Several European gas storage sites at which Russian state-controlled Gazprom or its former subsidiaries have long-term capacity are now essentially empty.

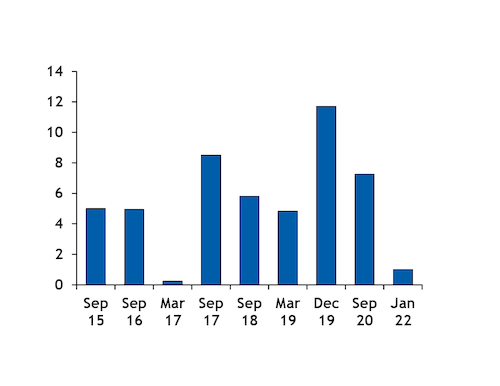

Gazprom's decision to pull gas from its already heavily depleted European storage late last winter, coupled with a lack of injections so far this summer despite ample spare Russian pipeline delivery capacity to Europe, hints at an end to the company's use of European gas storage amid the deterioration of energy relations between Russia and Europe (see Gazpromexport historical stocks graph).

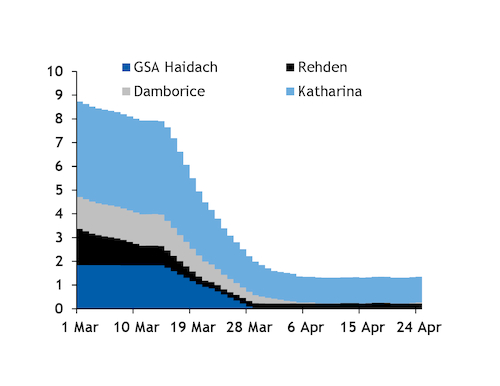

There was a move starting in mid-March to strong withdrawals from relative inactivity at three sites at which Gazpromexport holds most of the capacity — its share of Haidach in Austria, at Damborice in the Czech Republic, and at Katharina in Germany. And withdrawals at the 44TWh Rehden facility, Germany's largest site, accelerated at the same time as the other three sites (see Gazpromexport recent stocks graph).

All four sites except Katharina are now essentially empty. Katharina held 1.08TWh this morning, broadly matching the amount of space sold until the end of the 2022-23 storage year at auctions in late 2020 (see data & download).

It is more difficult to assess how much gas Gazprom holds at other sites, where it has a lower proportion of space.

Gazpromexport holds 1.85bn m³ of space at Bergermeer in the Netherlands under a long-term agreement, having provided the site's cushion gas. Bergermeer stocks were 6.3TWh on the morning of 28 April, about 13pc of capacity (see Bergermeer graph). Gazprom "made no use" of this space last summer, the Dutch economy ministry has previously said.

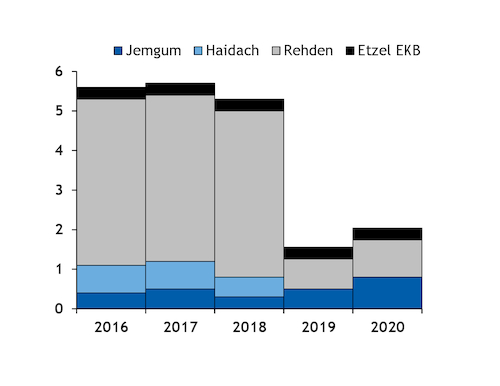

And the ownership of several Gazprom sites — including Rehden, Jemgum and parts of Haidach and Etzel EKB — may have passed from the Russian state after Gazpromexport cut ties with its former Gazprom Germania subsidiaries at the start of April.

Gazprom's ex-subsidiary, Wingas, has long been the owner of the Rehden site and was co-investor in all but 100mn m³ of Jemgum's 900mn m³ capacity. Jemgum held 1.52TWh this morning, following net injections this month (see Jemgum graph).

Wingas was also a co-investor at the Astora-operated part of Haidach, where it has had capacity. Stocks were 1.94TWh this morning, or about 17pc of capacity (see Haidach graph).

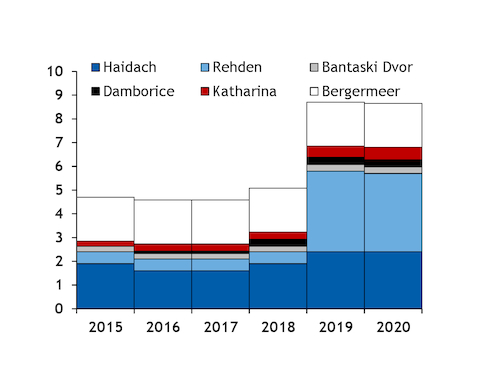

Gazpromexport built up its European storage space in recent years, including at the expense of its former subsidiaries, particularly at Rehden (see Gazpromexport capacity graph, other Gazprom capacity graph). The split in capacity was last published for the end of 2020.

Gazprom also probably holds about 120mn m³ of storage space in Serbia at Banatski Dvor, based on recent comments by Serbian president Aleksandar Vucic. These may now be its largest European reserves.

Gazprom's considerable European storage space has given it greater flexibility to ramp up sales over peak demand periods and to meet customer nominations during summer maintenance on its key export pipeline routes.

Its European storage reserves had already shrunk to about 1bn m³ at the turn of this year from a record 11.7bn m³ at the end of 2019 (see storage drawdown graph).

27042022080321.jpg)

27042022080316.jpg)

27042022080317.jpg)