coal under this policy as they failed to meet their annual domestic target, although the ban has since been lifted for some exporters.

Argus assessed NAR 5,800 kcal/kg coal prices at $141.10/t fob Newcastle and $163.30/t cfr South Korea this week, up by $3.31/t and $7.26/t on the week, respectively.

Delivered prices continued to rise faster than fob prices amid ongoing strength in the freight market. The Capesize freight rate between east Australia and South Korea increased to nearly a decade high of $22.30/t on 27 August, boosting the Monday-Friday average price by $1.08/t on the week to $21.59/t. By comparison, the rate averaged $11.96/t during the same period a year earlier.

International dry bulk rates have been rising since early this month as port congestion at Chinese ports due to heightened Covid-19 restriction measures has tightened global vessel availability.

Compared with rallies in the wider commodity complex, South Korean coal market activity remained lacklustre this week, with utilities taking a breather following a series of tender awards in the summer. A South Korean trader told Argus this week that all five state-owned Kepco utilities have reportedly stocked enough coal for the year and will procure further cargoes through private negotiations or a request for proposals (RfPs) only.

An unknown South Korean utility reportedly bought a NAR 5,800 kcal/kg coal cargo this week at around $148/t on a NAR 6,080 kcal/kg basis but this could not be confirmed, meaning the deal was likely done via private negotiations.

Further ahead, state-owned East-West Power issued an RfP, seeking 140,000t of minimum NAR 5,300 kcal/kg for loadings in November-December. The request is scheduled to close on 30 August, and Colombian coal suppliers are not allowed to participate.

Independent power producer SGC Energy also issued a spot tender this week, closing on 30 August, seeking two Panamax shipments of NAR 5,300 kcal/kg coal for deliveries to Gwangyang port on 31 October-31 December.

Waning coal demand in South Korea was in line with the September power demand forecast provided by the Korea Power Exchange. The exchange projects temperatures across the South Korean peninsula to remain within a seasonally normal range of 20.2-20.8°C next month and forecasts average power demand to remain flat at about 60.9GW, up by 1pc on the year, according to the latest monthly power outlook report.

But nuclear availability is scheduled to average 16.9GW next month, compared with an average output of 12.9GW a year earlier.

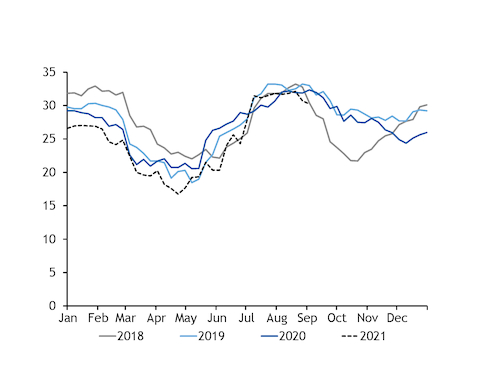

Flat power demand and firmer nuclear availability may encourage Kepco utilities to resume voluntary restrictions across their coal-fired units, at least during the off-peak season. Kepco utilities' coal-fired availability is currently scheduled to average 29.5GW in September, which implies output of about 24.8GW, assuming load factors are in line with the 84pc 2018-20 average for the time of year.

By comparison, Kepco's coal-fired power generation averaged 25.6GW in September last year. Scheduled availability could still be lower than currently estimated, as the shutdown schedule is updated weekly.

Power demand uncertainty

Net-forward coal prices to Japan extended their gains this week on regional market strength, but oil-linked LNG continues to gain in competitiveness against coal for power generation.

But the overall demand outlook for thermal generation is clouded by renewed Covid-19 restrictions that pose a downside risk to power demand in the near term.

Japanese wholesale electricity contracts trading on the Japan Electric Power Exchange rebounded this week on firmer power demand and unexpected shutdowns at thermal plants. Power demand in Japan increased by 19pc on the week to 110GW from 20-26 August amid hotter weather, while operations at combined capacity of 1GW thermal units were unexpectedly disrupted during some days this week, boosting power prices.

Stronger power prices lifted margins for thermal generators, although margins for oil-linked LNG generation remained competitive against coal. The theoretical margins for day-ahead-delivery, oil-linked LNG generation from 58pc-efficient units jumped to an average of ¥1,563/MWh from 20-26 August, compared with ¥667/MWh a week earlier. The equivalent margins for 44pc-efficient coal-fired units jumped more sharply, nearly tripling on the week to ¥1,235/MWh, but remained lower than margins for oil-linked LNG generation on an outright basis.