The northeast Asia coal market rebounded sharply this week on the back of colder weather across the region and a risk premium built over Russia-Ukraine tensions during the lunar new year holiday.

Argus assessed NAR 5,800 kcal/kg coal at $209.98/t cfr South Korea and $200.07/t fob Newcastle on 11 February, up by $17.46/t and $11.06/t on the week, respectively.

Seoul has announced plans to increase its fossil fuel inventories such as LNG, crude and bituminous coal as part of contingency plans for a possible supply impact resulting from the situation between Russia and Ukraine, according to a statement released following a meeting of the country's industrial resource security task force on 10 February. As part of the plan, state-owned Kepco utilities will share their coal inventories if Russia cuts off gas supplies to Europe, causing global commodity prices to skyrocket, the energy ministry said.

Stronger demand in South Korea could further boost seaborne coal prices, while the market is already buoyed by colder weather and supply disruptions in the Asia-Pacific region. Temperatures in Beijing, Seoul and Tokyo are forecast to fall below the seasonal average for most days during the next two weeks, with overnight temperatures in Beijing projected to fall to as low as minus 14˚C next week, according to Speedwell Weather data.

Heavy rain across major coal-producing countries, including Indonesia and Australia, is continuing to send spot coal prices higher, along with ongoing domestic market obligation (DMO) rules in Indonesia requiring producers to commit at least a quarter of their output to the domestic market.

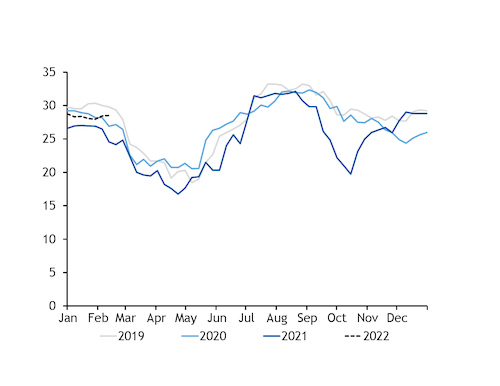

On South Korea's coal-burn demand side, none of Kepco's coal-fired units are scheduled to go off line for winter restriction purposes next week, although eight units will be put down for maintenance, the latest plant schedule published by Korea Power Exchange (KPX) shows. Kepco's coal availability is now scheduled to average 27.6GW in February, compared with 24.9GW availability and 17.9GW coal-fired output a year earlier. South Korea's 36.9GW coal-fired fleet, including private units, has been running at 23-26GW since 7 February, according to real-time power data provided by KPX as of 11 February at 22:00 local time (13:00 GMT).

By comparison, gas-fired generation fluctuated from 13-30GW during the same period, while nuclear generation has maintained a flat profile of 21.6GW throughout this month.

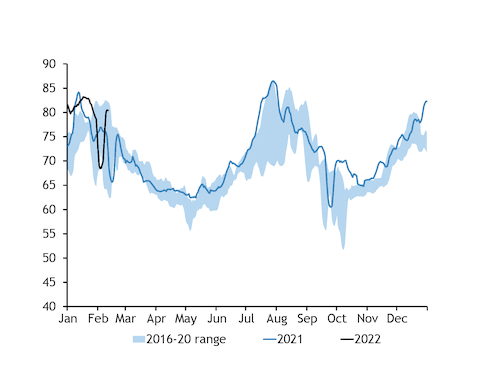

Meanwhile, South Korea's coal-fired power generation increased to 24.6GW in December from 21.1GW a year earlier, according to Kepco's latest monthly power report. Kepco's coal-fired units supplied about 20.9GW of output with an average availability of 27.8GW, implying a load of about 75pc, according to Argus analysis.

For comparison, about 25GW of Kepco's coal capacity was available in December 2020 and also dispatched at a 75pc load to produce 18.8GW of output.

Gas-fired output decreased to 19.3GW in December 2021 from 22.4GW a year earlier.

Snowstorm, nuclear cuts add to upside

A forecast adverse weather event in Japan, combined with lower nuclear availability, boosted the country's power prices this week, improving margins for thermal generators.

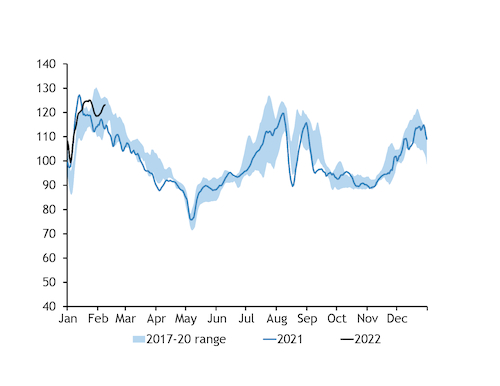

An unusual snowstorm forecast for Japan's wider Kanto-Koshin region, which includes Tokyo, increased demand for power contracts this week. Power demand across Japan's 10 service areas rose by 3pc on the week to an average of 123GW on 3-9 February, according to Japan's transmission operator, Occto.

Firmer power demand supported the Japan Electric Power Exchange (Jepx)'s systemwide day-ahead power prices to increase by 25.3pc on the week to ¥22.18/kWh during the week ending 10 February, with day-ahead prices for the Tokyo area surging by 43.3pc to a ¥26.52/kWh average.

Stronger power prices improved generation economics for thermal generators this week, given that the price of fossil fuels in Japan fell sharply over the lunar new year holiday. Theoretical margins for a 44pc-efficient coal-fired unit for day-ahead delivery increased by 54pc on the week to an average of ¥11,467/MWh on 3-9 February, based on implied Japan delivered NAR 5,800 kcal/kg fob Newcastle spot coal prices.

Coal remained more competitive against gas for power generation, although margins for the most efficient 58pc gas-fired plant running on spot LNG for day-ahead delivery returned to a positive range of ¥3,142/MWh for the same period, compared with a negative margin of ¥2,533/MWh a week earlier.

Meanwhile, nuclear availability across Japan's 10 operational units is expected to average 5.4GW in March, down from 7.7GW in February and the three-year high of 8.7GW reached in January, according to Argus analysis.

Lower nuclear availability will continue to support demand for fossil fuels, especially coal, with fuel-switching economics heavily favouring the solid fuel in Japan. But fuel availability remains tight in Japan, and cold weather forecasts have also spurred gas demand for March-April delivery, supporting regional spot LNG prices.